Daily Comment (May 26, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Good morning! Today’s Comment starts with our thoughts about the potential benefits and risks associated with generative artificial intelligence (AI). Next, we examine the impact that a German recession would have on the European Central Bank’s policy rate decision. Finally, we discuss the Turkish election and what it may mean for markets.

More Chips: As investors clamor for AI-related stocks, regulators are seeking to contain risks associated with the technology.

- Chipmakers are confident that they can capitalize on the generative AI craze. Semiconductor producer Nvidia (NVDA, $379.80) projected second-quarter sales of $11 billion. Nvidia’s strong guidance and positive earnings report boosted sentiment in the tech sector, sending the company’s share price up 24.37% on the day. Meanwhile, the tech-heavy NASDAQ surged 1.7% on Thursday, and the S&P 500 closed up 0.9%. Optimism that the sector will revolutionize the way companies generate profits has outweighed concerns regarding regulatory risks and potential geopolitical disruptions.

- Government authorities are finding it difficult to balance the interests of shareholders with national security concerns. European regulators have proposed new rules that would limit AI companies’ abilities to use copyrighted material and to make critical decisions such as granting loans and hiring. Additionally, friction between the U.S. and China continues to pave the way for tit-for-tat restrictions on chips. Earlier this week, Beijing banned some Chinese companies from purchasing chips from semiconductor company Micron (MU, $69.61). The move is likely in retaliation for U.S. export restrictions of advanced chips to the country and may lead to a response from the Biden administration.

- Concerns over regulation and geopolitical tensions is not likely to sway investors from buying tech shares. This is best seen in the performance of Micron Technology. Despite the company’s shares plunging more than 4% following the news of the ban, its stock price is now trading at its highest level in almost a year. This is likely not a one-off. The fear of missing out may encourage investors to overlook many of the risks associated with AI and semiconductors. That said, we suspect many of the dangers associated with the AI boom will likely play out over time and should not lead to the overall change in outlook for the industry in the short- and medium-term.

Recession or Not: The European Central Bank is expected to raise interest rates at its next meeting, despite data showing that the eurozone’s largest economy is in a recession.

- Germany’s economy shrank 0.3% in the first quarter of 2023, driven by weak consumer spending and a slowdown in exports. This was the second consecutive quarter of contraction; thus, it meets the formal definition of a recession. The lack of growth is related to shoppers reining in their spending to cope with rising inflation. Household final consumption expenditure fell 1.2% in the first three months of 2023. Meanwhile, the overall price level of goods and services has risen 7.1% since April 2022. Despite the recession, the European Central Bank is expected to raise interest rates at its next meeting in June.

- Inflation concerns have kept European Central Bank officials hawkish as they look to restore price stability. Hours after German GDP figures were released, ECB Vice President Luis de Guindos advocated for central bank officials to maintain their fight against inflation. Later that day, Dutch Governing Council member Klaas Knot argued that interest rates should increase until at least July and stay there for some time. Central bankers’ insistence on maintaining policy tightening will make it difficult for countries to recover from a downturn. However, we suspect that hawkish ECB policy may offer support for the EUR, especially if the Federal Reserve holds its interest rates steady at its next meeting as expected.

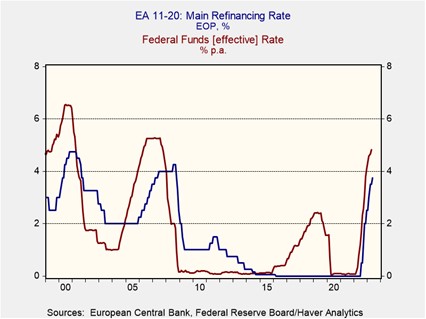

- If history serves as a guide, the ECB will be less aggressive in easing policy than its American counterpart. As the chart above shows, the ECB did not raise interest rates as fast as the Federal Reserve, but it was also much slower to cut. Overnight index swaps show that traders expect European interest rates to rise by 50 bps and American rates to fall by 25 bps by the end of the year. The narrowing of interest rate differentials should allow the EUR to appreciate against the USD, making European assets relatively more attractive.

Final Round: Markets are worried that another five years of Recep Tayyip Erdoğan as President will be damaging to the Turkish economy.

- After months of speculation about the potential end of his reign, Erdoğan is currently poised as the frontrunner to win the upcoming presidential run-off on Sunday. However, the backlash from victims of the devastating earthquakes combined with the mismanagement of the country’s economy could still hurt his chances of securing a victory. Interestingly, prior to emerging as the top vote-getter in the first round of the election, Erdoğan was trailing behind his rival Kemal Kılıçdaroğlu, with opinion polls indicating a gap of 43.7% to 49.3%. However, with the recent endorsement from the third-place candidate Sinan Oğan, Erdoğan now enjoys increased support and is heavily favored to win, much to the disappointment of investors.

- The market is bracing for another Erdoğan presidency, and as a result, it is expecting the Turkish lira (TRY) to decline in value after the election. Market participants are concerned that Erdoğan will continue to steer the country in a negative direction. Mounting inflation, a burdensome debt load, and sluggish economic growth weighed on investor sentiment. The iShares MSCI Turkey ETF has already fallen by 12% since the first round of elections. As a result, Turkey will need to undergo a significant and comprehensive transformation in order to rebuild the trust of investors.

- However, it is important to acknowledge that Turkish equities have demonstrated the ability to defy expectations in the past. This is evidenced by the remarkable 110% surge in dollar terms of the Borsa Istanbul 100 index last year, compared to a 20% decline in the S&P 500. Although some of those gains have been retracted, this rally highlights the possibility that investors may not always adhere strictly to conventional wisdom. From our perspective, Turkey’s strategic geographic location, robust military capabilities, and growing industrial base position it as an enticing prospect, provided the country manages to address its internal challenges. Only time will reveal if Turkey can fulfill its potential and capitalize on these advantages.