Daily Comment (March 20, 2018)

by Bill O’Grady and Thomas Wash

[Posted: 9:30 AM EDT]

Framing the Fed: The FOMC meeting begins today. Here we lay out the basic path for monetary policy.

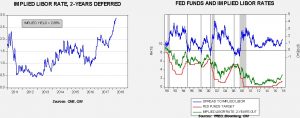

The chart on the left shows the implied three-month LIBOR rate, two years deferred, derived from the Eurodollar futures market. Note that the yield has increased dramatically since mid-2017, coinciding with optimism and then the passage of the tax bill. The chart on the right compares that rate to the fed funds target, with the spread between the two rates shown on the upper line of the chart. In general, LIBOR rates exceed fed funds (fed funds have less credit risk), but the two rates do become a good guidepost for policy. We have set vertical lines where the two lines cross. Usually, this marks the end of a tightening cycle. The Greenspan Fed seemed to closely watch this rate and stopped raising rates when the implied rate fell below fed funds.

The current spread indicates the FOMC will raise rates another 150 bps, to a terminal rate of 3.00%, in two years. Assuming 25 bps per hike, that implies seven more increases before this time in 2020. That could mean three hikes this year and four in the remaining 15 months, or four this year and three in the last 15 months. The number for this year is the topic of discussion. We expect a clear signal for three and the potential for an additional hike. It is worth noting that it was not unusual in previous tightening cycles for the implied rate to decline to the target. Thus, we may not make it to 3.00%. However, for that to happen, the implied rate will need to decline at some point.

The other issue is that this meeting will be the first press conference for Chair Powell. A number of pundits have applauded the new Fed leader for speaking plainly. This is not actually a virtue in our estimation. Clarity in policy dampens fear and encourages investors to take on more risk until financial markets become unstable. Thus, a little obscurity should be welcomed.

The prince is in Washington: Saudi Crown Prince (CP) Mohammed bin Salman is visiting the U.S. capital today. There are a number of items on his agenda, including an attempt to pull the U.S. into a harder line on Iran and likely feeling out policymakers for their reaction to the Kingdom of Saudi Arabia (KSA) acquiring nuclear power. CP Salman would like to diversify the KSA’s energy away from hydrocarbons, but getting nuclear reactors could give the country the infrastructure to develop indigenous nuclear weapons. The harder line on Iran should be a bit like pushing an open door—the nomination of Pompeo to the State Department puts an Iran hawk in place and the president has been consistently critical of the Iranian nuclear deal. In May, the president has to recertify the Iran deal and there is growing speculation he won’t do so. Finally, the KSA is considering limiting the listing of its Saudi Aramco IPO to the Saudi equity market only. We suspect the KSA doesn’t want to tackle the intrusive reporting requirements of London or New York. However, we would not count out Beijing as it would not be a shock to see China offer placement for the IPO and wave Western-level compliance. Concerns surrounding Iran may be behind the rise in oil prices today.

More Facebook (FB, 172.56) fallout: Shares are lower again this morning as the company struggles to get in front of the fallout from the Cambridge Analytica scandal. Perhaps the most interesting development is that Democrats are turning on the company.[1] Generally speaking, industry groups line up politically and technology has tended to land with Democrats. The extractive industries and much of manufacturing has been captured by the GOP, while the financial sector tends to be divided between both parties. The Democrats are angry that Facebook may have assisted the GOP during the presidential election and are thinking of exacting revenge. If this broadens to the entire sector it may affect donation flows for the upcoming mid-terms and the 2020 presidential race.

China trade issues: It appears the president is poised to impose some $60 bn in tariffs against Chinese products on Friday.[2] So far, China appears to be following two tracks on this issue. First, China is trying to be conciliatory; Premier Li Keqiang promised in a speech at the end of the National Party Congress to do more to protect intellectual property.[3] Chairman Xi’s top economic advisor, Liu He, told a group of business leaders that he intends to takes steps to open up China’s economy.[4] It appears China is trying to manage the relationship and avoid an all-out trade war; however, President Trump seems to be spoiling for a fight. Second, if a trade war does start, look for China to attack U.S. agriculture.

[1] https://www.politico.com/story/2018/03/19/angry-democrats-facebook-424456

[2] https://www.washingtonpost.com/business/economy/trump-prepared-to-hit-china-with-60-billion-in-annual-tariffs/2018/03/19/fd5e5874-2bb7-11e8-b0b0-f706877db618_story.html?utm_term=.33ce92d9800c

[3] https://www.bloomberg.com/news/articles/2018-03-20/china-to-open-manufacturing-cut-tariffs-and-taxes-premier-says

[4] https://www.bloomberg.com/news/articles/2018-03-02/top-xi-aide-is-said-to-promise-u-s-ceos-action-on-china-reforms, https://www.reuters.com/article/us-china-parliament/chinas-premier-hopes-trade-war-can-be-averted-pledges-more-open-economy-idUSKBN1GW0AO