Daily Comment (May 23, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Our Comment today opens with several new indicators pointing to a possible further worsening in tensions between the US bloc and the China/Russia bloc. We next review several other international and US developments with the potential to affect the financial markets today, including signs of better economic growth in Europe, a snap election in the UK, and minutes of the Federal Reserve’s most recent meeting on US monetary policy.

China-Russia: Following on the UK defense minister’s assertion yesterday that the US and UK have intelligence showing that China is sending or preparing to send lethal aid to Russia for its invasion of Ukraine, US National Security Advisor Sullivan said he has not seen such evidence and would have to discuss the matter with his British counterparts. At this point, it isn’t clear whether the disagreement reflects differences over how to interpret the same intelligence or perhaps is due to the Biden administration’s extreme reluctance to push China or Russia too far.

- In any case, the US-UK disagreement seems to be based on some kind of intelligence showing China’s support for Russia is more substantial than previously known.

- As we noted in our Comment yesterday, such substantial support for Russia’s invasion would potentially be quite incendiary and could lead to sanctions directly against China. Obviously, broad Western sanctions against China would likely exacerbate the current spiral of tensions and present greater risks for investors.

China-Taiwan: While China draws closer to authoritarian allies such as Russia, it continues to ramp up its aggressiveness against Taiwan and other democracies. In an apparent effort to intimidate Taiwan’s newly inaugurated, independence-minded president, the Chinese military today has launched large-scale exercises practicing encirclement of the island. The drills are planned to last two days and will include air, navy, ground, and rocket forces.

- According to a Chinese military spokesperson, the exercises are intended to “serve as a strong punishment for the separatist acts of ‘Taiwan independence’ forces and a stern warning against the interference and provocation by external forces.”

- We still believe that the biggest near-term risk involving China’s geopolitical aggressiveness is in the Philippines. Nevertheless, exercises such as the ones China is launching today around Taiwan raise the risk of accidental confrontation or miscalculation that could escalate into a bigger conflict and draw in the US.

China-Australia: Australian wine exports to China jumped to $10.4 million in April after removal of the tariffs Beijing imposed in 2021 to punish Australia for questioning China’s role in the coronavirus pandemic. Australian wine exports to China in April were about eight times greater than in the same month one year earlier and are expected to keep growing in the near term. The improvement shows how China sometimes does back down after imposing punitive trade barriers on countries that anger it.

China-European Union: In contrast with the improved China-Australia relationship, a top Chinese auto market expert who works closely with the government said in an interview that China should hike import tariffs against foreign internal-combustion autos with large engines. With the European Commission (EC) expected to release its decision on possible import tariffs against Chinese electric vehicles in the next two weeks, the remark has been widely interpreted as a warning that Beijing is prepared for a trade war if the EU puts up barriers to Chinese EVs.

- Europe’s large auto industry is a juicy target for Chinese attack in a trade war, and European nations have often proven timid when faced with threats to their sales in China.

- Nevertheless, the EC has exclusive responsibility for the region’s trade policies, and its priority is to avoid another decimation of a key European industry at the hands of China. Individual countries can’t block any anti-China tariffs the bureaucrats in Brussels might impose, so the risk of an EU-China trade war is rising.

- Any such trade war would further the process of global fracturing, in which countries are coalescing into relatively separate geopolitical and economic blocs. Since many large European companies are dependent on exporting to China, a trade war could weigh heavily on European stock markets.

Eurozone: The composite purchasing managers’ index for May rose to a seasonally adjusted 52.3, beating expectations and improving from 51.7 in April. Like most such indexes, the eurozone’s composite PMI is designed so that readings over 50 indicate expanding activity. The May data adds to the evidence that the European economy is recovering a bit from its recent contraction, which stemmed from factors such as high energy prices and rising interest rates.

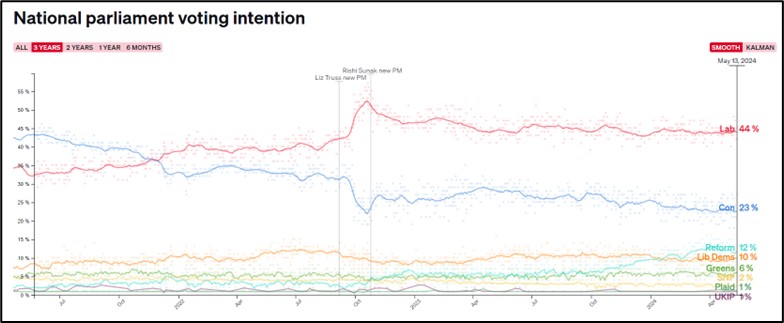

United Kingdom: Prime Minister Sunak yesterday called a snap election for July 4, even though the ruling Conservative Party is trailing the leftist Labour Party by about 20 percentage points in recent opinion polls. Sunak and the Conservatives are hoping, perhaps against hope, that a string of positive data points on economic growth and price inflation will overcome voter fatigue with the Conservatives and perceptions that the party is too chaotic and divided to govern.

US Monetary Policy: The minutes of the Fed’s April 30-May 1 policy meeting, released yesterday, show that the policymakers as a group continued to believe the benchmark fed funds interest rate is high enough to slow economic activity and bring down price pressures, but the process is likely to take longer than originally thought. Importantly, the minutes show some officials “mentioned a willingness to tighten policy further should risks to inflation materialize in a way that such action became appropriate.”

- Even though Fed board member Waller said separately yesterday that the probability of rate hikes is currently “very low,” the reference to potential policy tightening drove stock prices lower.

- By market close, the S&P 500 was down 0.3% to 5,307.01.

US Antitrust Policy: The Justice Department and several state governments today are expected to file an antitrust suit against entertainment ticketing giant Live Nation. Based on allegations that Live Nation has a monopoly that leads to higher ticket prices, the suit will essentially ask that the 2010 merger between Live Nation and Ticketmaster be reversed.

- The suit against Live Nation is another example of the Biden administration’s effort to toughen US competition policy. To date, that effort has had a mixed record.

- Coincidentally, Bloomberg’s latest “Odd Lots” podcast, published just today, carries an interview with the top DOJ economist, who explains how the department identifies and analyzes potentially uncompetitive behavior that could lead to an antitrust suit.

US Stock Market: After market close yesterday, artificial intelligence darling Nvidia said sales in its latest quarter rose to $26 billion, three times greater than one year earlier, while its net income rose to $14.88 billion, nearly 7.5 times more than in the year-earlier period. Moreover, the firm lifted its sales forecast for the current quarter, and its CEO pronounced a bullish outlook for its products in the coming years.

- The company also announced a 10-for-1 stock split effective June 7 and more than doubled its dividend.

- In after-hours trading, the stock jumped approximately 6%. So far this morning, Nvidia’s stock is up about 6.7% to $1,013.40.