Daily Comment (March 28, 2019)

by Bill O’Grady and Thomas Wash

[Posted: 9:30 AM EDT] Happy Opening Day! Even as cool temperatures linger in much of the country, major league baseball opens in the U.S. today, one of the official signs of summer. Here’s something to make you feel older: for the first time in the 21st century, there are no players on team rosters that have major league playing time in the 20th century.[1] Equities are modestly higher in a quiet news environment. There have been a number of Fed speakers in the past few days. The message remains consistent—the central bank is on pause, but not moving to ease. Here is what we are watching this morning:

Brexit: If ever there was a day that showed there is no consensus on a path forward, it was yesterday. All the indicative votes failed to reach a majority.[2] PM May offered to resign if her plan was accepted. Although that did sway some hardline Brexit supporters, the Northern Irish DUP rejected the offer.[3] This outcome probably means we will get a long extension of Article 50 and a new PM to guide the effort. The GBP is down a bit today but a long extension probably means the exchange rate will remain mired at roughly current levels.

Turkey: As we noted yesterday, in the run-up to elections Turkey has sent overnight interest rates to astounding levels, in excess of 1,000%, to punish currency shorts. Turkey has been struggling for the past year with rising inflation and recession. We would expect rates to fall after this weekend’s local elections.[4] While Erdogan is clearly safe in his position, this election has evolved into a referendum of sorts on the regime, so he is trying all kinds of actions to lift sentiment. Although conditions in Turkey remain difficult, we note that the exchange rate has fallen significantly, supporting a strong improvement in the current account. In other words, conditions are not good, but most of the bad news is already discounted.

Chinese trade: USTR Lighthizer is back in Beijing for talks; Chinese officials are expected in Washington next week. There are reports of progress[5] but nothing concrete ever emerges. This looks like a “stall” game. China is probably hoping that it can extend negotiations into early next year and expect election issues to dominate, allowing China to avoid making excessive concessions.[6] From a financial markets perspective, discussions won’t end suddenly, leading to tariffs and a drop in equity values.

A side note on China: Former colleagues of mine at Doane, an agricultural research service, inform me that the African Swine Fever[7] (ASF) is becoming a serious problem. The disease, so far, has affected Europe, Asia and South America. It poses no risk to humans but it is nearly 100% fatal to pigs. Thus, once a herd is affected, it essentially wipes out the group. The USDA and Customs continue to work hard to prevent the disease from entering the U.S.[8] ASF can be spread by pork products, so strict enforcement is vital. This event will almost certainly lead to higher pork prices in the U.S. as summer grilling season approaches; we would also expect China to “offer” to buy lots of U.S. pork as their supplies dwindle due to the epidemic in China.

Another side note on China: Taiwan’s President Tsai Ing-wen said today that the U.S. is open to the island’s request for new arms sales.[9] If the Trump administration does increase arms sales to Taipei, it will increase tensions with Beijing.

India joins another club: India has successfully shot down a satellite with a ground-based missile, becoming the fourth nation in the world to show it has this capacity.[10] Although there is speculation that this news is part of a pre-election plan to boost Modi’s reelection, the fact that India could “blind” its primary adversary, Pakistan, in a conflict raises the potential for escalation in a crisis.

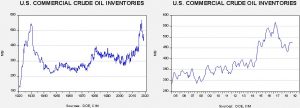

Energy update: Crude oil inventories rose 2.8 mb last week compared to the forecast decline of 3.0 mb.

In the details, refining activity fell 2.3%, which was a surprise. Estimated U.S. production was unchanged at 12.1 mbpd. Crude oil imports and exports both fell 0.4 mbpd.

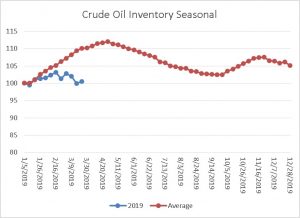

This is the seasonal pattern chart for commercial crude oil inventories. We would expect to see a steady increase in inventory levels that will peak in early May; the pattern coincides with refinery maintenance. Even with the build this week, the market is well behind normal which is supportive for prices.

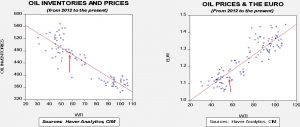

Based on oil inventories alone, fair value for crude oil is $59.87. Based on the EUR, fair value is $53.30. Using both independent variables, a more complete way of looking at the data, fair value is $54.86. We are seeing the two fair value levels widen, with oil stocks very supportive, while the dollar isn’t all that supportive for prices.

In other oil news, President Trump tweeted for lower oil prices this morning, sending markets lower. OPEC has consistently ignored the president on his calls for greater output. Saudi Aramco is coming to market with a $10 bn bond to partially fund its purchase of a Saudi petrochemical company.[11]

[1]https://www.apnews.com/c171fd38f1d0498390b4e7f0e5b092ee?utm_source=newsletter&utm_medium=email&utm_campaign=newsletter_axiosam&stream=top

[2] https://ig.ft.com/brexit-indicative-votes/?emailId=5c9c3e08c597400004352bc8&segmentId=22011ee7-896a-8c4c-22a0-7603348b7f22

[3] https://www.ft.com/content/27ac0b14-50d1-11e9-9c76-bf4a0ce37d49?emailId=5c9c3e08c597400004352bc8&segmentId=22011ee7-896a-8c4c-22a0-7603348b7f22 and https://www.ft.com/content/c80604c4-50b4-11e9-9c76-bf4a0ce37d49?emailId=5c9c3e08c597400004352bc8&segmentId=22011ee7-896a-8c4c-22a0-7603348b7f22

[4] https://www.politico.eu/article/tayyip-erdogan-turkey-election-the-invincible-faces-tough-election-test/?utm_source=POLITICO.EU&utm_campaign=6ce3f2f806-EMAIL_CAMPAIGN_2019_03_28_05_45&utm_medium=email&utm_term=0_10959edeb5-6ce3f2f806-190334489

[5] https://www.reuters.com/article/us-usa-china-trade-exclusive/exclusive-china-makes-unprecedented-proposals-on-tech-trade-talks-progress-u-s-officials-idUSKCN1R905P

[6] https://www.ft.com/content/3c84214a-507f-11e9-b401-8d9ef1626294?emailId=5c9c3e08c597400004352bc8&segmentId=22011ee7-896a-8c4c-22a0-7603348b7f22

[7] http://www.oie.int/en/animal-health-in-the-world/animal-diseases/african-swine-fever/

[8] https://www.agdaily.com/news/illegal-chinese-pork-products-seized/

[9] https://www.reuters.com/article/us-taiwan-usa/taiwan-president-seeking-tanks-and-fighters-says-us-responding-positively-idUSKCN1R82OA

[10] https://www.washingtonpost.com/world/asia_pacific/india-shoots-down-satellite-announces-itself-to-be-a-space-power/2019/03/27/a1e73426-5068-11e9-af35-1fb9615010d7_story.html?utm_term=.1f898d630442&wpisrc=nl_todayworld&wpmm=1

[11] https://www.wsj.com/articles/aramco-plans-10-billion-bond-next-week-opening-books-for-first-time-11553761555?utm_source=newsletter&utm_medium=email&utm_campaign=newsletter_axiosmarkets&stream=business