Daily Comment (May 23, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! Financial markets are digesting the president’s latest comments on potential new tariffs. In sports, the Oklahoma City Thunder secured a 2-0 advantage in the Western Conference Finals against the Timberwolves. Today’s Comment focuses on the Federal Reserve’s recent court victory, important details emerging from the Republican tax bill proposal, and other market-moving news. We’ll conclude with our regular roundup of economic data releases from both domestic and international sources.

Fed Independence Win: The Supreme Court’s ruling is expected to reinforce market confidence in the central bank, potentially easing recent bond market jitters.

- The Supreme Court ruled that the president has the authority to dismiss the heads of independent agencies while a court case is pending. However, the decision explicitly excluded the Federal Reserve’s board, describing the central bank as a “uniquely structured, quasi-private entity” and thus outside the scope of the ruling. This outcome reinforces the view that the president lacks the power to remove the Federal Reserve’s chair, Jerome Powell.

- The ruling should reassure bond markets that the president cannot single-handedly control the Fed. Concerns had grown after the president repeatedly threatened to oust Fed Chair Powell for refusing to align interest rate decisions with White House demands. These threats spurred a bond sell-off as investors feared political interference in monetary policy, particularly the president’s push to lower rates simply to follow moves by other countries.

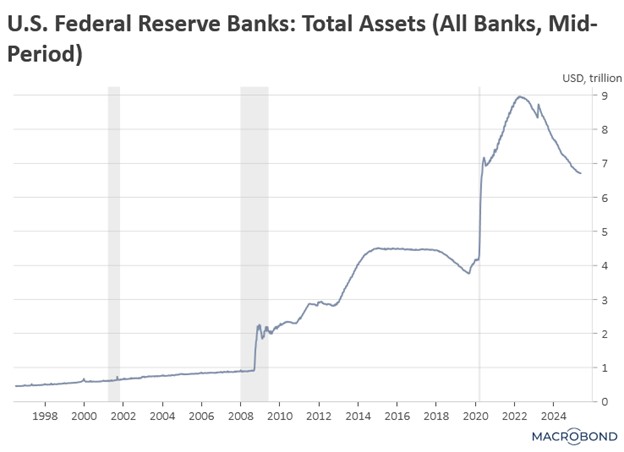

- The ruling further solidifies the central bank’s ability to sustain its moderately restrictive policy stance. Fed officials have repeatedly expressed hesitancy about cutting interest rates, warning that inflation could rebound by mid or late summer, keeping short-term rates elevated. Meanwhile, Federal Reserve Governor Chris Waller has dismissed speculation about expanding the Fed’s balance sheet to stabilize bond markets, instead maintaining its strategy of shrinking holdings to transition reserves from abundant to ample levels.

- In summary, the court’s decision to shield the Fed from presidential dismissal authority is ultimately market-positive but presents short-term uncertainties. While the ruling strengthens the central bank’s long-term credibility by cementing its political independence, it may paradoxically make the Fed more cautious about near-term market interventions. Policymakers could now require clearer signs of financial stress before acting after becoming wary of appearing politically influenced even when staying on the sidelines.

Republican Tax Bill: The GOP succeeded in passing its tax bill through the House, but there is still a strong chance the final legislation will differ from the current version.

- The bill passed by the narrowest possible margin, with a 215-214 vote. The legislation now heads to the Senate where bipartisan calls for changes are growing, particularly over proposed Medicaid cuts and the rollback of renewable energy tax incentives. At the same time, there does seem to be some concerns among moderate Republicans that the bill could hurt them in the mid-term election.

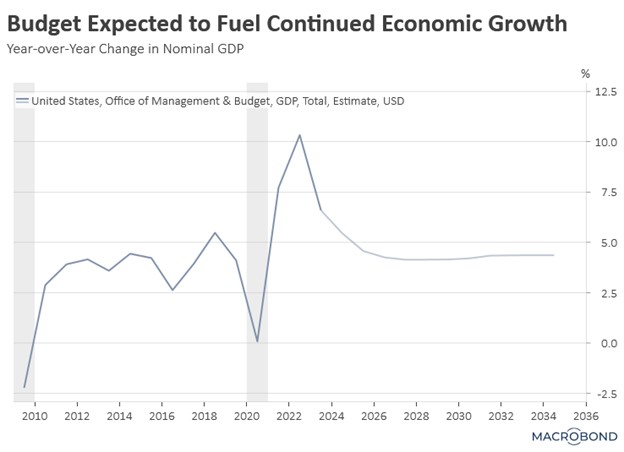

- That said, the House bill fulfills several of President Trump’s major campaign promises, including an extension of the corporate and individual tax cuts initially passed under his 2017 tax reform. The legislation also embraces more populist proposals, such as tax exemptions for tipped wages, overtime income, and auto loan interest. Additionally, the bill increases funding for immigration enforcement and border security while raising the SALT deduction cap from $10,000 to $40,000 for households earning $500,000 or less.

- The bill introduces significant changes to Medicaid, including stricter work requirements for able-bodied recipients, more frequent eligibility checks, and verification provisions to confirm beneficiaries’ legal status. It also reduces Medicaid funding for states that provide coverage to undocumented workers. Additionally, the bill imposes stricter work requirements on food programs like SNAP. It also eliminates energy tax breaks for consumers and phases out tax credits supporting green energy investments.

- While the final legislation may differ, we expect many of the tax benefits to remain largely intact. However, spending cuts could gain more attention as the Senate works to reduce the bill’s overall cost. As previously noted, we believe the tax package will be a net positive for equities. The proposed changes should help offset the impact of tariffs while encouraging greater private investment.

Trade Flows to Capital Flows: There are signs that some countries have started to take aim at foreign investments as they look to prevent market distortion.

- In response to Spain’s worsening housing crisis, the Socialist Party of Prime Minister Pedro Sánchez has introduced legislation that would impose a 100% tax on property purchases by non-EU buyers. While the proposal includes exemptions for foreign workers legally residing in Spain, its passage remains uncertain given the government’s slim parliamentary majority. If approved, the measure would take effect in January 2026.

- Spain’s focus on restricting foreign real estate investment may signal a shift in how governments view capital flows. While countries typically welcome beneficial investments like foreign direct investment for job creation and infrastructure, portfolio investments are increasingly scrutinized due to their links with asset bubbles and widening wealth gaps.

- While these measures for the Spain housing market specifically target the distortive effects of foreign capital inflows, they also underscore a fundamental tension in global economic governance. The challenge is particularly acute in trade relations with China, where the systematic recycling of export revenues into importing nations serves as an implicit currency stabilization mechanism. These permissive capital flow regimes have exacerbated structural imbalances in global trade.

- We do not anticipate that Spain’s measures will trigger widespread EU restrictions on foreign investment in financial assets, nor do we expect significant spillover into equity markets. However, these actions may signal an emerging trend as governments increasingly seek to shield domestic markets from distortive foreign capital flows. Over the long term, we expect countries will focus on developing domestic industrial capacity — a shift that could ultimately enhance the appeal of international investment opportunities.

Trade Hardline: While the market believes trade tensions are easing, Trump’s actions suggest that they could heat up again.

- President Trump has threatened to impose 25% tariffs on iPhones unless Apple shifts production back to the US. This comes as the tech giant plans to move much of its iPhone manufacturing from China to India. The escalation reflects the administration’s broader push to force companies to relocate supply chains to the US.

- The Trump administration has rejected the EU’s proposal for a mutual tariff reduction, warning that negotiations will stall unless the EU accepts stricter reciprocal duties. The remarks underscore how far apart the two sides remain in trade talks.

- We’ve noted the president’s strategic pattern of creating high expectations before negotiations, only to later secure a more favorable compromise. A prime example was his initial proposal of an 80% tariff floor rate ahead of China talks, which was subsequently reduced to 30% following discussions. Given this precedent, the current EU tariff threats likely serve as a tactical opening position rather than a definitive policy. We therefore recommend maintaining perspective and avoiding an overreaction to these developments.

- That said, the president’s recent remarks underscore how quickly the administration’s stance can shift from easing tensions to sudden cooling. As a result, we maintain that a “wait-and-see” approach remains prudent for conservative investors. However, those willing to take on risk may find opportunities by focusing on key factors such as strong earnings growth and minimal overseas supply chain exposure.