Daily Comment (May 1, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! The market is currently digesting the latest tech earnings. On the ice, the Jets secured a third playoff victory against the Blues. Today’s Comment dives into why we’re not overly concerned about the economic contraction in Q1, the market’s focus on Treasury developments, and other key market news. As always, we’ll also provide a summary of relevant international and domestic data releases.

GDP Contracts: While the economy’s contraction in Q1 has intensified recession concerns, a closer examination of the underlying data paints a more nuanced picture.

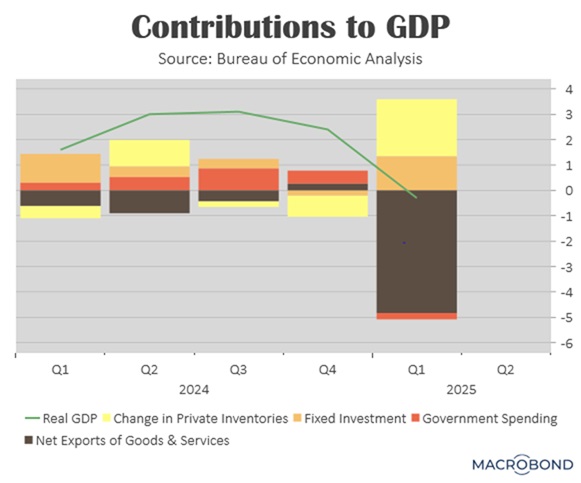

- The US economy shrank at an annualized rate of 0.3% in Q1 2025, marking the first quarterly decline since 2022. This downturn was primarily driven by a surge in imports as businesses and consumers accelerated foreign purchases ahead of anticipated tariff implementations. The flood of foreign goods more than offset gains in domestic consumption and fixed investment. Further exacerbating the weakness, a drop in government spending created additional headwinds for economic growth.

- While the import surge is expected to reverse — easing GDP concerns — the sustainability of recent consumption and investment growth remains doubtful. Much of the apparent strength stems from temporary factors such as businesses stockpiling inventory ahead of tariffs and using existing stock to suppress price hikes, therefore artificially boosting demand. These short-term dynamics suggest that underlying economic weakness may persist once these one-off boosts fade.

- The report also revealed emerging signs of inflationary pressures as the GDP price deflator — the inflation measure used to adjust nominal output for price changes — accelerated to its fastest pace since Q4 2022. This sharp increase, driven primarily by stronger adjustments to prices related to personal consumption and government spending, may fuel concerns about potential stagflation risks in the economy.

- We advise investors against overreacting to this single economic report as conditions are expected to shift throughout the year. As we’ve highlighted previously, the administration likely anticipated an early-year slowdown, positioning itself to deploy stimulative policies like tax cuts later this year to reinvigorate growth. Such measures could materialize in the coming months, potentially boosting the economy ahead of next year’s midterm elections.

Under the Radar: The Treasury signaled no changes to its borrowing program, sticking with existing issuance levels even as investors worry about bond market saturation.

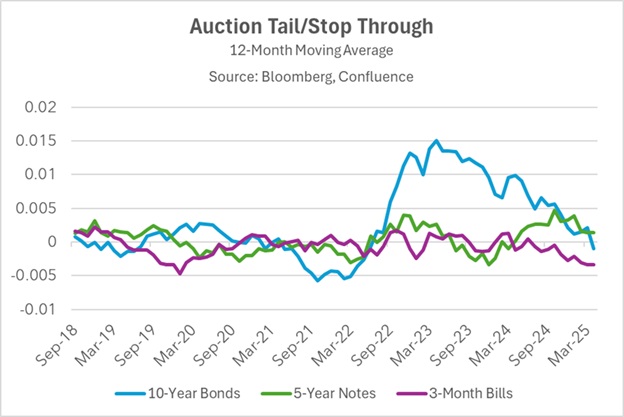

- The US Treasury’s latest quarterly refunding announcement maintained steady issuance sizes for long-term bonds, with officials indicating this approach would continue for “several quarters.” While market participants had speculated about potential bond buyback changes to address supply concerns, Treasury Secretary Bessent only confirmed that the department is studying such measures but stopped short of committing to implementation or providing a timeline.

- Growing speculation about an expanded buyback program follows weeks of exceptional volatility in long-dated bonds. The 10-year Treasury’s trading range in April marked its widest swing since the March 2023 banking crisis triggered by Silicon Valley Bank’s collapse. While these adjustments would extend a program initiated by the prior administration, market participants view the potential expansion as further evidence of the Treasury’s increasingly active role in the bond market.

- The statutory debt limit has further complicated the Treasury’s position, preventing increases in net Treasury supply and forcing reliance on cash reserves and extraordinary measures to maintain government funding. The department is expected to announce in early May when these temporary measures will be exhausted, potentially adding another layer of uncertainty for the Treasury market.

- Though boring, Treasury auctions are emerging as a critical market force. Successive administrations have deliberately managed issuance patterns to prevent liquidity shortfalls and improve market functioning. We expect coordinated Treasury and Federal Reserve action to actively contain long-term yield volatility in the future, creating potential tailwinds for both fixed income and equity markets as policymakers intervene to maintain orderly conditions.

BOJ Holds Off Hikes: The Bank of Japan is postponing its policy normalization plans as it continues to assess the potential economic impact of US tariffs.

- The Bank of Japan held its policy rate steady at 0.5%, while slashing its 2025 GDP growth forecast by more than half — from 1.1% to 0.5% — citing heightened risks from US tariffs imposed on Japan’s export-driven economy. Despite inflation being above its 2% inflation target, policymakers opted to delay rate hikes, signaling concern over near-term headwinds while preserving flexibility for possible monetary tightening should economic conditions stabilize.

- Japan’s economy has taken center stage in global markets as investors gauge how potential shifts in trade policy could reverberate across the world economy. The Trump administration has placed Japan at the forefront of its trade agenda, heightening the significance of ongoing bilateral negotiations. However, progress of the talks remains uncertain, with Japanese Prime Minister Shigeru Ishiba recently asserting that Japan will not compromise its national interests to accommodate US demands.

- The two nations are preparing for a third round of trade talks in which Japan is anticipated to offer an increase in imports of US rice and soybeans, while easing certain auto safety regulations. However, more substantial concessions appear unlikely as Ishiba faces domestic political constraints ahead of July’s critical elections, limiting flexibility for potentially unpopular trade compromises.

- Given the risk of slowing growth ahead of elections, the BOJ will likely delay monetary tightening to avoid additional economic strain. This dovish stance should support global bond markets as higher Japanese rates could have prompted the nation’s institutional investors, a crucial source of global fixed income demand, to repatriate significant capital.

US Tech Shows Life: Despite growing concerns about the economic fallout from the tariffs, robust tech earnings — particularly in AI-focused companies — demonstrate the sector’s remarkable resilience.

- Several mega-cap tech leaders revealed robust earnings growth in their cloud computing divisions, with Microsoft and Meta both surpassing market expectations, fueling positive momentum across the AI sector. Investor attention now turns to upcoming reports from Apple and Amazon, particularly focusing on how these companies navigated supply chain challenges amid escalating trade tensions last quarter.

- AI-related sectors are likely to be among the first to rebound as global economic expectations reset, with investors favoring established players that have demonstrated consistent growth. However, the sector may experience heightened volatility if ongoing macroeconomic uncertainty persists in the coming months.