Daily Comment (March 26, 2020)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EST]

The long-awaited initial claims data is out; we offer details below, but claims rose a record 3.28 mm. After a two-day respite, equities have turned lower. As we note below, the Senate has passed a $2.0 trillion spending package. As usual, we update the COVID-19 data. The Weekly Energy Update is available. Here are the details:

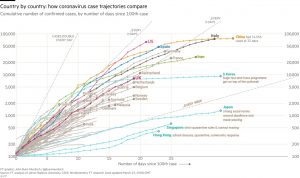

COVID-19: The official number of global cases is 487,648 with 22,030 fatalities and 117,749 recoveries. Although we report on this data each day, readers should note that these numbers are, at best, a mere snapshot. The number of actual cases is probably far higher. Here is the usual FT chart:

The virus news:

- Spain has now suffered more fatalities than China. Nursing homes in Spain have suffered significant numbers of deaths. The EU is struggling to acquire COVID-19 drugs due to the lack of airfreight capacity.

- There are some interesting developments on the testing front. The U.K. looks poised to roll out a home test for the virus. That could dramatically increase data on the disease and help policymakers fine-tune shutdown orders. In the U.S., a simpler test is replacing the current one. The current test requires a special swab that is administered deep within the nasal cavity, and the associated gagging can expose health care workers administering the test. The new test eliminates that risk. The U.K. and Senegal are doing a trial on a 10-minute COVID-19 test. Perhaps even more important, the U.K. is running a trial on a test that would determine if a person has immunity to COVID-19; this would be a huge breakthrough because we could tell who is no longer at risk to the disease. These individuals could return to everyday life. Meanwhile, the lack of testing kits in Europe is preventing medical personnel from being tested. The search for drugs that would help victims recover from COVID-19 continues apace.

- Medical capacity limits are being hit in some cities in the U.S. As ERs fill up, doctors are being forced into triage decisions.

- Epidemiologists are watching Wuhan to see if there is a rise in infections after restrictions are lifted.

- Brazil and Mexico continue to avoid aggressive containment measures, perhaps creating a natural experiment to see how the virus spreads and how lethal it is without constraints.

- There is a patron saint for epidemics, St. Corona.

The policy news:

- The $2.0 trillion stimulus bill passed the Senate last night. The deal has five major components:

- Income support: There will be direct payments to households of $1,200 per adult with additional payments for dependent children. The payments phase out at $75k for individuals or $150k per household.

- Business bailouts: The bill sets aside $500 billion for loans to businesses, with $25 billion for airlines. Buybacks would be curbed for aided companies.

- Unemployment insurance: This existing benefit is increased by $600 per week for four months. Gig economy workers are included.

- Hospitals: This sector gets $150 billion.

- Small businesses: The bill gives $367 billion of loans and grants to firms with less than 500 employees.

- The bill now moves to the House.

- Although this bill is a massive spending package, it may not be enough. Expect lawmakers to do more in the coming weeks. This deal would not be a cure, but a stopgap; after all, economists are expecting a massive drop in Q2 GDP and this amount may not fill that one-quarter gap.

- Europe is opening the fiscal spigots as well:

- Germany has released the “debt brake” and is deploying deficit spending.

- France is promising massive medical spending.

- Even little Malta is boosting fiscal spending.

- The U.K. and the Netherlands are abandoning fiscal austerity.

- Nine Eurozone nations have issued a call for “coronabonds,” which would be a common debt instrument for the currency bloc. If this single bond emerges, it would increase the viability of the Eurozone.

- At the same time, European leaders are worried that the crisis could lead to foreign investors buying vulnerable companies.

The economic news:

- Estimates for U.S. Q2 GDP are looking increasingly dire. Forecasts for China’s GDP for 2020 are falling as well.

- China has been ramping up its economy after its shutdown due to quarantine. Sadly, companies are finding that exports are falling as the rest of the world slows.

- The USPS may be on the brink of failure due to the virus.

The market news:

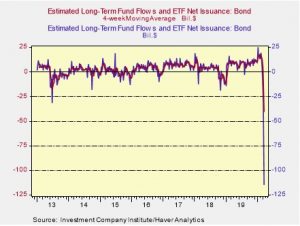

- Bonds have been a mixed bag. Investment grade is rebounding as the Fed measures improve liquidity. However, high yield, which lacks similar support, remains strained. Weekly flows data show a massive “bond dump.” This chart shows the weekly flows into bond mutual funds and ETFs, showing the raw data with a 12-week moving average. The chart speaks for itself.

- Corporate insiders are buying stock. Meanwhile, companies are hoarding cash. Gold bars are in short supply.

- One measure of economic stress is the dollar; when financial stress rises, the dollar tends to rally. At some point, we do expect the U.S. will take steps to deliberately weaken the dollar.

Foreign policy:

- The G-7 was unable to issue a joint statement because the U.S. insisted that COVID-19, the official name for the virus issued by the WHO, be called the Wuhan virus. The U.S. is also pushing the U.N. to single out China as the source of the virus. Although this may appear petty on its face, the naming fight reflects the U.S. reaction to an aggressive propaganda campaign by Beijing over the virus. China has allowed rumors to circulate that COVID-19 originated from a U.S. bioweapons lab, or that it may have been in Italy before it was in China. Beijing has also made numerous high-profile donations of medical equipment, designed to raise its profile. All of this has raised tensions between the U.S. and China to high levels.

- Russia has announced it would delay a referendum on extending Putin’s presidency due to the virus.

Odds and ends: Turkey has indicted 20 Saudis in connection with the murder of Jamal Khashoggi. There is growing dissention within the right-wing populist AfD in Germany.