Daily Comment (March 27, 2020)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EST]

Happy Friday as we wrap up another long week. After three days of vigorous equity rallies, we are taking a breather this morning. We update all the COVID-19 news. Venezuela’s president is indicted. Israel has a new unity government. Here are the details:

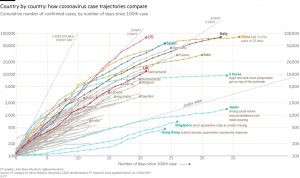

COVID-19: The official number of global cases is 542,788 with 24,361 fatalities and 124,351 recoveries. There is growing skepticism over China’s numbers; this is especially pertinent given media reports that the U.S. now has more cases than China. Here is the usual FT chart:

There is a recognizable “bend” developing in the U.S. infection rate. That is potentially good news.

The virus news:

- Boris Johnson has tested positive for the virus, the first G-7 leader to do so. So far, his symptoms have been mild, and he is continuing to work in isolation.

- There is a growing debate among epidemiologist modelers about how COVID-19 is spreading. The conventional position is that the virus is potentially dangerous because it is novel and there is no imbedded immunity in the community. This position prescribes widespread social distancing. However, other modelers suggest there is a significant number of cases that were asymptomatic so the level of immunity in the community may be much higher than we think. If the latter is true, then the need for social distancing is less critical. What we see is that the disease is overwhelming the medical capacity in several cities worldwide. This observation bolsters the conventional position. However, the opposing position may be the one that leads us out. Sweden has opted for very modest restrictions; it is gambling that (a) most cases are mild and thus the costs of infection are bearable, and (b) its medical system can handle the influx of cases if it is wrong. Sweden, Mexico and Brazil are offering natural experiments on the policies of lockdowns and social distancing.

- As we noted yesterday, Russia is postponing a referendum on extending Putin’s time in office. It also announced social distancing measures and is going to tax bank deposits to pay for them.

- Earlier this week, the U.S. Navy announced that 23 sailors aboard the U.S.S. Theodore Roosevelt tested positive for COVID-19. This vessel has been ordered to port so the remaining sailors can be tested.

- China has closed its borders to foreign travelers in an attempt to prevent a rebound in cases.

The policy news:

- The House is expected to vote on the stimulus bill, which passed the Senate yesterday. Although we expect it to pass, it will not be without drama. The leadership is trying to ensure it can get enough members back in Washington to form a quorum. House leadership was hoping to pass the measure with a voice vote, but it only takes one member to object which would force a physical vote; hence the rush to Washington.

- In the bill, airlines will give equity stakes to the government in return for support. Cruise lines, due to foreign ownership, won’t get aid.

- Although getting this bill passed is a significant achievement, the reality is that it only partially replaces the losses already endured. Further measures are likely, but getting them passed will become increasingly difficult.

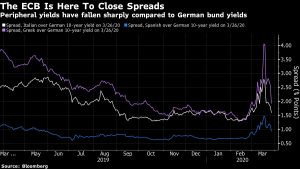

- The ECB has started new bond purchases. We are already seeing yield spreads narrow between countries.

- The next “big thing” will be countries figuring out how to restart after social distancing restrictions are relaxed. The U.S. is considering a county-by-county Europe is working on similar policies. It seems to us that the key to this approach is wider testing for both current infections and immunity. Without those elements, restarting the economy is a shot in the dark; start too soon and you risk a jump in infections, but wait too long and one suffers unnecessary pain.

- The Fed’s balance sheet has exceeded $5.0 trillion for the first time on record. The Treasury is trying to give support to mortgages on fears that homeowners will slow or stop payments.

- The EU continues to struggle with policy surrounding the virus. Border blockages are playing havoc on internal trade. The blocks are also affecting migrant farmworkers. Our upcoming Weekly Geopolitical Report is a two-part series on this issue.

- The U.S. is planning to approve delays to tariff payments due to the virus.

The economic news:

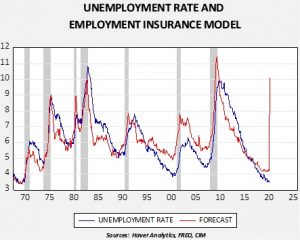

- The jump in initial claims, reported yesterday, was historic. And, it is quite possible that the claims data was understated. We modeled the unemployment rate using the four-week average of claims and continuing claims. We will likely see a massive rise in unemployment.

The March employment data will be very sensitive to the survey week, which is usually the second week of the month. We may not get the full impact of the virus until the April data is released, which comes out in early May.

- Although we continue to lack data on the level of damage to the economy, there are high-frequency reports from new sources that suggest serious weakness. Here is one on consumer confidence. Polling suggests widespread pain.

- With reference to our recent WGR, the Swiss have been managing their shutdown with relative ease because of government strategic stockpiles of foodstuffs.

- Companies are reporting a jump in sales of tops and shirts, but without the corresponding pants and skirts—perhaps a reflection of increased videoconferencing.

The market news:

- Despite the Fed’s efforts, short-dated T-bill yields have turned negative, a sign that liquidity issues persist.

- Insurers are scrambling to deal with expectations of incoming claims due to COVID-19.

- Ecuador may be on the brink of default.

- Casinos in Macau have reopened; crowds are thin.

- The NHL has canceled its season.

- Oil markets remain under pressure. China has been reportedly building inventory, taking advantage of low prices. The key issue is storage; once available storage is tapped, oil prices would be vulnerable to a catastrophic decline. Iran is facing additional pressure; the S. has limited Iraq’s waiver to buy Iranian oil to 30 days. If the U.S. finally ends the waivers, Iran will have one less nation to buy its crude. The KSA is reportedly struggling to find buyers for its crude oil.

Foreign policy:

- Presidents Trump and Xi held a call in a bid to ease rising tensions between the U.S. and China.

Israel: Although Netanyahu and Gantz vowed not to form a unity government, under the stress of the virus, they have worked out a deal.

Venezuela: The U.S. has indicted Venezuelan President Maduro for narcotics trafficking and has offered a $15 million reward for information leading to his capture and conviction.