Daily Comment (May 18, 2016)

by Bill O’Grady and Kaisa Stucke

[Posted: 9:30 AM EDT] There are two items of interest this morning, which are linked. First, worries about the Fed moving rates higher are starting to rise. Fed funds futures are now projecting a 12% chance of a hike in June. Although this level remains low, it is up from 4% a week ago. Comments from San Francisco FRB President Williams and Atlanta FRB President Lockhart indicating that two hikes are in the pipeline for this year hit the market yesterday afternoon. It should be noted that neither of these two regional presidents are voters this year. Tomorrow, NY FRB President Dudley and Vice Chair Fischer, who are permanent voters, will speak. Dudley has been reliably dovish but Fischer is another matter. At heart, Fischer appears to back a Phillips Curve-influenced view of the world and thus should lean toward raising rates. Fischer’s stance will likely be the deciding factor at the June meeting because it will be hard for Chair Yellen to offset his weight on the committee if he swings his vote for a rate hike.

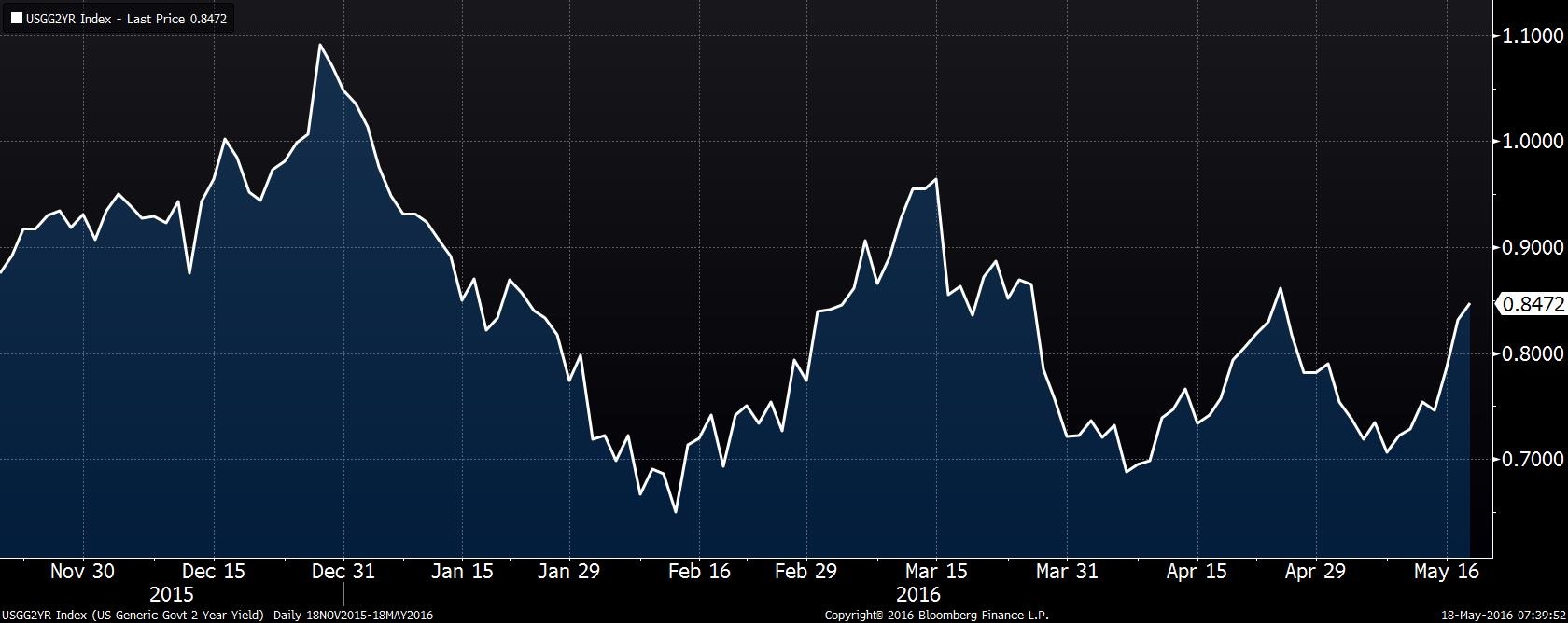

We are starting to see the markets react.

This chart shows the yield on the two-year Treasury. It has been steadily rising after falling from late April into early May. This rate is consistent with a fed funds target of 50 bps, implying that the market is building expectations of a rate move. As noted below, the Fed minutes are out later today, which may give us some color on the odds of a hike next month.

Although all the financial markets will be affected by a tightening of Fed policy, exchange rates may be the most sensitive. Since the last G-20 meeting three months ago, there has been speculation that a deal was put in place to stabilize currencies. According to this narrative, China did not want to see a stronger CNY so it prevailed upon the U.S. to back away from tightening talk. This led to a weaker dollar and the CNY stabilized because the CNY is mostly pegged to the greenback. At the same time, both the ECB and the BOJ refrained from further aggressive easing measures, leading to some dollar weakness against both currencies. The weaker dollar helped gold but really supported oil, easing credit conditions in the U.S. and helping China stabilize. The losers? Europe and Japan, especially the latter. The BOJ and the Ministry of Finance have been making rumblings about pushing fiscal policy in Japan, which, given the degree of QE, might be monetary financing of fiscal spending (which we discussed over the past three weeks in the WGR).[1] If the Fed really wants to raise rates, the dollar’s retreat gives Yellen room to move. At the G-7 meeting this weekend, where China won’t participate, we may see this “gentleman’s agreement” on forex break down. If so, the JPY and EUR could weaken, emerging markets will be at risk and commodity prices would likely retreat.

Finally, a poll this morning suggests 55% of U.K. voters favor remaining in the EU. This gave the GBP a lift.

This is a one-day chart of the £/$ exchange rate; when news of the poll broke, the GBP rallied strongly. If the polls lean toward remaining as we move into the FOMC meeting next month, the committee may assume the U.K. will stay and this situation would increase the odds of a rate hike.

_______________________

[1] See WGRS, The Geopolitics of Helicopter Money: Part 1 (5/2/16); Part 2 (5/9/16); and Part 3 (5/16/16).