Daily Comment (May 25, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Good morning! Today’s Comment starts with an update on the debt ceiling negotiations. Next, we argue that the Fed may pause this year but is not likely to pivot. We end the report with our thoughts about the rising likelihood of a hard split between the U.S. and China.

Debt Ceiling: Ongoing talks between President Joe Biden and House Speaker Kevin McCarthy have yet to yield results, and investors are worried.

- American lawmakers are under pressure to reassure investors that they will raise the debt ceiling in a timely manner. The credit rating agency Fitch Ratings has placed the U.S. triple-A rating on watch for a possible downgrade due to concerns that political brinkmanship could prevent the government from honoring its debts. Despite progress made by negotiators, it is unclear when Congress will raise the debt limit to avoid a catastrophic default. The standoff is expected to continue today, but we are still confident that an agreement will be reached before the June 1 deadline. That said, the market may get a bit choppy as traders respond to the latest developments regarding negotiations.

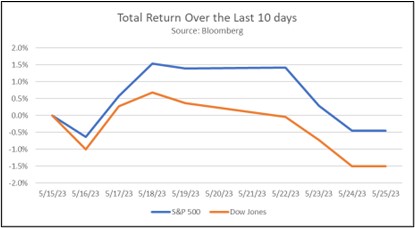

- Uncertainty over lifting the debt cap has unnerved markets. The S&P 500 and Dow Jones Industrial Index are both trading lower this week (see chart below). At the same time, yields on Treasury bills expiring in the first eight days of June have risen above 7%. Anxiety over when the debt ceiling will be raised has led to a surge in market volatility. On Wednesday, the CBOE Volatility Index (VIX) surpassed 20 suggesting an unusual amount of fear amongst traders. The strong reaction highlights the significant risk a potential default will have on the U.S. economy.

- We are confident that an agreement will be reached with bipartisan votes but suspect that the deal will push the country closer to recession. Despite speculation that McCarthy will need to win unanimous support from his party to get a spending bill through Congress, there are Democrats willing to fill the gap if needed. However, the combination of a liquidity drain and spending cuts from the new deal will remove fiscal stimulus from the economy. As a result, we still believe a recession is likely to happen within the next few quarters, even if the U.S. avoids default.

Hold Not Cut: The release of the latest Federal Open Market Committee meeting minutes has led investors to boost bets about a possible Fed pause.

- According to the May minutes, tighter financial conditions have led some Fed officials to question the need for additional rate hikes. The notes showed that central bank officials expressed a willingness to keep their options open as the committee determines whether it wants to raise rates further. The decision to maintain policy flexibility is related to concerns that inflation risks remain tilted to the upside. The latest staff projections for the annual change of personal consumption expenditure price index (PCE) were revised upward from 2.8% to 3.1% for 2023. That said, some policymakers argued that the committee should be patient before raising rates further.

- Recent speeches from officials suggest that the committee may be split between those favoring another hike and others preferring a pause. Earlier this month, Federal Reserve Governor Christopher Waller and Cleveland Fed President Loretta Mester advocated for additional rate hikes. Meanwhile, Chicago Fed President Austan Goolsbee and Federal Reserve Chair Jerome Powell expressed support for a pause at the June meeting. The conflicting reports have led traders to become less optimistic regarding a Fed pause. The latest CME FedWatch Tool now forecasts a 56.4% chance that the Fed will hold rates at their current levels at the time of this writing, much lower than the 90.1% prediction from three weeks ago.

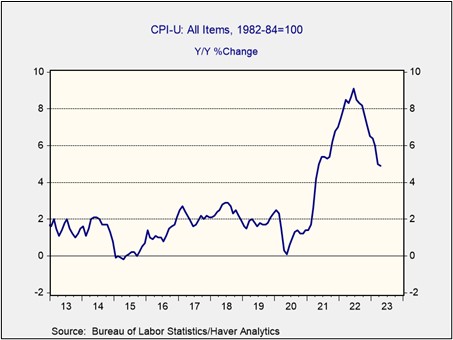

- As the chart above shows, the Fed is still far away from achieving its 2% inflation target. The lack of progress in achieving price stability suggests that policymakers will likely keep rates higher for longer than the market anticipates. As a result, the risk of a hard landing is relatively elevated as Fed officials will likely not pivot anytime soon. That said, we still believe the central bank is close to ending its tightening cycle and is more likely to seek a potential off ramp as the country heads toward a recession.

Chinese Rivalry: From spying to resource hoarding, Beijing is leaving no stone unturned as it prepares for its eventual decoupling from the U.S.

- Chinese state-sponsored hackers have implanted malware on critical infrastructure in the U.S. and Guam, according to Microsoft (MSFT, $313.85). The breach was designed to disrupt communications links between America and Asian countries in the event of a potential conflict. Although spying between the two countries is routine, experts believe this was the widest Chinese espionage campaign ever against American infrastructure. This is the second time this year that Chinese spy attempts were discovered and will likely prevent a thaw in tensions between the major powers. Following the report, Chinese stocks erased gains made in 2023 as investors prepared for additional headwinds.

- On a related note, China is building relationships with authoritarian governments as it seeks to avoid being denied access to key resources. Chinese firms have spent $4.5 billion to acquire stakes in lithium mining firms in Latin America and Africa. Those investments are somewhat risky given the security threat within these countries. However, Chinese firms have little choice but to work with these authoritarian governments as Beijing attempts to dominate the electric vehicle market. Additionally, China’s decision to deepen ties with Russia is also evidence of the country’s willingness to work with authoritarian governments to guarantee that it has the commodities it needs to sustain economic growth.

- The rift between the two major powers continues to reinforce our view that the world is likely to split into regional blocs. Although China still offers some attractive opportunities, we believe that investors have options if they seek to maintain their exposure to the second-largest economy without having to invest directly in the country. For example, nations that have a lot of trade exposure to China, such as Japan and the countries of Europe, have had strong stock market rallies following the end of China’s Zero-COVID policies. That said, as the largest economies start to diverge, the need for diversification will likely be necessary to hedge against unexpected changes in the geopolitical landscape. Hence, investors should be wary of putting all of their eggs in one basket.