Daily Comment (May 22, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! Financial markets are monitoring developments in the pending tax legislation. In sports, Tottenham Hotspur ended their 17-year trophy drought with a dramatic Europa League final victory over Manchester United. Today’s Comment will examine growing concerns about US debt sustainability, analyze progress in EU-US trade negotiations, and highlight other market developments. As usual our report includes a summary of domestic and international economic data releases.

Debt Problem: Tepid demand at auction reflects investor focus pivoting from trade and toward fiscal deficits.

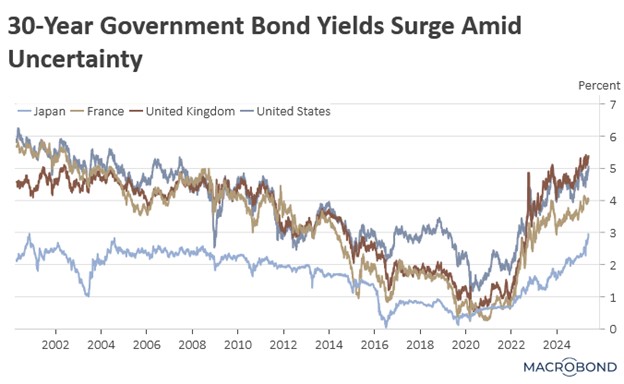

- The Treasury’s $16 billion 20-year bond auction on Wednesday saw weak demand as yields rose above 5% for the first time since October 2023. The poor showing resulted in a 1.2 basis point tail (the spread between average and lowest accepted yields), which was significantly wider than the recent -0.4 bp average. This miss reflects dwindling appetite among rate-sensitive buyers, with domestic investors particularly reluctant to absorb the bulk of issuance at current yield levels.

- The weak auction results will likely fuel concerns about sovereign credit quality, especially after Moody’s downgrade of the US credit rating last week. Since the decision, long-dated bond yields have climbed across the US and other G-7 economies as investors grow wary of duration risk. Rising debt sustainability worries, persistent inflation, and ongoing trade tensions have all contributed to this reluctance.

- Investors are closely tracking the new tax bill’s progress through Congress as lawmakers debate critical provisions. Key sticking points include proposed cuts to green energy credits and Medicaid, along with potential tax increases aimed at covering the bill’s costs. According to Congressional Budget Office estimates, the legislation could increase the national debt by approximately $3.8 billion over the next 10 years.

- The interplay between rising interest rates and the proposed tax bill creates competing forces for equity markets. While the stimulus measures could bolster business and household incomes, potentially driving higher consumption and investment, tightening financial conditions may pressure corporate margins and dampen household borrowing. Although we currently assess the tax package as a net positive, the trajectory of interest rates warrants close monitoring, as further increases could pose headwinds for equities.

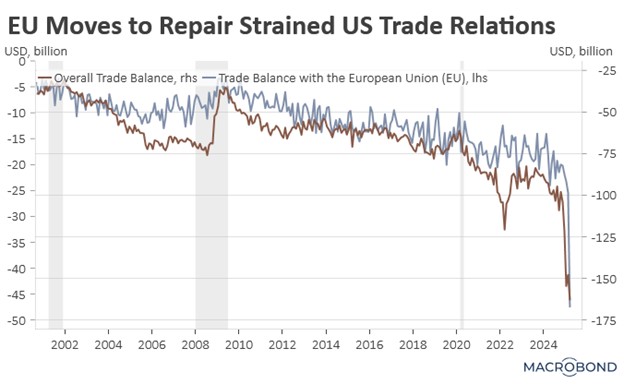

EU Wants a Deal: Brussels has updated its trade proposal to the Trump administration in an effort to prevent further tariff escalation.

- The new proposal aims to address White House priorities on regulatory reform and trade policy more effectively. Although specific details have not yet been released, the framework seeks to identify areas of alignment, particularly regarding international labor standards, environmental protections, and economic security measures. The plan also includes provisions for targeted investments and strategic procurement initiatives in key sectors such as energy and artificial intelligence.

- The EU’s latest proposal comes as it seeks to revive negotiations with the US and build diplomatic momentum. Initially, the bloc offered a “zero-for-zero” tariff arrangement on automobiles and industrial goods, but the White House rejected the proposal. The EU remains hopeful that it can persuade the current administration to reduce tariffs and has warned of retaliatory measures if it fails to secure a more favorable deal than the one recently obtained by the UK.

- The upcoming US-EU negotiations are expected to focus primarily on trade reciprocity and equitable market access. Washington has consistently argued that Brussels maintains regulatory frameworks that effectively serve as non-tariff barriers, particularly targeting American agricultural exports and digital services. These measures have significantly hindered the ability of US companies to compete fairly in the European market.

- Nevertheless, a US-EU agreement appears increasingly likely, as the White House has emphasized its goal of finalizing a trade deal by mid-summer. We anticipate the new framework will center on coordinated efforts to counterbalance China’s economic influence, resulting in a mutual reduction — though not complete elimination — of tariffs. As negotiations progress, we expect trade tensions to gradually ease in the coming weeks.

AI Importance: A senior CIA official has declared that outpacing China in artificial intelligence development now represents America’s foremost intelligence priority.

- The official’s remarks follow concerted US efforts to strengthen international partnerships regarding semiconductor supply chains. CIA leadership has announced plans to reorganize the agency and refocus priorities to better counter China’s technological advancements. This strategic shift reflects the expanding nature of US-China competition, which has evolved beyond trade disputes to encompass critical technology sectors.

- President Trump’s recent trip to the Middle East signaled this shift in US policy priorities. During his visit, the president sought to strengthen alliances with Gulf nations by offering access to advanced American AI technology and commitments to support their technological infrastructure development. Additionally, his administration has rolled back previous restrictions that limited these countries’ ability to acquire critical components for building domestic tech ecosystems.

- The escalating competition has prompted new restrictions for companies and nations engaging in technology trade with China. The White House has warned that countries utilizing Chinese-developed semiconductor technology risk losing access to critical US technological exports. Meanwhile, American firms continue lobbying the administration to maintain access to China’s lucrative and expanding technology market.

- As outlined in our escalation ladder framework mentioned in our export controls report, the focus on AI trade restrictions represents an escalation in tensions. We anticipate that these trade measures, currently targeting goods, will expand to the diplomatic sphere as both nations seek to rally third-party countries to their respective positions. While we do not view this technological competition as likely to trigger immediate military conflict, the emerging AI arms race is clearly exacerbating strategic tensions between the two powers.

The Golden Dome: The president’s push to develop an advanced missile defense system aims to bolster national security, but risks accelerating a new arms race in space.

- Earlier this week, the president approved a $175 billion missile defense shield initiative, appointing a Space Force general to oversee its development. The program aims to deploy a constellation of advanced satellites capable of detecting, tracking, and potentially intercepting inbound missiles targeting the United States — a direct response to escalating threats from Russia and China.

- China has condemned the move, warning it could trigger a destabilizing space arms race and further escalate tensions between the two powers. Beijing has called on the US to reconsider the program’s development, although it recognizes that Washington is unlikely to alter course. Analysts suggest China’s objections may signal its intent to pursue a comparable system, potentially accelerating military competition in orbit.

- The missile shield initiative highlights the return of Cold War-era tensions between global powers. This strategy evokes strong parallels with the Mutually Assured Destruction (MAD) doctrine that dominated geopolitics in the 1980s, when rival nations amassed nuclear arsenals solely to prevent first strikes. Notably, similar defensive systems were considered but ultimately abandoned during that period. We think the situation is a reminder of the rise in global geopolitical tensions.