Daily Comment (May 2, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Good morning! Equity futures are up today as investors embrace a less hawkish Fed. In sports news, Borussia Dortmund edged out PSG with a narrow 1-0 aggregate lead in the Champions League. In today’s Comment, we delve into the FOMC’s decision to keep rate cuts on the table, examine the disappointing trend in economic data, and discuss the impact of a possible security pact between the US and Saudi Arabia. As usual, our report concludes with a round-up of international and domestic data releases.

Less Hawkish: The Federal Reserve failed to deliver the hawkish shift markets had feared in a sign that rate cuts are likely to remain on the table for the foreseeable future.

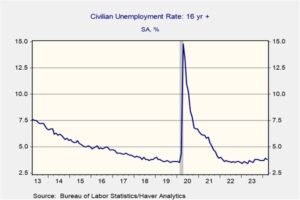

- The Federal Open Market Committee (FOMC) decided to maintain the target range for its federal funds rate at 5.25% to 5.5%. In a separate move, the FOMC announced it will slow the pace of its securities holdings runoff with a reduction in its monthly redemption cap on Treasury securities, decreasing from $60 billion to $25 billion beginning in June. At the press conference, Fed Chair Jerome Powell downplayed the prospect of an immediate rate hike aimed at further curbing inflation. However, he emphasized policymakers’ heightened focus on labor market developments, suggesting their preparedness to cut rates if unemployment were to deteriorate substantially.

- Markets seem to be taking comfort in Chair Powell’s cautious approach to interest rates, effectively dodging the scenario of a renewed tightening cycle. Before the decision, anxieties were mounting over whether persistent inflation would force the Fed’s hand back to rate hikes in order to fully extinguish inflationary pressures. The slowdown in balance sheet reduction further underscores the committee’s preference for a pause in tightening rather than new restrictions. The Fed’s dovish tone has sparked investor optimism, leading to revised rate cut expectations of two reductions starting in September. We would caution, however, that this optimism may be short-lived.

- Powell’s comments suggesting a dovish stance might not represent the entire committee’s view, echoing a pattern from previous meetings. Notably, he sidestepped a question on whether further rate hikes were discussed if inflation worsens. This underscores the importance of studying the Fed’s speeches for clues on committee sentiment before the FOMC minutes are released. That said, Powell did reiterate that the committee is ready to act if the labor market cools unexpectedly. Consequently, a payroll figure below 125,000 and an unemployment rate exceeding 4.2%, while unlikely, could keep rate cuts on the table despite high inflation.

Negative Economic Surprises: Despite headlines touting strong economic data, a recent disappointing string of data points indicates that momentum may be shifting in the wrong direction.

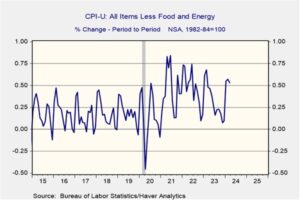

- Disappointing economic data emerged on Wednesday, raising concerns about a potential slowdown. Job openings reported by the BLS JOLTS survey plummeted to a three-year low in March. The decline was particularly notable in construction, which also coincided with an unexpected drop in spending for the sector in the same month. The weakness in construction activity may signal that companies are potentially facing margin pressure due to rising costs. The ISM price index surged to its highest level since June 2022, highlighting ongoing inflationary pressures despite the weakness in the manufacturing sector overall, suggesting that firms might be trying to force costs onto consumers.

- Wednesday was hardly an anomaly. Consumer confidence, as measured by the Conference Board’s index, plummeted from 103.1 to 97.0 in April, defying expectations of a rise to 104.0. This unexpected decline was primarily driven by a steep drop in consumer expectations, the steepest in nearly two years. Further fueling concerns is a broader trend of emerging economic weakness. Citigroup’s Economic Surprise Index has been on a downward trajectory since February, dropping from a peak of 44.1 to 15.1. While it hasn’t dipped below zero yet, the sharp decline indicates a potential slowdown on the horizon.

- Despite signs of a strong economy, recent data weaknesses suggest the expansion might be more fragile than previously thought. A key question remains, one that has not yet been fully addressed by the markets, regarding consumer tolerance for ongoing price increases. While businesses initially attempted to pass on these costs in early 2023, a closer look at non-seasonal data reveals they weren’t able to sustain this pace throughout the year, leading to a slowdown in price hikes, particularly in the summer months. If this trend persists, as the recent data suggests, companies may be forced to address cost pressures through workforce adjustments.

Saudi Defense Pact: The US and Saudi Arabia are nearing a security guarantee agreement, potentially opening the door to normalized relations between Saudi Arabia and Israel.

- The proposed security agreement builds on discussions held before the October 7 Hamas attack on Israel. It could grant Saudi Arabia access to offensive weapons after a three-year freeze, allowing it to replenish missile stocks and potentially pursue uranium enrichment. Additionally, Riyadh would limit its purchases of Chinese technology in its key network exchange for US investment in Artificial Intelligence (AI). However, a major hurdle remains — the deal hinges on an Israeli withdrawal from Gaza and commitment to a Palestinian state, a difficult condition for Israel to accept after the recent conflict.

- The proposed US-Saudi defense agreement could reshape the security balance of the Middle East, but it faces hurdles from both Israel and the US Senate. The Biden administration hopes economic incentives and a security guarantee will win over Israel, while assuring senators that Saudi Arabia won’t misuse weapons nor manipulate its oil production to harm US interests. However, navigating these challenges is difficult, especially given Israel’s strengthened right wing and waning trust in US security commitments. The deal’s prospects seem slim, but a potential path forward might still exist.

- The ability to provide a counterweight to Iran in the Middle East may play a significant factor in garnering support from all parties. There is strong suspicion that Iran provided some level of support to Hamas during its conflict with Israel. Additionally, Iran’s actions since the conflict began have increased the likelihood of a broader military conflict in the region. The prospect of Iranian deterrence could incentivize Israeli Prime Minister Benjamin Netanyahu to engage in negotiations. However, a lasting agreement might necessitate strategic ambiguity from all parties regarding the Palestinian state issue, allowing for concessions without jeopardizing domestic support.

In Other News: The US is considering refilling its strategic reserves in a sign that oil prices may receive some support in the coming days. Strong speculation surrounds Japan’s potential intervention in the foreign exchange market to bolster the yen. This raises the possibility of the Bank of Japan tightening monetary policy to defend its currency.