Daily Comment (May 10, 2022)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Today’s Comment opens with an update on the Russia-Ukraine war. Russian forces remain bogged down in the face of strong Ukrainian resistance and their own poor planning, weak execution, low morale, and resource shortages. We next review a range of international and U.S. developments with the potential to affect the financial markets today, including a trading issue in a key digital currency that probably contributed to yesterday’s sharp market declines. We close with the latest news on the coronavirus pandemic.

Russia-Ukraine: Russian forces continue to make very little progress in their efforts to seize more territory in eastern and southern Ukraine, although they are consolidating their control over areas they already hold. A senior U.S. defense official said Russian forces facing tough Ukrainian resistance are exhibiting extraordinarily poor discipline and morale. Many Russian troops are reportedly refusing to obey orders, frequently abuse alcohol, and shoot at their own vehicles to avoid going to the frontline. Russia also continues to face serious force generation problems. In his Victory Day speech yesterday, President Putin failed to announce the kind of general mobilization that could eventually provide a substantial boost to Russian manpower. Reports suggest young Russians are receiving draft notices under a “covert mobilization,” but those notices could merely represent the ongoing spring draft, which in ordinary times would run from April 1 to July 15. We have also seen one document pointing to the call-up of reserves, but under the Russian personnel system, the pool of soldiers available in the reserves is very limited. In sum, the Russian military is not only suffering from poor planning and amateurish operations but also from growing shortfalls in military equipment, supplies, and personnel.

- The EU effort to ban Russian oil imports continues to face resistance from several Eastern European members that are particularly dependent on Russian energy. European Commission President von der Leyen yesterday traveled to Hungary in an effort to sell the ban to Prime Minister Orbán, who has been the principal obstacle to a deal but reportedly had no success.

- The EU is reportedly offering to let Hungary, Slovakia, and the Czech Republic phase in the import ban over the next two years or more.

- Even if the Eastern European countries get to keep importing Russian oil, for the time being, any import ban implemented by the major EU economies will keep the demand for non-Russian oil high. It will tend to buoy prices despite the recent downdraft as investors fret about weakening economic growth in China.

- Separately, reports this morning say Brussels has shelved its plans to ban the EU shipping industry from carrying Russian crude oil. That plan had faced hard pushback from Greece and Malta, which together account for more than half of EU-flagged tonnage.

- Despite the delay in new EU sanctions on Russia, the Ukrainian government is becoming increasingly confident and ambitious in its war aims. According to Foreign Minister Kuleba, the government has upgraded its war aims and is now looking to push Russian forces out of the country entirely, as long as western allies rapidly deliver promised heavy weaponry.

- Kuleba particularly noted the importance of pushing the Russians out of the Kherson region of southeastern Ukraine and regaining control over the country’s coast.

- According to Kuleba, that would allow Ukraine to neutralize Russia’s Black Sea Fleet and restart exports through the country’s southeastern ports.

European Union-Ukraine: In a development that would be as important for the EU as it would be for Ukraine, EU officials are planning an issue of €15 billion in joint debt to fund financial aid to Ukraine over the coming three months. Although the debt issue wouldn’t be nearly as large as the groundbreaking mutual debt issued to fund the EU’s massive pandemic relief program, it could point to a certain normalization of joint debt backed equally by all members of the EU.

United Kingdom: In the House of Lords today, Prince Charles, as heir to the throne, for the first time stood in for his mother to deliver the Queen’s Speech, laying out the government’s legislative priorities for the coming year. It was the first time since 1963 that Queen Elizabeth had not delivered the speech herself.

South Korea-North Korea: In his inauguration speech yesterday, conservative South Korean President Yoon Suk-yeol offered economic aid to North Korea if it suspends its nuclear weapons program and starts to denuclearize. The offer marked a pivot away from his campaign promise to emphasize military deterrence to reduce the threat from Pyongyang.

Iran: As the Russia-Ukraine war and other factors drive up global food prices, President Raisi said Iran would cut back and reform the country’s bread subsidy system. Starting in about two months, the government will offer citizens digital coupons, allowing them access to a limited amount of bread at subsidized prices, while the rest will be available at market rates.

- The scheme will later include other goods such as chicken, cheese, and vegetable oil.

- Cutting back on food subsidies is a risky move because it could spark mass protests.

- As we have noted in the past, rising food costs have often sparked periods of political instability in emerging markets.

Philippines: As expected, Ferdinand Marcos, Jr., the son of the former dictator, yesterday cruised to a landslide victory in the country’s presidential election. His opponents fear he could use his power to wage political battles against his family’s adversaries, shield allies from scrutiny, and enrich his associates like his father did before an uprising ousted him 36 years ago.

Sri Lanka: Prime Minister Mahinda Rajapaksa resigned after months of mass protests against his government’s handling of an economic crisis marked by high inflation and acute shortages of fuel and medicines. It is not yet clear whether the prime minister’s resignation has been accepted by his younger brother, President Gotabaya Rajapaksa.

- The prime minister’s resignation points to continued political and economic disruptions in the country.

- While Sri Lanka isn’t a major economy or investment destination, it has been a high-profile recipient of Chinese investment under President Xi’s “Belt and Road” initiative. The continued political and economic problems in Sri Lanka could therefore weaken China’s effort to build alliances and counter U.S. influence through trade and investment.

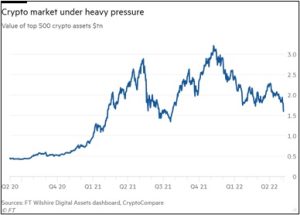

U.S. Financial Market: Amid the widespread carnage in the financial markets yesterday, we took note that the TerraUSD stablecoin, a type of cryptocurrency whose value is supposedly pegged to $1.00, traded as low as $0.94. The drop in value triggered a wave of selling, which likely contributed to yesterday’s substantial drop in the broad cryptocurrency market.

- As of last weekend, Terra was the third-largest stablecoin. Unlike traditional stablecoins, Terra is strictly algorithmic, i.e., it isn’t necessarily backed by any assets at all.

- Instead, algorithmic stablecoins rely on financial engineering to maintain their link to the dollar. Such designs have been criticized as risky because they rely on traders to push the value back to $1.00 rather than having assets that continuously support the price.

- Once Terra “broke the buck” yesterday, at least some traders panicked and rolled into more traditional asset-backed stablecoins. At the same time, algorithmic rules prompted others to sell stablecoins such as ether and bitcoin in an effort to drive up the price of Terra again.

- We have long posited that the Wild West development of the cryptocurrency markets could pose risks for the traditional financial markets, especially as the Federal Reserve pushes up interest rates. At this point, it’s not clear what sparked the loss of confidence in Terra, but we note a couple of important points:

- The downdraft in stablecoin prices looked very much like “contagion” in the traditional financial markets.

- To the extent that any of these assets have been pledged as collateral, the volatility in their values potentially could spark further selling and broader contagion. We remain on the lookout for any such broader financial risks.

- More broadly, the Fed warned in its semiannual Financial Stability Report yesterday that the sharp upside surprises in inflation or interest rates “could lead to higher volatility, stresses to market liquidity and a large correction in prices of risky assets, potentially causing losses at a range of financial intermediaries.”

U.S. Labor Market: With the tight labor market driving up wage rates, teens are now working in greater numbers than any other time since the Great Financial Crisis of 2008-2009. Federal data show that about one-third of young people aged 16 to 19 are currently working, potentially helping keep some lower-paying firms in business.

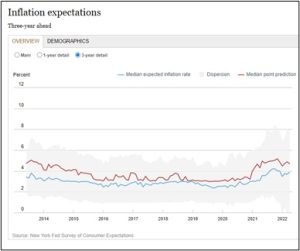

U.S. Inflation: In its April survey of inflation expectations, the New York FRB said respondents saw prices rising at an annual rate of 3.9% three years from now, versus 3.7% in its March survey. However, those figures remain below the three-year forward expectation of 4.2% registered in the survey last autumn.

- When the April consumer price index (CPI) is released on Wednesday, we expect base effects will finally start to reduce the calculated inflation rate on a year-over-year basis.

- As of this writing, the April CPI is expected to be up 8.1% year-over-year, versus 8.5% for the March CPI.

COVID-19: Official data show confirmed cases have risen to 518,073,573 worldwide, with 6,253,752 deaths. The countries currently reporting the highest rates of new infections include Germany, France, South Korea, and the U.S. (For an interactive chart that allows you to compare cases and deaths among countries, scaled by population, click here.) In the U.S., confirmed cases rose to 81,973,693, with 998,041 deaths. In data on the U.S. vaccination program, the number of people considered fully vaccinated now totals 220,163,884, equal to 66.3% of the total population.

Virology

- The seven-day average of people hospitalized with confirmed or suspected COVID-19 in the U.S. came in at 19,009 yesterday. The tally of people hospitalized for COVID-19 is now up 20% from two weeks earlier, although it remains relatively low.

- Just days after President Xi reiterated his “zero-COVID” policy, authorities in Shanghai are reportedly tightening the city’s lockdown. New cases have been declining in the city, and officials haven’t formally announced tighter restrictions. In recent days, however, residents have reported more forced quarantines at centralized facilities and halted deliveries of nonessential items, including medicines.

- Other local and provincial governments are likely to follow Shanghai’s lead regarding redoubling their pandemic restrictions. As a result, nascent popular protests against the policies could widen and intensify.

- Just as important, any further tightening of China’s pandemic restrictions threatens to slow the economy further, creating additional headwinds for the global economy and financial markets.

Economic and Financial Market Impacts

- Reflecting how badly China’s lockdowns are hurting its economy, the China Passenger Car Association yesterday said April auto sales were down 36% year-over-year. Production was down even more sharply, by 41% year-over-year.