Daily Comment (May 24, 2021)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT] | PDF

Good morning, and happy Monday! U.S. equity futures are higher this morning. The Northern Hemisphere’s hurricane season runs from June 1 to November 1, but recently it has become common for storms to form early. NOAA has named Ana the first tropical storm of 2021, but it has already become subtropical. Our coverage starts with the Belarus situation. Cryptocurrency news is followed by the international roundup. Next up is economics and policy, and we close with pandemic news.

Belarus: In a bold action, Belarus forced a Ryanair (RYAAY, USD, 115.64) flight to make an emergency landing in Minsk, using the pretext of a bomb threat. The flight originated in Athens on its way to Vilnius. Belarusian security agents on the plane claimed that there was a bomb on board and then sent a MIG-19 to force the civilian airliner to land at the Minsk airport. Once the plane landed, Roman Protasevich, a Belarusian journalist, was detained. He is wanted by the regime for disclosing state secrets and for fomenting unrest. Protasevich faces a 12-year sentence and perhaps worse if convicted (and it is highly likely he will be). After a “search” for a bomb showed that no such device was on board, the plane was allowed to fly to its original destination; however, Protasevich, his girlfriend, and four security agents did not complete the last part of the flight.

It remains to be seen what actions the West will take. The common refrain is that this event was ”state hijacking.” Eastern European Nations are incensed, but getting Western European Nations to take any significant actions will be difficult. EU leaders are discussing the situation today. But, if the reaction of the European Commissioner for Transportation is any guide, we wouldn’t expect much beyond strong statements. The U.S. issued a statement condemning the act. America already sanctions Belarus, so we would not expect much more to come from Washington. We would, however, expect the EU to ban commercial flights originating in the region from entering Belarusian airspace. Nonetheless, fears that further measures may lead to Russia absorbing the former Soviet state will likely limit action.

Cryptocurrencies: After selling off most of the night, bitcoin is moving higher at present. Prices have been under strong pressure recently. As we warned last week, it appears the crypto assets are beginning to have an impact on broader financial markets. Although recent behavior between markets could be a coincidence, we suspect that the rising use of leverage in crypto trading will end up linking this market to the broader financial system. We are noting a more hostile stance from central bankers concerning crypto; perhaps the most substantial risk to that market comes from the government.

International roundup: Japan is signaling a more aggressive military stance, tensions remain high in Myanmar, and election violence in Mexico is elevated.

- Japan Defense Minister Nobuo Kishi indicated that his country must radically increase defense spending to counter the threat from China. He also noted that the threat to Taiwan is a direct threat to Japan as well.

- In Myanmar, the current government plans to dissolve the National League of Democracy, the party of Aung San Suu Kyi. The EU has denounced the action. Fighting continues against the junta, and the government has suspended 125,000 teachers for opposing the coup.

- Mexico will hold midterm elections on June 6. Over the weekend, a mayoral candidate for Ciudad Obregon was shot while campaigning. This is the 83rd candidate killed in Mexico since September.

- In Peru, Pedro Castillo, the leftist candidate for president, is gaining ground in the polls.

- The Nyiragongo volcano in Congo has erupted, killing at least 15 people and displacing thousands. Over one million people live within the vicinity of the volcano, which had a large eruption in 2002.

- Although expectations are high that the Iran nuclear deal will be resurrected, SoS Blinken noted that Tehran has not taken the actions required to lift sanctions. Oil prices have come under pressure recently on fears that Iranian oil will return to markets soon. It should be noted that oil has been evading sanctions for some time, although a return to the agreement will likely lift Iranian sales by 1.0 mbpd to 1.5 mbpd over time.

- Russia, seeing the rapid ice melt in the Arctic, is quickly building its defense forces in the region. Russia has traditionally expected the cold and ice to make its long Arctic border safe from invasion but now realizes this border will need to be defended.

- Ukraine is asking Congress to maintain sanctions on Nord Stream 2 as the administration moves to ease them.

Economics and policy: A bipartisan infrastructure bill isn’t likely, a deal on corporate taxes is more likely, and economic expectations have caught up with the data, meaning that positive surprises will probably decline.

- It is looking increasingly like a bipartisan deal on infrastructure isn’t going to happen. Although there has been some movement, the two sides remain far apart. It remains to be seen whether the president’s full bill can make it through the Senate. In the end, we may see something, but momentum is slowing, and, as often happens, the White House has to deal with surprises that distract it from moving forward (e.g., Israel, Belarus, Nord Stream 2, etc.).

- We may be getting close to a deal on corporate taxes; the U.S. is supporting a 15% minimum rate within the G-7. That won’t prevent firms from moving business to traditional tax havens, but a deal within the G-7 will likely raise revenue from corporations.

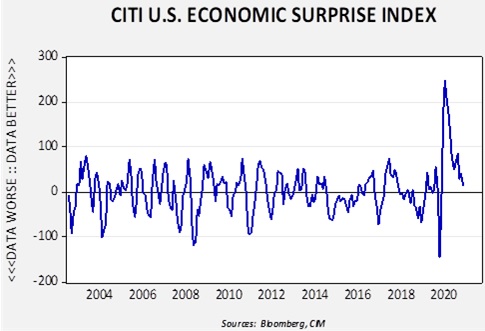

- The Citi economic surprise index measures the difference between economist expectations and the actual data. The index is adjusted for its impact on the forex markets, but it is a handy way of seeing how much of the economic trends are discounted in markets. Recent data is approaching zero, suggesting that much of the economy’s good news is in market prices.

If so, this means that even strong economic data will have fewer positive effects on prices, and it increases the likelihood of negative surprises.

- This is one to watch—Atlanta FRB President Bostic’s name is being circulated as a candidate for the next Fed Chair. He has made very clear statements suggesting that he would push hard to move the Fed’s priority to full employment and has suggested less emphasis on financial markets. Although Chair Powell is well-liked and could get another term, his term as chair ends next February.[1] A Bostic Fed would send an unmistakable signal that the Volcker era is over (although we think that signal has already been sent) and likely be taken as negative by financial markets.

- One of the problems tied to the exodus of households to smaller cities is that these new buyers bid up the price of existing homes, putting them out of reach for local buyers. Investor groups buying single-family homes have exacerbated the problem. There are several resolutions to this problem, but the one that is most socially viable is an expansion of homebuilding.

- The pandemic has brought havoc to supply systems. A telling development is that hand sanitizer, which was in very short supply last year, is now so abundant that retailers can’t get rid of it fast enough.

- Recently, the Biden administration offered to suspend intellectual property (IP) rules on vaccine patents. South Africa and India have proposed new rules on IP that are so broad that they will almost certainly be rejected by the WTO.

- The FTC leadership looks to take a more aggressive posture on antitrust.

COVID-19: The number of reported cases is 167,229,205 with 3,464,997 fatalities. In the U.S., there are 33,117,923 confirmed cases with 589,893 deaths. U.S. cases and deaths are at their lowest levels in a year. For illustration purposes, the FT has created an interactive chart that allows one to compare cases across nations using similar scaling metrics. The FT has also issued an economic tracker that looks across countries with high-frequency data on various factors. The CDC reports that 357,250,375 doses of the vaccine have been distributed with 285,720,586 doses injected. The number receiving at least one dose is 163,309,414, while the number of second doses, which would grant the highest level of immunity, is 130,014,175. The FT has a page on global vaccine distribution.

- Today’s big story is that there is evidence that three researchers at the Wuhan virology lab became sick enough to see hospitalization in November 2019. This facility has come under scrutiny as perhaps being the origin of COVID-19. Although the dominant origin story is that the virus crossed over from bats to humans, this lab, which works on coronaviruses, may have leaked SARS-CoV-2 through inadequate security measures. Beijing strongly rejects this theory and pushed WTO researchers from this idea. The Wuhan institute has not shared its data, raising concerns that it may have inadvertently released the virus. The theory that the virus originated in this lab has become politicized; however, we note that a growing chorus of scientists have suggested that further investigation is warranted.

- The death rate has been on a long-term downtrend, but the pandemic has led to the highest death rate in 17 years. It’s not just the disease itself. Shutdowns delayed preventive health care measures, and social distancing likely facilitated a surge in drug overdose deaths. Life expectancy fell from 78.8 years in 2019 to 77.8 years in 2020; a decline in life expectancy is common with pandemics.

- China, which has lagged the rest of the world, has stepped up its distribution of vaccines.

- Taiwan is experiencing a jump in cases, although some of the increase may be due to lags in reporting.

- Indonesia is reporting a cluster of new cases after treating merchant sailors who were infected.

- Latin America has suffered one million fatalities from COVID-19.

[1] For reference, Vice-Chair Clarida’s term ends September 2022 and Vice-Chair Quarles’s term ends in October.