Daily Comment (March 24, 2020)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EST]

As Tuesday dawns and financial markets surge, it’s important to remember that true market stabilization amidst the pandemic would probably require three things: 1) full support for the economy and financial markets by the Federal Reserve and other major central banks; 2) a credible fiscal support package from the U.S. Congress to cushion the economic impact; and 3) a slowdown in the rate of infections that would take pressure off national health systems. Investors today are encouraged by yesterday’s progress on the first factor after digesting it overnight, but there is still work to do on the second and the third, as discussed below.

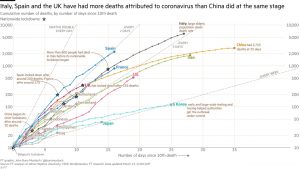

COVID-19: Official data show confirmed cases have risen to 392,331 worldwide, with 17,156 deaths and 102,972 recoveries. In the United States, confirmed cases rose to 46,450, with 593 deaths and 17 recoveries. According to a new IPSOS poll, just 1% of Americans say they’ve been able to get tested for the virus, but 5% say they know someone who tested positive. Here is the latest chart of fatalities from the Financial Times:

The key takeaway from the chart is that the rate of infections continues to grow exponentially, with hospitalizations and deaths rising in tandem. Spain had more than 500 deaths from the virus in the last day. In Belgium, new hospitalizations moderated a bit, but the number of victims going into intensive care surged.

- Real Economy. As discussed in greater detail below, IHS Markit said its “flash” composite PMI for the Eurozone plunged to a record low of 31.4 in March from 51.6 in February. According to IHS Markit, the figures are “indicative of an 8% annualized decline in Eurozone GDP, and it is unlikely that the index has hit rock bottom yet.”

-

- German Finance Minister Sholz said the pandemic will reduce German GDP by 5% this year.

- British Prime Minister Johnson finally succumbed to pressure and announced a stay-at-home order for all of the U.K., arguing, in part, that the move was necessary to keep the National Health System from being overwhelmed. Officially, the lockdown is for three weeks, but Johnson aides have admitted privately that it could last until May or even beyond.

- Japanese Prime Minister Abe succumbed to pressure to postpone the Tokyo Summer Olympics until 2021 at the latest.

- Major U.S. airlines are drafting plans for a potential voluntary shutdown of virtually all passenger flights across the U.S. Government agencies are considering ordering such a shutdown as COVID-19 cases make it harder and harder to staff the nation’s air-traffic control system.

- In contrast with the job losses in travel, tourism, and small businesses, major retailers facing a surge in demand for food and household products and have announced plans to hire at least 500,000 new workers in the coming weeks.

- Highlighting the improved situation in China, authorities said they will soon relax travel restrictions into and out of the hard-hit Hubei province. However, there is some concern that the move could be premature, especially as China and other Asian countries report a surge in imported infections that could lead to new waves of the epidemic.

- Financial System. Real estate investment trusts that specialize in buying mortgage-backed securities are playing a prominent role in the current market turmoil, dumping their holdings in response to margin calls by their banks. Expectations are that the financial system will see a surge in missed mortgage payments as more people lose their jobs. Separately, major credit-rating firms have issued a wave of downgrades for corporate and government bonds, eliminating some triple-A designations and cutting many below investment grade. In addition, reports now say powerhouses Goldman Sachs (GS, 134.97) and Bank of New York Mellon (BK, 27.49) both had to put money into their money market funds to keep from “breaking the buck,” which we see as the modern-day equivalent of a bank run.

- Fiscal Policy Response. For the second straight day, Senate Republicans and Democrats couldn’t agree on the Phase III economic support package. Showing they’ve learned the lessons of the corporate bailouts in 2008, the Democrats continue to insist that the support be weighted toward assistance for workers rather than working capital for companies. Even though the failure to reach an agreement sent markets lower, it’s encouraging that all participants continue to express optimism that a deal will soon be made. Separately:

-

- EU finance ministers today formally approved a suspension of the Eurozone’s deficit and debt limits in order to allow countries full scope to boost spending to combat the epidemic.

- A dozen countries in the Middle East, North Africa and central Asia have already approached the IMF for financial assistance to help limit the human and financial cost of the coronavirus.

- Monetary Policy Response. Although the massive new asset purchases announced by the Fed yesterday weren’t enough to offset the disappointment over the failed fiscal support bill, we think they could end up being seen as a turning point in the crisis. In general, the Fed is now saying it will do whatever it takes to support the economy and financial markets in the midst of the crisis. Indeed, the program has appeared to have some modest success in the debt, precious metals and currency markets. Now that more details are available, we think the key elements in the program, which will be backstopped by the fiscal program from Congress, are as follows:

-

- To ensure sufficient liquidity in the financial system, the Fed will now buy U.S. Treasuries and mortgage-backed securities without limit;

- To support the multi-family housing sector, the Fed will now begin purchasing commercial mortgage-backed securities issued by government-supported entities;

- To support the consumer and business lending markets, the Fed will now relaunch the Term Asset-Backed Securities Loan Facility (TALF) of 2008, under which it will lend money to investors to buy securities backed by credit-card loans and other consumer debt;

- To support the market for new, highly rated corporate debt, the Fed will wade into commercial banking by offering corporations bridge loans of up to four years, with limits on dividends and stock buybacks for firms that defer interest payments on their loans;

- To unblock the market for existing corporate debt, the Fed will now purchase bonds already issued by highly rated companies and eligible exchange-traded funds;

- To support the markets for municipal bonds, the Fed will expand last week’s commercial paper facility to purchase high-quality, short-term obligations of state and local governments;

- To further support municipal obligations, the Fed will expand last week’s money market facility to purchase high-quality, ultrashort-term obligations of state and local governments.

Odds and ends: After failing to convince Afghanistan’s rival presidents to form a national unity government, Secretary of State Pompeo said the U.S. will slash $1 billion from its aid budget for the country. Secretary of Defense Esper says the U.S. military has conducted a raid in Honduras to rescue a U.S. citizen facing an undisclosed danger.