Daily Comment (May 1, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Good morning! Equities are down as investors await the Federal Reserve’s policy decision. In sports news, Real Madrid showed their fighting spirit again, securing a draw against Bayern Munich in a thrilling Champions League match. Today’s Comment examines our views on monetary policy, where we believe the market should be less focused on rate cuts and more on balance sheet reduction. We also discuss how investors are paying closer attention to earnings and whether China may look to stimulate its economy over the next few months. The report concludes with a summary of domestic and international data releases.

No Cut, No Problem: The market anticipates a hawkish stance from the Federal Open Market Committee (FOMC) after its meeting, but the Fed’s balance sheet plans shouldn’t be overlooked.

- Strong economic data has cast doubts on the Federal Reserve’s plan to cut rates three times this year, as initially outlined in their economic projections. The CME FedWatch Tool now reflects a more cautious approach, suggesting one or two cuts are more likely. This shift aligns with the Fed’s wait for clearer signs of inflation subsiding. Tuesday’s employment cost index, showing a jump in wages and benefits from 0.9% to 1.2% in Q1, is a prime example. The data highlights persistent wage pressures, particularly for unionized workers whose compensation rose 6.3% compared to 4.1% for non-union workers.

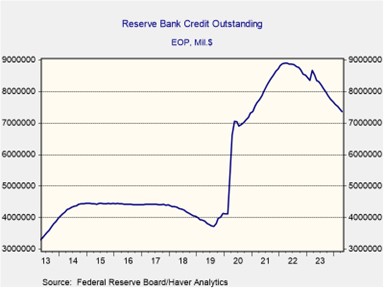

- Despite the economic data, the Fed might prioritize easing financial conditions through other means. Minutes from the March FOMC meeting showed that a majority of policymakers favored a measured slowdown in quantitative tightening (QT), specifically by reducing the pace of US Treasury drawdown while maintaining the current pace of runoff of mortgage-backed securities. The FOMC minutes didn’t provide a specific timeframe, but policymakers expressed a preference for a “fairly soon” implementation, likely indicating this summer or even this month. This move could help anchor Treasury yields and alleviate the risk of funding pressures in the repo market.

- While a rate cut delivers a more direct economic boost, slowing the pace of QT could still offer some market relief. Unlike rate cuts, a measured slowdown in balance sheet reduction is unlikely to significantly impact consumer spending. This signals the Fed’s consideration of a less restrictive policy stance. However, we don’t expect it to completely rule out rate cuts in 2024. Instead, it will likely signal less confidence in its ability to lower rates moving forward. Given persistent inflation, our current forecast is for a maximum of two rate cuts this year, with a strong possibility of none at all.

Investors Not Deterred: Investors have shifted their focus to corporate earnings, scrutinizing the ability of companies to maintain profitability amidst tightening financial conditions.

- Early signs from earnings season are positive. Over 80% of the nearly 300 companies that have reported have exceeded analyst expectations, defying concerns as the country continues to experience strong consumer spending growth. The S&P 500 has seen earnings growth of 5.6%, handily surpassing Bloomberg’s estimate of 3.8%. This strong performance is broad-based, with some companies reporting positive surprises exceeding 8% in earnings growth. This robust corporate performance appears to be a bright spot in the market as investors adjust to the possibility of fewer rate cuts from the Fed.

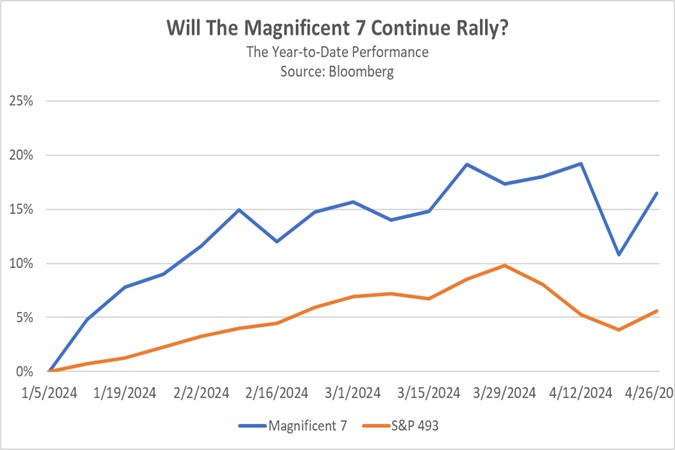

- The focus of tech earnings this week shifts to the “Magnificent Seven,” a group of high-valuation tech companies. Investors are eager to see if these companies can justify their lofty stock prices. So far, the tech sector has shown mixed results. Disappointing outlooks from Meta and weak sales from Apple have dampened investor enthusiasm. However, a surprise dividend from Alphabet and robust cloud performances by Amazon and Microsoft have offered some relief. A strong earnings report from Nvidia later this month could give the Magnificent Seven a much-needed boost. However, considering the recent reports from fellow chipmakers AMD and Supermicro, such a performance might be unlikely.

- Maintaining their stellar start to the year is proving difficult for major tech companies, suggesting much of their potential for growth is already reflected in their stock prices. This could explain the recent dividend announcements from companies like Meta and Alphabet, potentially aimed at appeasing investors seeking returns to offset the higher risks associated with tech stocks. However, such payouts are unlikely to become the norm, as tech companies prioritize reinvesting most of their earnings into research for the competitive AI landscape. This shift in focus could benefit less-favored sectors, particularly mid and small caps, which often boast stronger fundamentals.

China on the Move: Beijing is expected to announce new measures to help improve the country’s economic situation, while it struggles to deal with a struggling currency and slow growth.

- The Politburo met on Tuesday and set a date in July 2024 for the long-delayed Third Plenum. The postponement of the meeting, originally expected in late 2023 (a year after President Xi Jinping secured an unprecedented third term), has sparked speculation about internal discussions within the party leadership regarding China’s economic challenges. The focus of the July Plenum is expected to be economic reforms aimed at modernizing the country. Additionally, the Politburo indicated a willingness to support the struggling economy through measures such as bolstering the property market and potentially reducing interest rates.

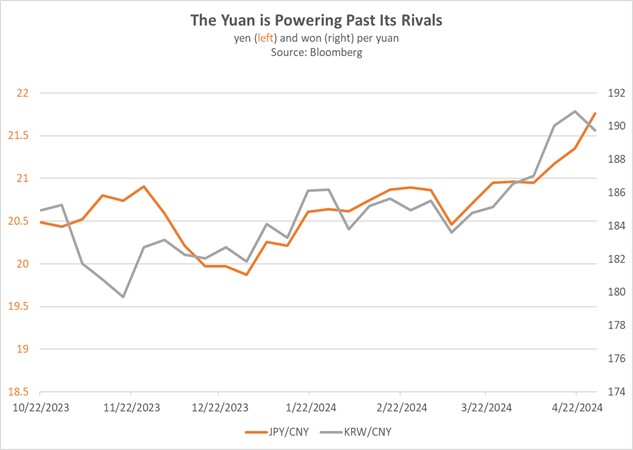

- China’s rising yuan (CNY) is raising concerns about export competitiveness. While the yuan is loosely pegged to the dollar, it has appreciated against other Asian currencies — 6% against the Japanese yen (JPY) and nearly 3% against the Korean won (KRW) — sparking speculation of a devaluation. Although a weaker yuan might boost exports, it could also trigger capital flight, similar to what happened after the 2015 devaluation. This could harm financial assets and erode investor confidence. Despite these drawbacks, the People’s Bank of China’s ongoing warnings against speculators suggest currency intervention remains a possibility.

- The delay of China’s Third Plenum sparks questions, but it could also indicate that the government believes there is a modestly improved economic situation when compared to a few months ago. The lead-up to the meeting may buoy Chinese stock markets as the government highlights the country’s growth prospects. While a currency devaluation is a lingering concern, it’s unlikely unless China faces significant economic pressure. However, despite tentative signs of progress, investors should remain cautious due to persistent geopolitical and regulatory risks.

In Other News: The Department of Justice’s plan to reclassify marijuana as a less dangerous drug has led to a surge in the WEED ETF. The US Senate passed legislation banning the import of enriched uranium from Russia in another sign that the ties between the country remain severed.