Daily Comment (May 30, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Our Comment today opens with an update on the weekend’s preliminary deal to lift the federal debt limit until 2025. We next review a wide range of other international and U.S. developments with the potential to affect the financial markets today, including the re-election of Turkey’s president and indications that quantitatively driven investment funds have been a key reason why U.S. stocks have been moving upward this year despite expectations of a recession.

U.S. Fiscal Policy: For those who were truly “off the grid” over the Memorial Day weekend, on Saturday President Biden and House Speaker McCarthy reached a deal in principle to lift the federal debt limit. The agreement would make sure the government can keep covering its debt service and other bills past June 5, which is Treasury Secretary Yellen’s new estimate of when the government will run out of cash. The challenge over the coming days will be for Biden and McCarthy to whip up enough support in their respective parties to pass the bill into law. On the Democratic side, many progressives are angry about compromises that will cap government spending and ease permitting for energy projects. On the Republican side, many right-wing legislators are mad that spending wasn’t cut even more. Nevertheless, we continue to believe the legislation will ultimately be passed into law in time to avoid a financial crisis.

- Key provisions of the deal include:

- The debt limit would be suspended until January 1, 2025, well after the upcoming federal elections. By that time, the Treasury will have rebuilt its financial flexibility and its ability to use “extraordinary measures” to pay its bills. That means any new debt crisis could probably be pushed off into mid-2025.

- Federal discretionary spending will be capped for the next two years. In the upcoming fiscal year, discretionary defense outlays would be allowed to rise by a nominal 3%, while discretionary nondefense outlays would be frozen at current levels.

- Some $30 billion in unused pandemic relief funds will be clawed back from dozens of programs.

- Work requirements to be eligible for SNAP nutrition benefits (i.e., food stamps) would be extended to those up to age 54, compared with 49 currently.

- Federal permitting procedures for energy projects would be accelerated by requiring a decision within one or two years.

- Rising prospects for the deal gave a boost to the stock market in recent trading sessions. However, it’s important to remember that if the deal is passed into law, the Treasury will need to rebuild its cash balances at the Federal Reserve, which will likely mean drawing hundreds of billions of dollars out of the economy in the coming weeks. That will amount to significant fiscal tightening that could pull stocks down again.

Russia-Ukraine War: As Ukraine endured another big wave of air attacks last night, officials in Russia today blamed Kyiv for a number of drone attacks on residential areas of Moscow. If confirmed as an attack by Ukrainian forces, the incident would mark the first such attack on Russian civilian targets, although it seems just as likely that the attack was carried out by Ukrainian sympathizers or partisans, perhaps the same who staged an attack on Russia’s border region last week.

- In any case, the notable attack on Moscow probably aimed to unsettle Russian citizens and undermine their support for Moscow’s invasion. Bringing the war home to the Russian people may be one of the “shaping operations” that the Ukrainians are carrying out to prepare for their expected counteroffensive.

- A key risk is that it could also encourage China or other Russian allies to step up their support for Russia.

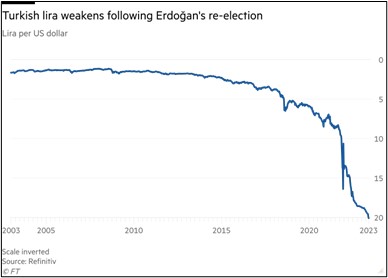

Turkey: In Sunday’s run-off presidential election, right-wing nationalist President Erdoğan defeated opposition leader Kemal Kılıçdaroğlu by 52.2% to 47.8%. Our analysis suggests that Turkey will remain in the U.S. geopolitical and economic bloc, reflecting its membership in NATO and its tight trade ties to the U.S., but the victory by Erdoğan means he will likely continue trying to play the U.S. off China and its evolving bloc. Erdoğan is also likely to continue his unorthodox economic policies, such as holding down interest rates in the face of high inflation and a depreciating currency. The news of Erdoğan’s victory has, therefore, weighed on the Turkish lira (TRY) yesterday and today.

Spain: In regional and municipal elections on Sunday, the conservative People’s Party led by Alberto Núñez Feijóo roundly beat the ruling Socialist Party of Prime Minister Pedro Sánchez. Counting so far shows support for the People’s Party surged to 31.5%, up 9% from the elections in 2019, while support for the Socialists was nearly stagnant at 28.1%. Nevertheless, Sánchez gambled and called a snap national election for July 23 in order to keep some initiative in his hands and stem any momentum of the People’s Party and its far-right ally, the Vox Party.

- Spain’s relatively good economic environment may be one reason the prime minister was willing to gamble on new national elections.

- The country’s statistical agency today said its April consumer price index was up just 2.9% from the same month one year earlier, far better than the rise of 3.8% in the year to March and even below the expected inflation rate of 3.4%. Excluding the volatile food and energy components, the April core CPI was up 6.1%, down from 6.6% in the previous month.

Serbia-Kosovo: After boycotting recent local elections in northern Kosovo, Serbian protestors on Monday tried to prevent the ethnic Albanian mayoral winners from entering city halls and taking office. The resulting violence injured more than a dozen NATO peacekeepers, sparking condemnation by Western leaders. The new violence risks undermining a March peace deal between Serbia and Kosovo.

China: Now that the unemployment rate for young adults has risen to a record above 20%, officials report a surge in applications for programs that put young college graduates to work in the country’s vast, underdeveloped rural areas. While many college graduates continue trying to hold out for better-paying jobs in urban areas, the trend reflects the extent to which slowing economic growth has reduced attractive opportunities for young people—a problem that could eventually undermine political support for the Communist Party.

- Not only has China’s economy matured to the point where it can’t grow as fast as it did in past decades, but its recovery from Beijing’s draconian Zero-COVID policies is petering out much earlier than anticipated.

- Reflecting that, Chinese stocks trading in Hong Kong today temporarily dipped into bear market territory, down more than 20% from their peak in January before rallying to close above that marker.

China-United States: Stephanie Hui, the chief of Asia-Pacific private and growth equity for Goldman Sachs (GS, $332.01), said geopolitical tensions between Washington and Beijing have sapped U.S. investors’ interest in her funds, prompting her to stop trying to raise money in the country. Instead, Hui said she is now focused on raising money in places like the Middle East and Southeast Asia. Separately, Beijing has reportedly refused a request by Washington for U.S. Defense Secretary Austin to meet Chinese Defense Minister Li Shangfu at a security conference in Singapore this week. Taken together, these developments offer even more signs of the worsening estrangement between the U.S. and China.

U.S. Stock Market: New analysis from Wall Street indicates that the rise in U.S. stock values and the relative calm in the market so far this year can be ascribed to quantitatively driven funds. The data suggests their buying has been more than enough to offset the pullback in investing by individuals and other discretionary investors. Of course, a risk is that the quantitative models could start to flash sell signals, which presumably would drive market values down again.

Global Gold Market: A new survey by the World Gold Council shows that 24% of global central banks plan to increase their gold holdings in 2023. The survey indicates that the central bank buying plans, which were especially prevalent among emerging market institutions, are being driven by concerns ranging from geopolitical tensions to consumer price inflation. That’s entirely consistent with our oft-stated belief that aggressive sanctions by the U.S. and its allies against Russia and other authoritarian states will prompt countries to rely more on the yellow metal. We therefore remain bullish on gold prices in the coming years.