Daily Comment (May 17, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Our Comment today opens with a hawkish statement by Bank of England Governor Bailey that suggests British interest rates are likely to go higher. We next review a wide range of other international and U.S. developments with the potential to affect the financial markets today, including a new technology-theft scandal that will probably further worsen U.S.-China relations and news that commercial office buildings are starting to be sold at fire-sale prices.

United Kingdom: Bank of England Governor Bailey warned that he is prepared to keep raising interest rates as much as necessary to fight what he called a wage-price spiral and bring consumer price inflation down to the institution’s target of 2%. Despite optimism that the Federal Reserve will now pause U.S. interest rates, Bailey’s comments serve as a reminder that “second-round” inflation pressures are probably in place around the world and could still require the major central banks to hike rates higher and keep them there for longer than currently anticipated.

China-United States-South Korea: Yesterday, the U.S. Department of Justice’s new task force focused on protecting critical technologies from being stolen by foreign governments charged a Chinese citizen, Weibao Wang, with stealing trade secrets from Apple (AAPL, $172.07). While Wang worked for Apple in California on a project related to driverless-car technology, he simultaneously took a job at the U.S. subsidiary of a Chinese company developing driverless cars. Prior to informing Apple that he was quitting, he allegedly stole thousands of documents and other information before fleeing to China. Other recent reports show Chinese firms and spy services are ramping up their effort to steal technology secrets from South Korea and other advanced countries in the West.

- While many Western business elites continue to resist decoupling with China for fear of losing financial and economic opportunities, we think Beijing’s continued program of getting Western technology “by hook or by crook” will ultimately undermine their position. China’s aggressive military build-up will probably also justify decoupling.

- Indeed, Western leaders in recent months have noticeably shifted their rhetoric to emphasize protecting national security over trade and investment with China.

Taiwan: The island’s largest opposition party has picked Hou Yu-ih, the popular mayor of New Taipei City, as its candidate in January’s presidential election. To contrast himself with the independence-minded ruling party, the Kuomintang party’s Hou opposes a formal breakaway from China but also doesn’t support operating under Beijing’s “One China, Two Systems” arrangement as it is applied in Hong Kong. That stance may make him more palatable than other Kuomintang politicians who want the island to be closer to China, but it remains to be seen whether it will be enough to win the election.

Indonesia: The chief executive of the country’s sovereign wealth fund said the fund will deploy some $3 billion into Indonesian infrastructure, digital assets, and other domestic opportunities in 2023, including funds from international co-investors. The announcement is being seen as a sign of Indonesia’s attractiveness as an investment destination as investors sour on China, and Indonesia positions itself as a key supplier for materials related to green technologies.

Turkey: The united opposition group that unexpectedly lost the first round of Sunday’s election to President Erdoğan accused the electoral authorities of large-scale irregularities but admitted that it would have lost the first round anyway. Since Erdoğan very nearly snagged the 50% of the vote needed to win outright, he appears to be in the driver’s seat to win the second and final round of voting on May 28. The likelihood that Erdoğan’s unorthodox economic policies will remain in place continue to weigh on Turkish assets so far this week.

Brazil: State-owned oil giant Petrobras (PBR, $11.78) said it will end its longstanding practice of pegging the domestic price of its fuels to global prices. The move appears to clear the way for leftist President Luiz Inácio Lula da Silva to keep domestic prices artificially low for his own political purposes. If that comes to pass, it could portend expensive new subsidies to be paid from the government budget. The loss of fiscal discipline would likely be negative for Brazil’s stocks, bonds, and currency.

U.S. Monetary Policy: Consistent with our earlier comments on the Bank of England’s policy, Cleveland FRB President Mester yesterday warned that she hasn’t seen enough evidence that U.S. inflation pressures have eased to the point where the Fed should stop hiking interest rates. However, Chicago FRB President Goolsbee and Atlanta FRB President Bostic both signaled they want to hold rates steady now to avoid over-tightening and potentially sparking a financial crisis. We continue to believe the Fed is at least close to the end of its tightening cycle, if it’s not there already, but continued inflation pressures mean rates in the U.S. and in other developed countries could still go higher.

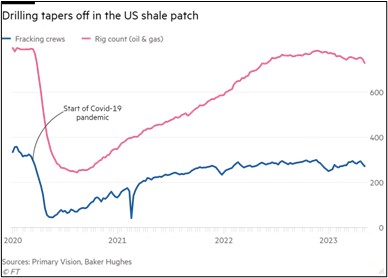

U.S. Energy Industry: Data from Baker Hughes (BKR, $27.44) confirms that U.S. oil and gas exploration has suddenly cooled since the beginning of the year. The figures show the number of oil and gas drilling rigs in operation has fallen some 6% so far in 2023 to just 731. The drop in exploration likely reflects multiple factors, including lower energy prices, investors demands that energy companies exercise capital discipline, and concerns about regulation and the green-energy transition. As we noted in our Comment yesterday, the fall-off in global output comes at a time of rising energy demand in China and other developing countries, which could spark a rebound in prices later in the year.

U.S. Commercial Real Estate Market: Several sizable office buildings around the country have recently been sold at fire-sale prices, suggesting the work-from-home movement and high interest rates are causing increasing stress in the commercial real estate market. Importantly, building owners now appear to have capitulated to the idea that weak prices are here to stay. Distressed sales are expected to keep increasing in the coming months.

- Of course, some firms are starting to insist that workers pare back their WFH time. For example, giant asset manager BlackRock (BLK, $633.83) yesterday told its employees that they will only be allowed to work remotely one day per week starting September 11.

- Despite such efforts, however, employee resistance and today’s tight labor market will likely keep office usage much lower than before the pandemic. Any significant rebound in office occupancy, rents, and building values seems a long way off.