Daily Comment (May 28, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! The market is currently paying close attention to the bond market and Nvidia’s earnings. Today’s Comment will talk about the unexpected jump in consumer sentiment and explore the factors behind this shift in optimism. We will also examine why King Charles’ speech added to US-Canada tensions and provide updates on other key financial reports. Finally, we’ll close with a summary of today’s major international and domestic data releases.

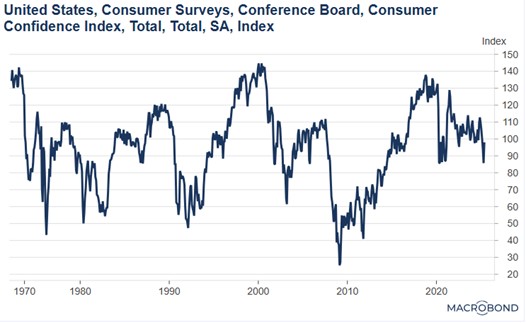

Confidence Bounce: Consumer sentiment rebounded in May, reflecting household relief amid progress in trade negotiations.

- The Conference Board’s Consumer Confidence Index significantly outperformed expectations in May, rising to 98.0 from a revised 85.7 in April. This notable increase was driven primarily by a dramatic improvement in consumer expectations, which surged 17.4 points from a historic low of 55.4 to 72.8. The Present Situation Index also showed strength, climbing from 131.1 to 135.9, suggesting households are growing less concerned about immediate recession risks.

- The recent improvement in consumer sentiment was largely driven by reduced concerns about potential tariffs fueling inflation. Notably, inflation expectations declined from 7.0% to 6.5%, reflecting growing confidence in price stability despite tariff concerns. The survey also revealed increased consumer willingness to make major purchases, with more respondents indicating plans to buy automobiles and take vacations within the next twelve months.

- While inflation expectations have moderated, lingering concerns about economic stability persist. The labor market indicators present a mixed picture. The share of respondents reporting jobs as “plentiful” edged up modestly from 31.2% to 31.8%, while those describing jobs as “hard to get” rose more significantly from 17.5% to 18.6%. This divergence suggests continued consumer skepticism about labor market strength, despite some positive signals.

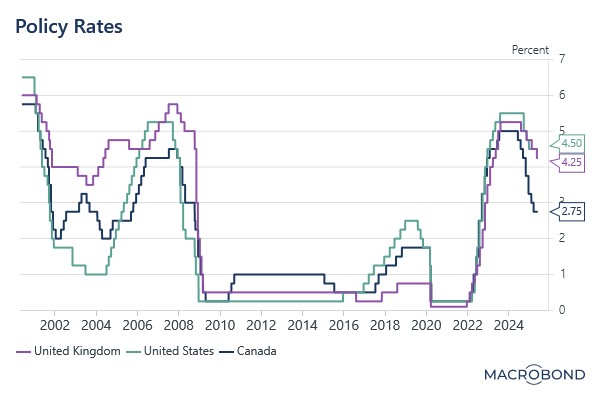

- The latest Conference Board survey indicates consumers are increasingly attuned to economic shifts. While household spending is expected to remain strong if the economy continues its positive trend, a scenario where tariffs don’t spark inflation and the labor market softens could push the Federal Reserve to ease monetary policy.

The 51st State? The king’s recent speech in front of the Canadian Parliament has brought renewed attention to the US threat of acquiring Canada.

- In his address, King Charles III emphasized that the nation faces grave threats to its democratic institutions, rule of law, and right to self-determination. Although he did not explicitly mention President Trump by name, the timing of these remarks is significant, as they coincide with the US president’s persistent efforts to bring the country under greater American influence. This speech will likely intensify ongoing debates about Canada’s relationship with its southern neighbor and the future of bilateral sovereignty issues.

- Discussions about reshaping the US-Canada bilateral relationship come as leaders from both nations seek to redefine their strategic partnership. The two countries explored collaborating on a joint missile defense system, dubbed the “Golden Iron Dome,” which would be capable of detecting, tracking, and intercepting attacks. While President Trump has threatened to charge Canada $61 billion for access to the system, its success would depend heavily on Canada’s radar coverage and Arctic airspace access.

- Rising tensions with its southern neighbor could further pressure Canadian equities. The country is already grappling with a weakening economic outlook, including slowing job growth, subdued business optimism, and a GDP contraction in Q1. A protracted dispute with its largest trading partner would only compound these challenges, adding fresh uncertainty to an already strained market environment.

- Despite escalating tensions between Canada and its largest trading partner, the country’s benchmark S&P/TSX Composite Index continues to trade near all-time highs — even outperforming the S&P 500 year-to-date. This resilience stems from the index’s heavy weighting in Energy and Financials, sectors relatively insulated from tariff risks. While economic pressures from trade disputes remain a concern, Canada’s market strength serves as a reminder that even in politically uncertain environments, pockets of opportunity can still emerge.

Japan’s Auction Blunder: Global bond yields rose following weak demand for longer-duration security issuance in Japan.

- Japan’s 40-year government bond auction drew its weakest demand since last July, despite offering higher yields. The bid-to-cover ratio — a key gauge of investor appetite — came in at 2.21, marking the second-lowest level since the pandemic. This tepid response underscores growing market reluctance to take on longer-duration risk, particularly in heavily indebted economies.

- The tepid demand for ultra-long bonds is increasing pressure on Japan’s Ministry of Finance to rebalance its issuance strategy toward shorter-dated securities. This shift would help contain long-term borrowing costs while meeting market demand, a move already showing some effect after Tuesday’s report about potential changes to the issuance mix helped ease 10-year JGB yields.

- The weak auction also presents new complications for the Bank of Japan’s normalization path. With investors showing limited appetite for duration risk, the central bank may need to adjust its balance sheet runoff plans to prevent excessive yield volatility. This development highlights the delicate policy coordination required between Japan’s fiscal and monetary authorities as they navigate an environment of rising global yields.

- The key trend we’re monitoring is the shift toward shorter-duration bond issuance among indebted developed countries. While this move helps alleviate yield pressures on longer-duration securities, it also increases the government’s exposure to rollover risk as bonds mature. This could pose challenges if unexpected shocks drive short-term rates higher. Although we do not anticipate this scenario materializing in the near term, we will closely track this dynamic.

Big Tech’s Litmus Test: The last Magnificent 7 company will report earnings this afternoon, in what could be the next major catalyst for equity markets.

- Nvidia’s upcoming quarterly earnings report represents far more than a routine corporate update — it will serve as the most consequential barometer of AI adoption and tech sector health. As the undisputed leader in AI accelerators, Nvidia has delivered eight consecutive quarters of earnings beats, transforming each report into a market-moving event that sets the tone for the entire technology ecosystem.

- The chipmaker’s unique position at the center of the AI infrastructure boom makes its financial performance particularly revealing. With every major cloud provider and tech giant racing to expand AI capabilities, Nvidia’s results will provide critical insight into whether corporate investment cycles remain intact despite macroeconomic pressures. Strong revenue growth and guidance would confirm sustained demand for AI infrastructure, while any weakness could signal broader enterprise spending pullbacks.

- Market implications extend well beyond the semiconductor sector. A bullish report could reignite the AI trade and potentially propel the S&P 500 above key psychological resistance at 6,000, as it would validate current growth expectations. Conversely, disappointing results might trigger a sector-wide repricing, particularly for high-multiple tech stocks that have benefited from the AI narrative.