Daily Comment (May 3, 2022)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

We begin today’s Comment with our update on the Russia-Ukraine war. Military action yesterday apparently involved no new Russian advances, even as the U.S. warned that Russia is preparing to annex the swaths of eastern and southern Ukraine that it currently occupies. We next review a range of international and U.S. developments with the potential to affect the financial markets today. We wrap up with the latest news on the coronavirus pandemic.

Russia-Ukraine: Russian forces reportedly refrained from staging any new ground attacks in either eastern or southern Ukraine yesterday, apparently in order to regroup and re-equip for future attacks. Also, Russian operations may still be disrupted by Ukraine’s April 30 rocket artillery strike on a command post of the Russian Airborne and 2nd Combined Arms Army near Izyum. However, the Russians continue to launch attacks on military and civilian targets throughout Ukraine using missiles, artillery, and aerial bombs. Separately, a high-level U.S. official said Russia is planning sham elections to annex wide swaths of eastern and southern Ukraine, just as it did after seizing Crimea in 2014.

- According to a Russian Telegram channel citing a high-placed Kremlin official, President Putin will undergo surgery for abdominal cancer shortly after the big May 9 parade celebrating the Soviet Union’s victory over Nazi Germany in World War II. As we noted in our Comment yesterday, some Western officials believe Putin will use the May 9 event to announce a major change in the war, perhaps including a call up of reservists and a general mobilization to intensify the war.

- Under Russia’s constitution, presidential power during Putin’s incapacitation should temporarily be transferred to Prime Minister Mishustin, a former tax service chief. Yet, the report says Putin will name Security Council leader and former top foreign intelligence official Nikolai Patrushev to run the war while he is under the knife.

- We have seen no other reporting that would confirm the Telegram report. We note the channel claimed 18 months ago that Putin was suffering from abdominal cancer, but that thesis doesn’t seem to be widely accepted. In any case, it would seem inconsistent for Putin to launch a new initiative and then immediately be unable to oversee it. There is a good chance that either the major May 9 announcement or the presidential surgery won’t happen.

- Meanwhile, European Union energy ministers are meeting today to discuss a sixth package of EU sanctions on Russia, including a phased-in ban on importing Russian oil. Although Germany has swung to support the idea, Economy Minister Habeck warned that such a ban would cost the European economy dearly.

- The sanctions would need to be approved unanimously, but Hungary and Slovakia are expected to resist because of their out-sized dependence on Russian oil. The key question is whether the officials can identify exemptions or other types of special treatment that will allow the ban to be approved.

- Even though the new ban wouldn’t apply to natural gas, Russia’s other major energy export to the EU, it could still be very disruptive to regional and global markets. Any ban on Russian oil would worsen the current scramble for other supply sources, potentially pushing prices even higher. Some refiners could be left with insufficient supplies of certain grades, while firms dependent on Russia’s refined or semi-refined products could be out of luck. On Russia’s side, ongoing sanctions and infrastructure limitations could make it hard to find other markets, potentially forcing wells to be shut in.

- Overall, the situation is a reminder that the Russia-Ukraine war will likely contribute to a long-term supply jolt that will help keep commodity prices high and inflation elevated for years into the future.

European Union: Austrian Foreign Minister Alexander Schallenberg has called for radical changes to the EU’s foundational treaties to expedite neighboring countries’ ability to join and avoid domination by Russia. Besides signaling a shift from Austria’s traditionally tight relationship with Russia, Schallenberg’s suggestion illustrates the sea change in geopolitical thinking touched off by Russia’s invasion of Ukraine. Not only has the invasion prompted a likely effort by Sweden and Finland to join NATO, but it could also spur a reinvigoration and expansion of the EU.

European Equity Markets: Citigroup (C, $48.71) acknowledged that one of its traders had the “fat finger” that sent some European stocks into a sudden, short tumble yesterday. According to Citi, the employee made an error while inputting a trade order for a basket of shares that included many Swedish stocks.

- Nordic stocks were particularly hard hit, with Sweden’s benchmark OMX 30 tumbling as much as 7.9% before recovering to close 1.9% lower.

- Overall, the regional Europe Stoxx 600 index slid as much as 3% yesterday before trimming its losses to trade down 1.5%.

Australia: Joining the global fight against inflation, the Reserve Bank of Australia today hiked its benchmark short-term interest rate more aggressively than expected to 0.35% from 0.10% previously. The increase was the central bank’s first in 11 years.

- It was also the RBA’s first rate hike during an election campaign since 2007.

- The hike, even from a historically low rate, has forced Prime Minister Morrison to defend his record of economic management — his main weapon in the election campaign — as the cost of living has risen sharply.

Israel: Palestinian militant group Hamas has stepped up a mass-media campaign urging Palestinians in the West Bank and Israel to attack Jews in the wake of clashes between Israeli security forces and Muslims around the Al-Aqsa Mosque in Jerusalem’s Old City. The renewed violence could threaten stability in the region and weigh on Israeli asset values.

Africa: Little noticed against the backdrop of the Russia-Ukraine war and high consumer inflation around the world, weak rainfall in the Horn of Africa has produced the region’s worst drought in four decades and put some 20 million people at risk of hunger. Besides adding to the demand for food from other regions, the drought could also spark market-disrupting political unrest in countries like Ethiopia, Somalia, and Kenya.

U.S. Monetary Policy: Today, Federal Reserve officials start their latest two-day monetary policy meeting, where they are expected to approve an aggressive 50-basis-point hike in the benchmark fed funds interest rate. At the meeting’s end tomorrow, they are also expected to detail a relatively quick run-off of bonds on the central bank’s balance sheet.

- We have no doubt the Fed will embark on an aggressive tightening of policy, just as the officials have indicated. Ahead of the meeting, the yield on the 10-year Treasury note yesterday briefly rose above 3.0% for the first time since late 2018. The rise in Treasury yields has also pushed up the income flow from foreign government bonds. The yield on 10-year German government bonds, the benchmark in Europe, today surpassed 1% for the first time since 2015 before slipping back to 0.974%.

- All the same, we remain skeptical that the Fed can implement its entire planned program of tightening without causing financial market disruptions or contributing to a sharper-than-planned slowdown in the economy.

- Amid sky-high inflation, fiscal tightening, continued supply chain disruptions, and a blow to confidence from the Russia-Ukraine war, we think the risk of a sharp economic slowdown, recession, or financial market volatility in the next 12 to 18 months remains elevated.

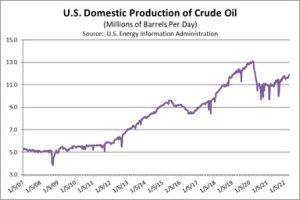

U.S. Oil Industry: Even though the Fed is trying to squelch inflation and the tight labor market makes it hard to find workers, high oil prices, touched off by factors such as rebounding demand and the Russia-Ukraine war, have finally prompted an uptick in U.S. oil drilling and more business for oil services companies in the U.S. oil patch. Recent data show the number of drilling rigs active in the U.S. is now up 60% from one year ago. Crude production is up more than 8% over the last year.

U.S. Labor Market – Unionization: The National Labor Relations Board said workers at a facility owned by Amazon (AMZN, $2,490.00) in Staten Island, New York, have voted against unionizing, despite last month’s pro-union vote at another Amazon facility close by. Even though today’s tight labor market has given employees more bargaining power and spurred an uptick in unionization, the result suggests any trend toward representation remains uneven.

- Widespread unionization could spur rapidly rising wage rates, higher inflation, and compressed profit margins.

- Added to those direct impacts on stock valuations, putting more of the nation’s income into the hands of workers would likely reduce the amount of capital channeled into the financial markets, given workers’ relatively higher propensity to consume.

U.S. Labor Market – Immigration: A new policy will address an unprecedented backlog of 1.5 million work-permit applications. The federal government said most immigrants with recently expired or soon-to-expire work permits would be able to continue working on those documents for up to a year and a half after they expire. The move will help prevent firms from losing employees at a time when finding replacements would likely be difficult and expensive.

COVID-19: Official data show confirmed cases have risen to 514,284,882 worldwide, with 6,238,487 deaths. The countries currently reporting the highest rates of new infections include Germany, South Korea, France, and Italy. (For an interactive chart that allows you to compare cases and deaths among countries, scaled by population, click here.) In the U.S., confirmed cases rose to 81,444,332, with 993,999 deaths. In data on the U.S. vaccination program, the number of people considered fully vaccinated now totals 219,778,035, equal to 66.2% of the total population.

Virology

- In the U.S., the Omicron BA.2 variant continues to spread, but it is still causing relatively few serious illnesses or hospitalizations. The seven-day average of people hospitalized with confirmed or suspected COVID-19 came in at 17,220 yesterday, up 16% from two weeks earlier. Because of the low level of hospitalizations and general fatigue with the pandemic, the new outbreak is generating few new policy responses.

- Amid China’s strict measures to fight its latest infection wave, a Shanghai nursing home put an elderly resident infected with COVID-19 into a body bag and loaded her into a crematorium van, only to find just before the vehicle drove away that she was still alive. The event, caught on camera, has exacerbated some citizens’ criticism of the government for its draconian measures against the pandemic.

Economic and Financial Market Impacts

- The pandemic’s resurgence in China has helped pull metals prices down from highs hit following Russia’s invasion of Ukraine.

- Worries that new economic lockdowns will erode demand from the world’s largest commodity consumer have dragged aluminum and tin down more than 17% from their recent all-time highs.

- Copper has lost 8.5% since its March record.

- Zinc and lead are off 8.7% and 10% from this year’s highs, respectively