Daily Comment (May 14, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! Financial markets are still in a good mood following the latest deals from the Trump administration. In sports news, fans are celebrating the Indiana Pacers’ victory over the Cleveland Cavaliers that secured their spot in the Eastern Conference Finals. Today’s Comment will examine the latest inflation data, important tax policy developments, and other market-moving news. As always, our report will provide comprehensive summaries of both domestic and international economic data releases.

Where’s the Tariff? Inflation was softer than expected, signaling a continued downward trend in underlying price pressures that began before the tariffs took effect.

- Overall, US consumer prices increased by 2.3% year-over-year, down slightly from the previous month’s 2.4% and well below the 3.0% reading at the start of the year. The decline was driven by a sharp 11.5% drop in energy prices compared to the prior year, along with a monthly decrease in food costs. Excluding food and energy, Core CPI held steady at 2.8% for the month.

- The most encouraging aspect of the report is the continued downward trend in services inflation, signaling a return to normalization. The year-over-year change in the index has declined for six consecutive months, with the deceleration primarily driven by shelter costs — a key inflationary driver. This moderation in shelter prices has played a major role in bringing overall inflation closer to the 2% target.

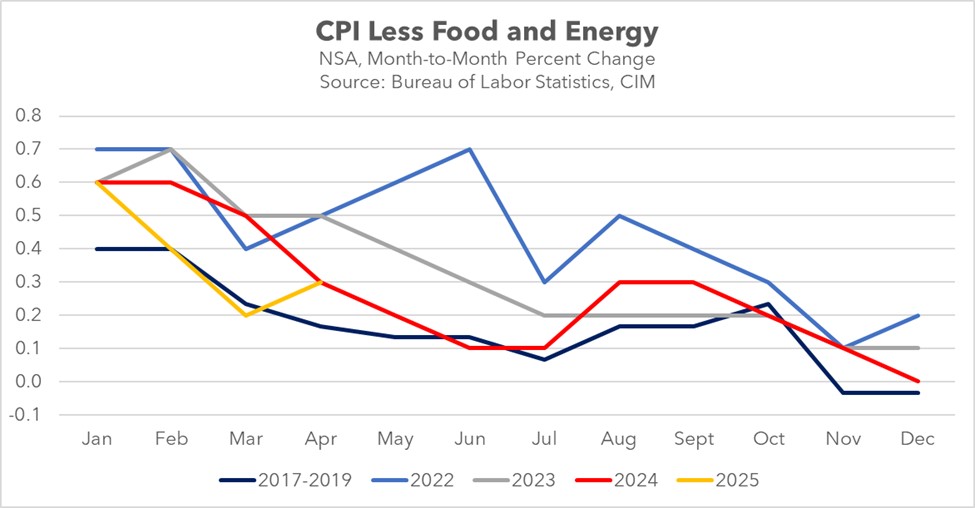

- However, there are early signs that tariff pass-through is beginning to influence inflation, albeit modestly. As the chart below illustrates, the latest CPI reading pushed inflation above its pre-pandemic trend, roughly matching the previous year’s monthly increase. Much of this uptick stemmed from key goods likely affected by tariff-related cost pressures. Notably, price indexes for appliances, recreational goods, and educational commodities all accelerated compared to the previous month.

- The April CPI report offers some reassurance that the feared inflationary surge may not be as severe as initially expected. As we’ve noted in previous commentaries, these tariffs are unfolding alongside a broader disinflationary trend, particularly in shelter costs, which should help restrain an increase in the overall index for the year. That said, the full impact of inflationary pressures may not materialize until mid-to-late summer. Therefore, investors can remain cautiously optimistic regarding inflation.

More Tax Details: The latest estimate for the House Republicans’ tax bill falls within the range projected by lawmakers, clearing the way for additional adjustments to the bill.

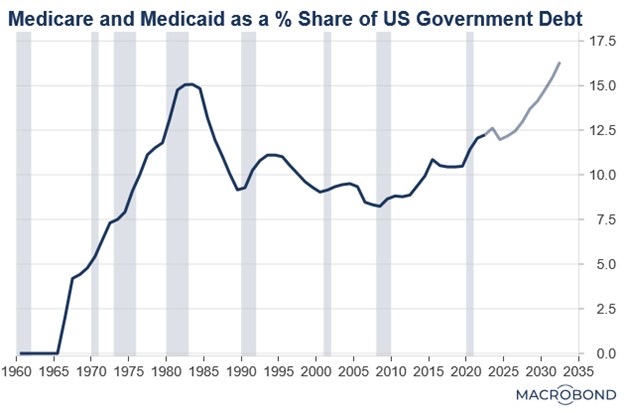

- According to the Joint Committee on Taxation, the GOP’s latest budget proposal is projected to increase the deficit by $3.7 trillion over the next decade. This figure reflects $5.8 trillion in proposed new tax spending, partially counteracted by $1.9 trillion in savings achieved through the reversal of clean energy incentives. With this projected deficit increase remaining below the House Ways and Means Committee’s $4.5 trillion benchmark, the possibility of additional tax reductions is being explored.

- Expanding the SALT deduction has emerged as the most likely concession. Several lawmakers have signaled they would support the tax bill only if the deduction is raised from the current $30,000 cap. They contend that opposing the bill outright could lead to a full repeal of the cap, so they are pushing for a larger deduction as an incentive to vote in favor. While negotiations over a potential increase continue, House Speaker Mike Johnson has indicated that a deal could be reached by Wednesday.

- The additional fiscal flexibility could also facilitate a partial reversal of eligibility restrictions for food and health assistance programs. Republican legislators have expressed concerns that these limitations might alienate key constituents who supported Trump’s 2024 presidential victory. This newfound budgetary margin may enable lawmakers to relax certain provisions, potentially averting significant political backlash.

- Although the bill has not yet reached its final form, it is still anticipated to deliver significant stimulus to the broader economy. This economic boost could help mitigate much of the anticipated impact from rising tariffs. We expect businesses may view the bill’s provisions as an incentive to increase investment activity. Consequently, the legislation could provide meaningful support to equity markets in the second half of the year when the tariff impact becomes clearer.

Strengthening US-Gulf Relations: On the first day of his Middle East diplomatic tour, President Trump strengthened strategic partnerships with key Arab leaders, marking a significant step in countering China’s growing influence in the region.

- During his diplomatic visit, the president focused on strengthening economic and security partnerships across the Middle East. The trip yielded significant results, including Saudi Arabia’s commitment to invest more than $1 trillion in the US. A landmark agreement was also reached to enable Nvidia and Advanced Micro Devices (AMD) to supply critical semiconductor chips for several countries in the Middle East, bolstering the region’s artificial intelligence capabilities.

- Additionally, President Trump aims to address long-standing regional conflicts through diplomatic engagement. His administration has announced plans to lift sanctions against Syria’s government and remains open to negotiations with Iran regarding its nuclear program. Furthermore, he is scheduled to meet with Qatari leaders on Wednesday to discuss strengthening bilateral security cooperation.

- The president’s actions appear to be part of a broader strategy to counter China’s expanding influence in the region. Over the past five years, China has significantly deepened its trade and investment ties across the Middle East as part of its effort to reduce economic reliance on the US. This expansion has included major advancements in digital technology, with Arab nations playing an increasingly important role in Beijing’s Digital Silk Road Initiative.

- The administration’s sanctions relief and technology agreements appear strategically designed to counter China’s regional influence by disrupting its economic momentum and isolating it technologically. The Trump administration is reportedly preparing to implement new trade rules that would require partner nations to limit technology transfers to China. If effectively executed, this strategy could substantially weaken Beijing’s ability to compete with American dominance in AI.

A New Plaza Accord: Speculation is growing that the Trump administration may pressure Asian nations to allow their currencies to appreciate to bring down the value of the US dollar.

- The Trump administration has reportedly engaged in preliminary discussions with South Korea regarding currency policy. These talks coincide with upcoming bilateral trade negotiations aimed at averting potential tariffs on Korean exports. While no formal agreements have been confirmed, market reaction to the reports has already triggered appreciation in the Korean won.

- A potential appreciation of Asian currencies could reinforce market expectations that the administration favors a weaker dollar policy to prevent tariff circumvention. While this approach would increase costs for foreign imports, it might also create conditions for either reduced tariff rates or at least an avoidance of additional increases beyond those implemented on April 2.