Daily Comment (May 16, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Our Comment today opens with new forecasts showing global crude oil demand in 2023 will likely rise more than expected, potentially boosting prices later in the year. We next review a wide range of other international and U.S. developments with the potential to affect the financial markets today, including a range of disappointing economic indicators out of China and signs of weakening small-business hiring in the U.S.

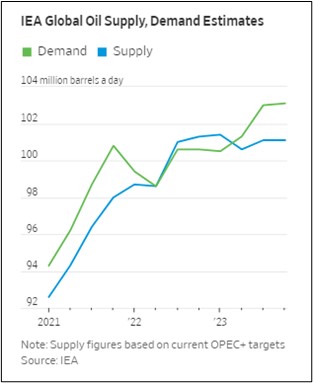

Global Oil Market: In its monthly report, the International Energy Agency boosted its forecast for global crude oil demand in 2023 to 102.0 million barrels per day (mbpd), up from 101.9 mbpd in last month’s forecast. The new forecast, driven by stronger-than-expected demand in China and other developing countries, represents an increase of 2.2 mbpd when compared with demand in 2022.

- In contrast, the IEA expects global supply to grow only weakly because of recent cuts by the Organization of the Petroleum Exporting Countries and its allies, capital discipline among drillers, and regulatory and energy-transition headwinds.

- Even though oil prices have recently pulled back because of concerns about weakening demand in the advanced countries, the IEA’s forecast indicates some risk that higher demand in the developing countries could boost prices later in the year.

China: Despite China’s stronger-than-expected oil demand in the IEA oil market report, several data releases today provided more evidence that the country’s post-pandemic economic rebound is running out of steam. For example, April retail sales were up 18.4% year-over-year, but that was largely because of the big pandemic lockdown in Shanghai in April 2022. The annual rise was weaker than expected, and sales last month were only slightly higher than in March. The April unemployment rate fell to 5.2%, but that masked a record jobless rate of 20.4% for people aged 16 to 24. Fixed-asset investment and factory production also disappointed.

China-South Korea: Chinese police on Friday arrested Son Jun-ho, a 31-year-old who plays in China’s top-tier soccer league and has appeared for the South Korean national team, on suspicion of accepting bribes. The arrest marks another in a series of detentions of high-profile foreigners from countries that have been working more closely with the U.S. to build their national defense capabilities and crack down on technology flows to China.

- Along with Beijing’s recent clamp down on foreign consulting and information businesses in China, the arrests are probably retaliation for the U.S.’s dramatic and internationally coordinated restrictions on selling advanced semiconductors and related equipment and services to China. Those restrictions were first announced October 7, 2022.

- The arrests and harassment of Western firms in China have already added to the disincentives for foreign companies to operate in China. That may seem counterproductive for Beijing. However, it’s important to remember that the Chinese Communist Party ultimately wants to end the country’s reliance on foreign providers for any high-value goods or services. The new arrests and harassments may signal that the party sees China as strong enough to push those foreign providers out now.

China-United States: Yesterday, the U.S. Department of Justice announced that it has arrested Litang Liang, 63, of Brighton, Massachusetts, on charges of acting as an unregistered foreign agent for China. Liang, a U.S. citizen, allegedly provided officials at the Chinese consulate in New York City with information about Boston-area individuals and organizations that oppose Chinese policies. He also organized counter-protests against anti-Beijing activists in the area and suggested the names of ethnic Chinese people that Beijing’s spy services should try to recruit.

- Naturally, the arrest of Liang will further spoil U.S.-China relations.

- The arrest also provides more evidence that China is running a large, aggressive program of spying, influence operations, and extraterritorial policing on U.S. soil.

Japan: As global investors plow into Tokyo’s stock markets, the country’s key indexes today have reached their highest levels in 33 years. We agree that Japanese equities look attractive on several counts, including valuations, corporate performance, geopolitical trends, and the prospect for a decline in the value of the dollar, which typically boosts returns for foreign stocks.

Brazil: Arthur Lira, the speaker of the Brazilian Congress’s lower house, vowed in an interview with the Financial Times that he will block any effort by leftist President Luiz Inácio Lula da Silva to roll back the business-friendly laws of the previous conservative President Bolsonaro. The statement is being seen as a shot across the bow of the Lula administration, since it does not command a majority in congress and must rely on Lira’s center-right bloc in order to pass bills.

U.S. Monetary Policy: Richmond FRB President Barkin yesterday said the Fed shouldn’t be afraid to keep raising interest rates to bring down inflation even if doing so raises the risk of financial instability. Barkin effectively argued that bringing down inflation was a higher priority, and that “steady” rate hikes would help lower the risk of a financial crisis.

U.S. Fiscal Policy: President Biden, House Speaker McCarthy, and other congressional leaders will meet face-to-face again today in an effort to reach a deal on raising the federal debt limit. Biden expressed optimism yesterday that Democrats and Republicans can reach an agreement that would avoid a federal debt default. Press reporting suggests the evolving deal might be built on fixed caps on federal spending for some period of time, clawing back unused pandemic relief funds, and tightening work requirements to receive certain federal benefits.

- Continued signs of progress in the talks will likely buoy stocks in the short term, at least until investors focus again on the likelihood of a recession starting soon.

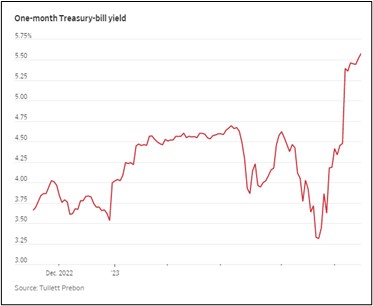

- Nevertheless, many individual investors appear to be dumping the shortest-term Treasury bills as they prepare for the worst. One-month bill yields have shot up in response.

U.S. Labor Market: A survey by the Wall Street Journal showed that the share of small-business owners who expect to expand their workforce over the next year was below 50% for the second month in a row in May, hitting the lowest level since June 2020. The fall in hiring intentions is another hint that the economy is slipping toward recession, even if the main economic indicators don’t show it yet.

- At the same time, the country continues to face longer-term imbalances in the labor market, in part because of the prospect for “re-industrialization” as geopolitical tensions and new government industrial policies encourage firms to invest more in domestic manufacturing.

- Many of the new factories being built are in technology-intensive sectors like semiconductors, defense, and clean energy. Because of a shortage of U.S. workers with top-notch skills in science, technology, engineering, and mathematics, a number of tech and clean-energy executives have called for the government to urgently loosen immigration rules to let in more highly-skilled workers from abroad.

- At the same time, the Biden administration has begun to stress that its signature laws which boost infrastructure investment and subsidize factory development will create many new jobs that don’t require a college degree. Once the economy has moved past the expected recession, the new re-industrialization could produce a long-lasting shortage of workers in areas like construction and construction trades, welding and metalworking, and machine-tool operating.

U.S. Stock Market: Berkshire Hathaway (BRK-B, $323.53) revealed in a regulatory filing yesterday that it has opened a new position in credit-card issuer Capital One (COF, $89.12). Because of CEO Warren Buffett’s reputation as a star investor, the news looks set to give a boost to Capital One when the market opens today. The filing also revealed that Berkshire has recently increased its holdings in Apple (AAPL, $172.07) and Bank of America (BAC, $27,65), which could help buttress near-term buying in those names as well.

- The company eliminated its position in at least two regional banks, consistent with the recent crisis in U.S. medium-sized and smaller lenders.

- It also eliminated its position in Taiwan Semiconductor Manufacturing (TSM, $85.66), which perhaps should be no surprise given Buffett’s recent concerns about growing geopolitical tensions between China and the West.