Daily Comment (May 12, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Good morning! Today’s Comment starts with our thoughts about this weekend’s presidential election in Turkey. Next, we explain why the recent drop in the British Pound Sterling (GBP) against the U.S. dollar may not hold. Lastly, we discuss how the controversy in South Africa may give investors insights into how the U.S. may respond to countries that don’t comply with sanctions.

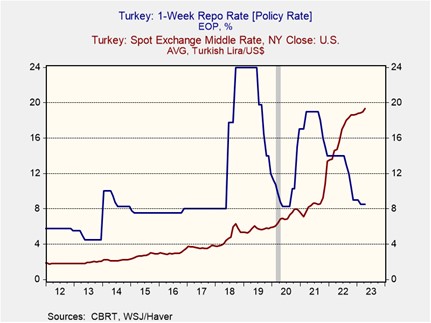

Turkish Election: Turkish President Recep Tayyip Erdoğan is facing his toughest election test on Sunday as he looks to extend his nearly 20-year rule.

- President Erdoğan’s rival, Kemal Kılıçdaroğlu, is the favorite to win the election this weekend. On Thursday, third-party candidate Muharrem İnce withdrew from the contest after an alleged indiscretion surfaced earlier this week. His exit is expected to support Erdoğan’s rival Kemal Kılıçdaroğlu, who is representing a six-party coalition. Several surveys show that Erdoğan lags in the polls, but the race is still too close to call. Despite İnce’s departure, his name has not been removed from the ballot, so it is possible that the election may still head to an unprecedented second round on May 28.

- Anticipation about the voting result has led to increased market jitters as traders brace for a shift in the country’s unconventional monetary policy. Erdoğan’s insistence that higher interest rates lead to increased inflation has led the country’s central bank to loosen monetary policy and slash its benchmark policy rate by more than half in less than two years despite annual inflation hovering above 40%. Capital restrictions have prevented currency holders from hedging against rising inflation. That said, the country will face significant currency devaluation no matter who wins the presidential race as the government will not have the tools needed to maintain tight currency controls for much longer.

- Sunday’s election has been closely watched by investors as the outcome may have geopolitical implications. Turkey is located between Europe and the Middle East and has control of the strategically important Black Sea and has the second largest army in the NATO military alliance. There has been friction between Turkey and its NATO allies, however, mostly because of President Erdoğan’s reputation for being an unreliable partner due to his tendency to play both sides of an international conflict. Hence, his ouster will likely improve relations between Turkey and the West. Additionally, a new Turkish President could pave the way for more traditional economic policy.

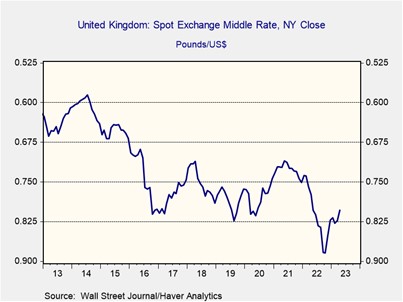

U.K. Confidence: Better-than-expected economic data has led the Bank of England to reassure investors that it has room to raise rates further.

- The U.K. central bank lifted its benchmark interest rate on Thursday by 25 bps to 4.5%, its high level since 2008. Additionally, the BOE revised its economic outlook by removing any prediction of a recession within the year. Despite the optimism, British policymakers insist that inflation remains too high and have warned that food prices would fall more slowly than they had anticipated. The 10.1% annual inflation in the U.K. is higher than in the U.S. and the European Union. As a result, BOE Governor Andrew Bailey vowed that the central bank would continue to work to get inflation down to its 2% target.

- The GBP is the best-performing G10 currency this year, but it weakened following the announcement. On Thursday, the GBP fell 0.9% from the previous day. Its weakness is related to concerns that the BOE may have oversold the health of the economy as investors doubt that the country can tolerate additional rate hikes. Unlike American homeowners, borrowers in the U.K. face significant interest rate risk as loan rates have short-term expirations. Thus, investors fear that the BOE may trigger a recession as it looks to restore price stability. Equities were little changed following the rate decision as interest futures are not convinced that policymakers will maintain their inflation fight.

- A recession will have a negative impact on the currency, but we still foresee the GBP outperforming the greenback this year. In our view, the Federal Reserve will end its hiking cycle before the BOE. The latest CME FedWatch Tool predicts that there is a high likelihood that U.S. policymakers will pause at their next meeting. Meanwhile, Gilt futures suggest that the BOE may institute another two rate hikes before it is finished. The differences in interest rates should put downward pressure on the dollar and may offer some support for British equities.

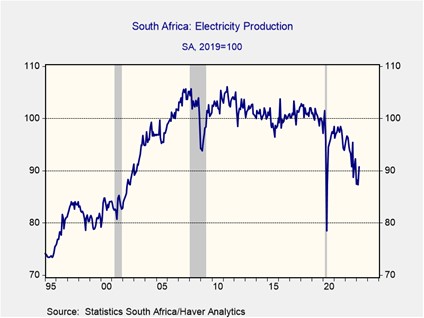

Beware of the Sanctions: South African assets are facing pressure after the U.S. accused the country of supporting Russian war efforts in Ukraine.

- A U.S. ambassador has accused the South African government of supplying ammunition to the Russians. The alleged incident took place last year after a Russian vessel arrived at a dock in Cape Town. The country’s president has denied that anyone in his administration was authorized to load weapons on the ship but has launched an investigation into the matter.

- The allegation comes at a delicate time as the country struggles to constrain the rolling blackouts that have led to concerns about the country’s grid. Also, electricity production in Africa’s second-largest economy has been plummeting. Despite South Africa’s robust growth over the last two decades, its electricity production is hovering near a 20-year low. Additionally, the situation puts South Africa’s preferential access to the U.S. market in jeopardy. As a result, investors do not believe the country will be able to expand its industrial activity as the country may face weaker demand for its goods.

- The controversy has led to a major sell-off of financial assets as investors’ concerns about growth worsened. The rand (ZAR) dipped below 19.35 against the dollar on Thursday, beating the previous record low set during the pandemic. Additionally, the Johannesburg Stock Exchange sank 1.0% in the same period.

- The situation in South Africa highlights the potential danger that countries could face when they decide to side with America’s enemies. As the world’s largest consumer market, the U.S. has the ability to use trade as a weapon to prevent countries from circumventing Western sanctions. Unlike the dollar, the use of trade cannot be remedied through the use of barter or with a simple workaround. The U.S.’s response to South Africa shows countries that America will have little tolerance for countries seeking to aid Russian war efforts. If we are correct, this may mean that countries will feel more pressure to choose sides as the world breaks into regional blocs. As a result, the incident reinforces our view that the U.S. dollar is headed toward a secular decline.