Daily Comment (May 25, 2016)

by Bill O’Grady and Kaisa Stucke

[Posted: 9:30 AM EDT] It was another quiet night for news. EU officials hailed a “breakthrough” in debt talks with Greece. Officials met “into the wee, small hours of the morning”[1] and agreed to release €10.3 bn of new funds to Greece in recognition of the fiscal reforms already made by the country. The EU did agree to offer debt relief in 2018, if necessary, to meet agreed upon criteria on its payment burden. This deal is nothing more than political expediency and the continued process of extending and pretending. The IMF was threatening to walk away from further involvement in the Greek situation. For Eurozone leaders, IMF participation gives the negotiations an air of global involvement; without the IMF, the Eurozone/Greek problems are simply a European situation that requires a European solution. The German translation of “European solution” is “Germany pays.” Thus, the Germans are desperate to keep the IMF on board, and to do so Germany has to offer some promise of debt relief. German Finance Minister Wolfgang Schäuble wants to avoid any sort of debt relief to Greece before the 2018 German national elections. Thus, he made vague promises of future debt relief after said elections and the IMF agreed to the deal. Essentially, all that has occurred is that Greece will receive much-needed bailout funds and the Germans have delayed the likely necessary debt relief by two years. When 2018 rolls around, we doubt Germany will be any more open to writing off the debt, which is deeply unpopular in Germany. Still, this agreement will forestall any immediate crisis in Europe.

China and the U.S. are holding talks on June 6-7, known as the “U.S.-China Strategic & Economic Dialogue.” According to Bloomberg, Chinese officials are going to ask U.S. officials when the Fed is going to raise rates and by how much. According to reports, Chinese officials are quite concerned about the Fed’s decision to raise rates because it will make managing the exchange rate more difficult. Yesterday, we discussed a WSJ report that indicated the PBOC has abandoned the practice of allowing market forces to adjust the exchange rate. Essentially, Chinese officials seem to back the idea of the market setting prices until the market does something these same officials don’t like. Then, they intervene to get the outcome they want. China does not want to see a weaker CNY because it fears that a rapidly weakening currency will trigger capital flight. It appears that the PBOC is allowing the CNY to gradually weaken in anticipation of a rate move.

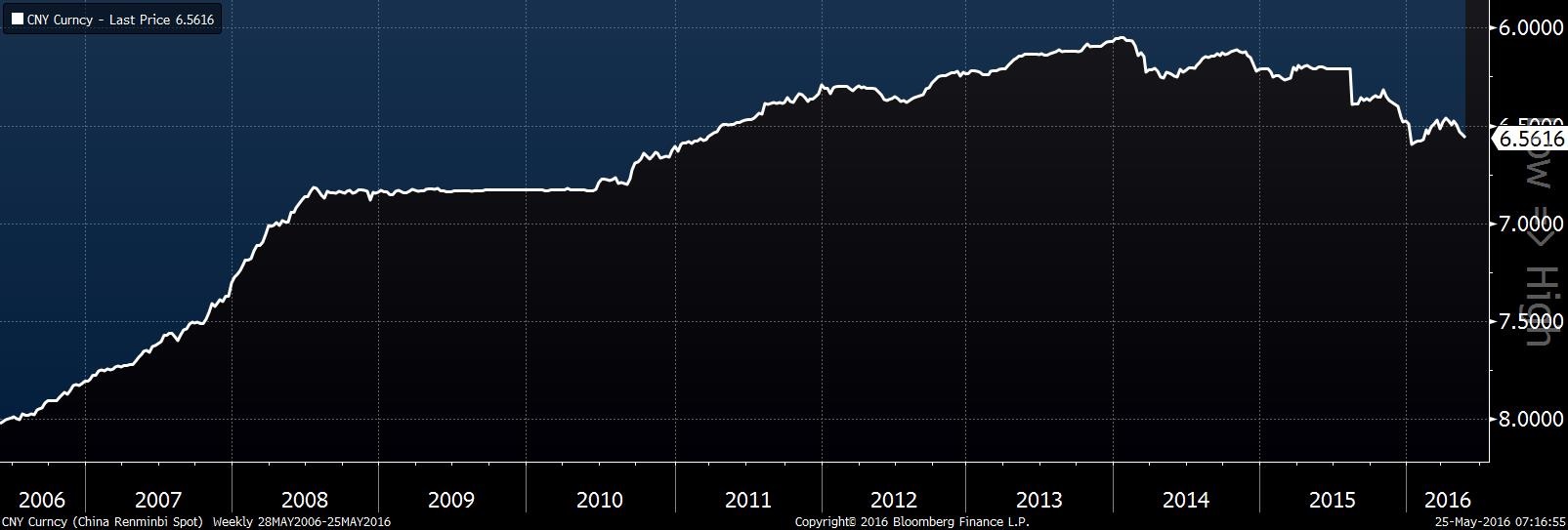

This chart shows a 10-year chart of the CNY/USD exchange rate on an inverted scale. Note that the Chinese currency did appreciate earlier this year but has started to weaken again. We suspect that if Chinese officials hear from U.S. officials that a hike will occur this summer, the PBOC will try to get in front of the move by gradually allowing the CNY to weaken further. The hope is that when the rate hike occurs in the U.S. it won’t lead to a sudden weakening of the exchange rate, which would lead to panicky capital flight out of China. Most likely, Chinese officials would prefer the Fed to keep rates steady; an appreciating dollar means that China must either maintain its loose peg, meaning its currency strengthens and undermines exports and growth, or allow the CNY to depreciate and risk capital flight.

______________________