Daily Comment (May 23, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Our Comment today opens with some key data showing how reduced demand for goods is slowing the global economy, even as post-pandemic demand for services continues to grow. We next review a wide range of other international and U.S. developments with the potential to affect the financial markets today, including more signs of tension and decoupling between the West and China.

Global Economy: Maritime research consultant Drewry has released data showing the world’s production of shipping containers has slumped dramatically in response to the falling demand for goods now that countries have eased their pandemic restrictions. With consumers shifting their spending back to services instead of goods, shipping activity has declined, leaving a glut of containers around the globe. Transportation dynamics often reflect the strength of economic activity, so the drop in container production helps confirm that the global economy is slowing.

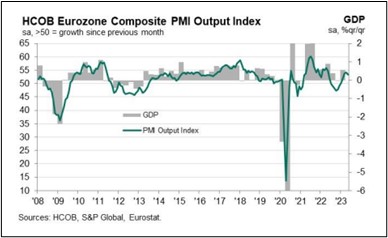

Eurozone: S&P Global said its May “flash” purchasing managers’ index for manufacturing fell to a 36-month low of 44.6, compared with 45.8 in April. Like all major PMIs, this one is designed so that readings below 50.0 point to declining activity.

- The recent readings, therefore, indicate that the Eurozone’s factory output remains in a deep slump.

- On a more positive note, however, the May flash PMI for the service sector merely pulled back to 55.9 from 56.2 in the previous month. That illustrates how service activity in the bloc continues to grow smartly.

- The increased activity in the service sector is keeping the overall Eurozone economy growing despite the post-pandemic pullback in manufacturing. Illustrating that, the May flash composite PMI stood at 53.3, down only modestly from 54.1 in April.

United Kingdom: The International Monetary Fund reported in an updated forecast that it no longer expects British economic activity to slip into recession this year. The institution now expects gross domestic product to expand 0.4% in 2023 and 1.0% in 2024, reflecting stronger wage growth, more supportive fiscal policy, and an easing of global energy prices and supply chain blockages. All the same, the IMF forecasters warned that consumer price inflation is likely to be elevated for some time to come.

Greece: As we flagged in our Comment yesterday, conservative Prime Minister Mitsotakis called new parliamentary elections for June 25, rather than trying to form a coalition government after winning a plurality, but not a majority, in Sunday’s elections. Because of how the seats in parliament will be allocated in the second election, Mitsotakis and his New Democracy Party will have a good shot at forming a government by themselves.

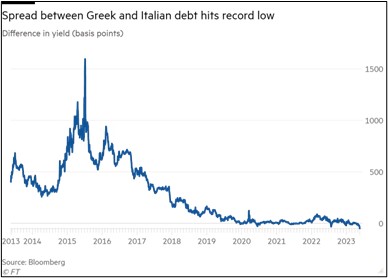

- Coupled with the economy’s rebounding tourism and transportation activity, Mitsotakis’ business-friendly policies have given a boost to Greek assets.

- Greek sovereign bonds rallied further yesterday on the election news, driving their yield to a record low against comparable Italian bonds.

Bulgaria: After having five elections since 2021 that have ended inconclusively or resulted in short-lived governments, the country’s two main political parties have agreed to a power-sharing deal aimed at finally producing an effective government. Under the deal, the two rival parties will form a coalition government with rotating prime ministers. The agreement could help the country finally make progress on important issues like cutting inflation, clamping down on corruption, reducing economic dependency on Russia, and joining the Eurozone.

Japan-China: Semiconductor manufacturers in China say they are worried that Japan’s new rules on selling advanced semiconductor-manufacturing equipment to the country could be tougher than the U.S. and Dutch restrictions. If so, the executives said the restrictions could crimp China’s output of basic, relatively unsophisticated chips like those used in automobiles or kitchen appliances. As we’ve warned many times before, investors remain at risk as the West and China try to decouple from each other economically and technologically.

United Kingdom-China: In a member survey last month, the British Chamber of Commerce in China said only 8% of its members were pessimistic about their prospects in the country, down from 42% at the beginning of China’s post-pandemic opening last December. However, fully 70% of the members said they were still taking a wait-and-see approach to new investments in the country because of continued regulatory uncertainty. The survey shows how President Xi’s drive to bring the economy under stricter state control and clamp down on security risks is also playing into the decoupling phenomenon.

United States-China: Several Chinese residents and a real estate firm filed a federal lawsuit to block a new Florida law restricting the sale of real estate to citizens of China, Russia, Iran, and other “countries of concern.” The suit seeks to invalidate the law on grounds that it violates the Constitution’s equal protection clause and intrudes on the federal government’s right to manage national security, international affairs, and international commerce.

- The new Florida legislation was championed and recently signed into law by Governor Ron DeSantis, a prospective Republican presidential candidate.

- We think passage of the law illustrates how both Republicans and Democrats will likely compete to look toughest on China in the run-up to next year’s elections. If so, there could be a spiral of aggressive measures and proposals against China, which would likely make U.S.-China tensions even worse than they are at present.

U.S. Fiscal Policy: In their latest face-to-face negotiation over raising the federal debt limit yesterday, President Biden and House Speaker McCarthy failed to reach an agreement, but McCarthy indicated the discussion was productive and that he expects to keep talking with Biden daily until they reach a deal. The key sticking points now appear to be how much to raise the debt ceiling and at what level to cap federal spending in the upcoming fiscal year. We continue to believe a deal will be reached and passed into law before the government loses its ability to pay its bills, but brinksmanship over the next couple of weeks could lead to heightened volatility in the financial markets.

U.S. Consumer Sentiment: In the Federal Reserve’s annual survey of financial well-being, conducted last October, some 73% of U.S. adults said they were doing OK or living comfortably, down from 78% in 2021. Importantly, a record 35% of the respondents said they were worse off financially than one year before, with more than half citing price inflation as a major challenge. The survey underscores how the pain of rising prices was more than enough to offset the impact of low unemployment and rising wages last year. It also reveals a likely reason why polls show that President Biden’s job approval ratings are so low despite high levels of employment.