Daily Comment (May 21, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! Markets remain cautious as investors weigh fiscal concerns amid the tax bill’s progress through Congress. In sports, the Oklahoma City Thunder claimed Game 1 against the Minnesota Timberwolves in the Western Conference finals. Today’s Comment will address renewed tensions in the Middle East, the Fed’s patient approach to rate cuts, and other market-moving developments. As usual, the report will include a summary of key domestic and international economic data releases.

Middle Eastern Tensions Rise: Israel has adopted a more assertive stance amid stalled US negotiations with Iran and escalating hostilities from Houthi rebels.

- US intelligence indicates Israel may be preparing to strike Iranian nuclear facilities. While no final decision to execute such an attack has been confirmed, Israeli officials have reportedly been weighing this option for months and military preparations appear to be intensifying recently. These developments suggest Israel may be losing confidence in the White House’s ability to diplomatically curb Iran’s nuclear program through diplomacy.

- The heightened tensions have emerged as US-Iran nuclear negotiations reached an impasse. Recent weeks saw active White House efforts to curb Iran’s nuclear program, with the US president noting last week that Iran had “sort of agreed to terms.” However, Iran’s Supreme Leader Ayatollah Ali Khamenei has rejected this optimism, declaring the talks “unlikely to succeed” and labeling US demands as “outrageous.” His ominous conclusion, “whatever happens will happen,” signals a dangerous hardening of Iran’s position.

- Israel’s increasingly aggressive posture toward Iran follows a dangerous escalation by Tehran-backed Houthi rebels. On Sunday, the group launched missile attacks against an Israeli airport, all intercepted by defense systems, while imposing a naval blockade on Israel’s Haifa port. The coordinated provocations prompted immediate retaliation, with Israel expanding its Gaza ground operations.

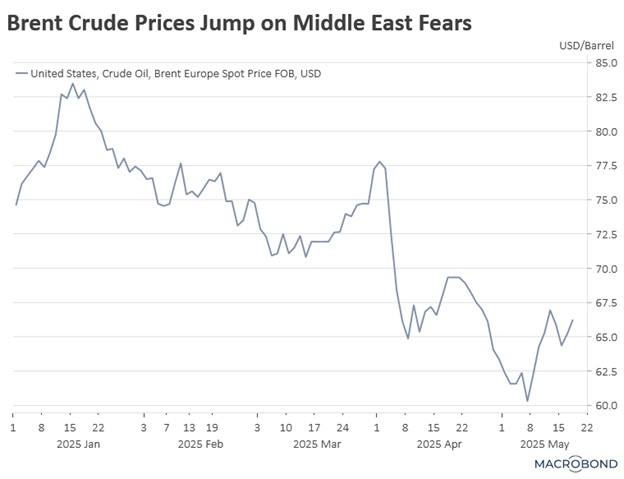

- While an immediate attack appears unlikely, escalating tensions in the Middle East have already begun driving up energy prices due to supply concerns. Brent crude has risen 3.5% following recent developments, trading above $66 a barrel. We believe Israel’s threats against Iran may partly be a negotiating tactic to pressure Tehran into accepting previous terms, though this strategy could backfire if Iran perceives it as offering no tangible benefits. A war in the Middle East will likely weigh on global risk assets.

Wait and See Approach: Fed officials are consistently trying to dampen expectations for rate cuts this year.

- Two Federal Reserve officials emphasized the need for policy patience during Tuesday’s remarks. San Francisco Fed President Mary Daly cautioned that policymakers still lack sufficient data to justify easing monetary policy. Separately, Cleveland Fed President Beth Hammack highlighted ongoing analysis of whether recent tariffs will produce only temporary inflationary effects or more persistent price pressures, noting that clearer insights should emerge in coming months.

- Their comments coincide with shifting market expectations for Fed rate cuts this year. Just a month ago, investors anticipated aggressive easing, potentially beginning as early as June with up to 100 basis points of cuts by year’s end amid fears of an economic slowdown. However, receding trade tensions and stronger-than-expected data have since led forecasters to revise projections, now pricing in just 50 basis points of cuts, likely starting in September.

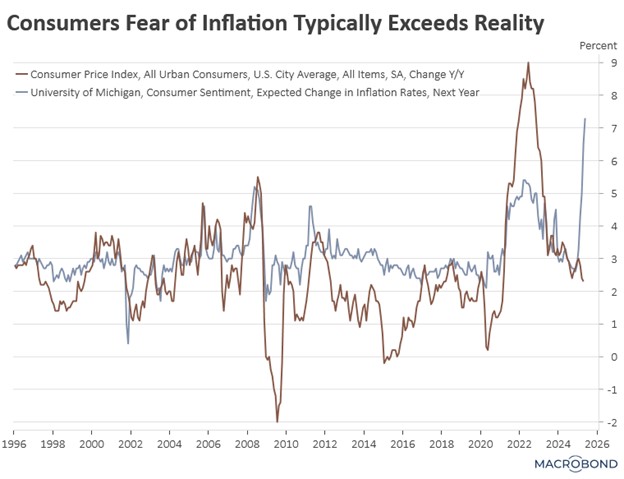

- The Fed’s focus on cutting interest rates appears to be driven by rising inflation expectations. The latest Michigan Consumer Sentiment Survey revealed that households expect inflation to rise 7.3% next year — the highest expected level since the 1980s. While inflation expectations are not typically a reliable indicator of future price pressures, these concerns likely explain the Fed’s decision to prioritize inflation over economic growth.

- So far, there is little evidence of broad-based inflation outside a few raw material intensive sectors. As we noted last week, many firms, including Home Depot, seem willing to absorb some tariff-related cost increases. While this could pressure earnings, it may also delay or mitigate the broader inflationary effects of tariffs. This dynamic could give the Fed room to cut rates once or even twice by year’s end, assuming the economy avoids a recession.

Trump Gets Involved: President Trump is pressuring Republican lawmakers to fall in line and is determined to push through his signature tax plan before year’s end.

- The president’s decision to personally lobby lawmakers reflects growing uncertainty about whether his tax legislation can secure enough votes to pass. The bill faces resistance from fiscal conservatives and SALT deduction supporters. Fiscal conservatives insist on larger social spending cuts to control the deficit and enhance fiscal sustainability. On the other side, SALT advocates are working to secure tax breaks for states most impacted by the potential expiration of the previous tax cuts.

- Despite some opposition, Republican lawmakers are fast-tracking a bill in the House this week. The current iteration proposes raising the SALT deduction cap to $40,000 for individuals earning up to $500,000, with a 1% annual income phase-in before making the deduction permanent. Concurrently, fiscal conservatives are advocating for an accelerated implementation of Medicaid work requirements, moving up the original 2029 timeline, which is likely to neutralize potential political fallout ahead of the election.

- While the Trump tax bill is expected to partially offset the tariffs’ economic impact, most analysts agree it won’t fully neutralize the drag. Economists now project import taxes could slow 2025 GDP growth to 1.4%, avoiding outright downturn but marking a sharp slowdown from previous years. This growth floor, however, may support equity markets. If the economy avoids recession, firms could maintain margins by passing some tariff costs through to consumers.

Buy European: The EU is starting to embrace more populist elements as it looks to protect its companies from foreign competitors.

- Brussels is urging EU member states to restrict foreign bidders from public procurement contracts as part of a broader strategy to strengthen economic sovereignty. This push comes alongside significant investments to bolster the bloc’s defense industry and reduce dependence on foreign technology. By nurturing homegrown companies, the EU aims to decrease its reliance on the US and China for critical technologies and essential raw materials while building domestic industrial resilience.

- The EU has similarly announced measures to curb the influx of small packages from China, aiming to avoid becoming an alternative destination for Chinese firms circumventing US tariffs. Under the new policy, e-commerce shipments will face a 2 GBP fee for direct-to-consumer deliveries and a 0.50 GBP charge for warehouse-bound packages. This tiered fee structure is designed to incentivize bulk shipments and distribution from warehouses within the EU.

- We believe these measures should marginally improve the attractiveness of companies within the region. However, the primary concern remains the regulatory framework around climate change. If the bloc moderates some of its green initiatives, we anticipate a stronger and more sustainable rally in European equities.