Daily Comment (May 29, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! Markets are actively digesting this morning’s landmark court ruling on tariffs. Today’s Comment examines how the Trump administration might respond to this latest trade policy setback, discusses the market implications of Nvidia’s stronger-than-expected earnings, and reviews other notable news moving global markets. As always, we’ll wrap up with a comprehensive overview of today’s most important domestic and international economic data releases.

No TACO For Trump: A court ruling has delivered a major setback to the US president’s trade agenda, yet his supporters are pressuring him not to retreat.

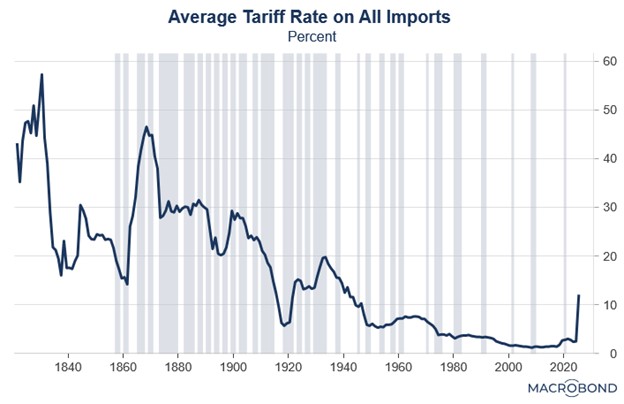

- The US Court of International Trade ruled that the president lacked the authority to impose tariffs under the emergency economic powers legislation he cited. This decision will invalidate certain reciprocal tariffs enacted on April 2, while leaving in place sector-specific tariffs on automobiles and steel. Although the White House has stated it will appeal the ruling, the verdict raises doubts about the legality of his broader tariff strategy.

- The ruling is expected to halt 6.7% of levies announced this year. However, the president appears to have alternative options to circumvent the court’s decision. According to Goldman Sachs, the administration could implement Section 122 tariffs for up to 150 days as a replacement for reciprocal tariffs, while simultaneously applying Section 301 and 232 tariffs on a country-specific basis.

- That said, the ruling could place the White House in a difficult position as it seeks to negotiate trade agreements with other nations. In recent weeks, tariff threats have successfully pressured several countries into trade discussions. Notably, the European Union, which initially pushed for complete tariff elimination, has now softened its stance, seeking reduced tariffs in exchange for concessions in other areas.

- Additionally, Trump faces mounting pressure to maintain his stance, particularly given concerns over market stability. The White House was compelled on Wednesday to push back against claims that “Trump Always Chickens Out,” a narrative that belittles the so-called “Trump put,” the perception that the president will consistently safeguard equity markets.

- While the court’s decision represents a setback for the administration, it is unlikely to be the final word on the matter as the White House prepares its appeal. Investors should therefore view the tariff reversal with caution. Our primary focus will be on the president’s response, as he may use this ruling to reinforce his protectionist stance rather than retreat. Given the potential for increased volatility, we maintain that conservative investors should adopt a wait-and-see approach in the current environment.

AI Rally Continues: Big tech stocks rallied on Wednesday after the world’s leading chipmaker reported stronger-than-expected earnings, reinforcing confidence in the sector’s growth.

- Nvidia surpassed analyst expectations with a strong quarterly revenue of $44.1 billion, marking 70% year-over-year growth despite significant headwinds from US export controls. The results comfortably exceeded Wall Street’s $43.3 billion consensus estimate, demonstrating remarkable resilience in the face of geopolitical challenges. For the current quarter, the chipmaker issued bullish guidance of $45 billion in revenue while disclosing an anticipated $8 billion hit from ongoing China sales restrictions.

- The earnings beat is poised to reinvigorate confidence in the AI rally, which has been largely driven by the seven biggest tech giants propelling the S&P 500. Recent concerns over US trade restrictions, particularly on exports, had raised fears that tech earnings could suffer and potentially dampen investment enthusiasm. Yet, Nvidia’s robust results suggest that major players remain committed to AI investments and undeterred by global economic uncertainty.

- Despite reporting robust earnings, Nvidia raised alarms over potential new US export controls on China. In a direct appeal to President Trump, CEO Jensen Huang warned that existing restrictions could completely shut Nvidia out of the Chinese market — a devastating outcome for the chipmaker’s revenue. His plea follows reports that the Trump administration is considering expanded bans, including cutting off sales of critical chip design software to China.

- The strong earnings report indicates that high-quality risk assets will remain appealing to investors navigating ongoing economic uncertainty. Companies with robust earnings growth potential and minimal foreign supply chain exposure are particularly well-positioned in this environment. Additionally, firms aligned with government strategic priorities, such as AI, present compelling opportunities for investment.

FOMC Meeting Minutes: According to its meeting minutes, the Federal Reserve opted to hold interest rates steady as it continues to navigate the economic fallout from the trade war.

- During the FOMC meeting held on May 6-7, Fed officials acknowledged they might face difficult trade-offs when deciding which aspect of their dual mandate — price stability or full employment — to prioritize. Their unease stemmed from navigating turbulent financial market conditions, including heightened volatility in equities and bonds. Adding to their concerns was the dollar’s significant depreciation, which further complicated the economic outlook.

- On a positive note, Fed officials expressed cautious optimism that households could weather the impact of tariffs. While acknowledging rising delinquencies on auto and credit card loans, they noted that household balance sheets remain fundamentally strong. Additionally, some policymakers suggested that lower energy prices might help offset trade-related pressures. There was even hope that consumer spending could gradually shift from goods to services, further easing economic strains.

- On the other hand, Fed officials also highlighted several growing vulnerabilities in the economy. One key area of concern is rising leverage within the financial sector, with banks potentially exposed to interest rate risks and hedge funds carrying significant debt. Additionally, they expressed concerns about the weakening status of US assets as a safe haven, raising questions about the economy’s long-term stability.

- Regarding policy, there appears to be broad agreement that significant uncertainty will persist until the president finalizes tariff rates. The staff economic outlook projects inflation will prove transitory, with a temporary increase this year and next before returning to the 2% target by 2027. Additionally, staff estimates suggest the unemployment rate may rise above its natural level by year-end.

- The meeting minutes indicate that the central bank may refrain from cutting rates at its next meeting and could delay rate cuts this year if inflationary pressures persist. This stance would likely push bond yields higher while dampening bond prices. Moreover, elevated interest rates may weigh on equity markets, particularly riskier assets.

DOGE Future: Tesla CEO Elon Musk has officially stepped down from overseeing the cost-cutting initiative, though the future of his efforts remains uncertain.

- The world’s richest man has stepped down from his role to dedicate more time to his business ventures. His position as a “special government employee” was capped at 130 days, meaning it was always expected to conclude by the end of the month. While leading the Department of Government Efficiency, he was tasked with identifying cost-saving measures to reduce government spending. While he successfully uncovered some inefficiencies, the effort fell far short of his ambitious $1 trillion savings target.

- However, he has submitted a list of $9.4 billion worth of proposed spending cuts to Congress, which must now decide whether to enact them into law. President Trump has urged lawmakers to prioritize these cuts, which include reduced funding for USAID and the Corporation for Public Broadcasting (CPB), the entity overseeing PBS and NPR.

- While Musk may be departing his government role, sustained efforts will still be needed to address the nation’s fiscal challenges. We believe the growing supply-demand imbalance in bond markets is exacerbating pressure on yields, particularly for long-term bonds. Consequently, we expect the DOGE initiative to persist in promoting fiscal discipline — a critical factor in restoring confidence among bond market participants.