Daily Comment (March 15, 2021)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT] | PDF

Good morning, Monday! We have an additional sign of spring, the semiannual clock adjustment. March Madness begins this week, all in one city. U.S. equity futures are ticking higher this morning as Treasury yields are steady to lower. Our coverage leads off with international news; German regional elections were negative for the ruling CDU/CSU coalition. Economics and policy are next, with a focus on bank leverage ratios and Treasury yields. Immigration is also a growing issue. China coverage is next, and we close with the pandemic update.

International news: German regional elections and Myanmar lead our coverage.

- In the fall, Germany will hold national elections and the CDU/CSU center-right coalition will head into that election without Chancellor Merkel, who is retiring. This weekend, in what was viewed as an early test of the ruling coalition’s popularity, regional elections were held in Baden-Württemberg and Rhineland-Palatinate, two strongholds of the CDU/CSU. It didn’t go well. The Greens dominated, with the CDU’s vote share falling to a record low 23% in Baden-Württemberg. In Rhineland-Palatinate, the SDU dominated with the CDU running second at 26.0%. The AfD actually suffered losses, suggesting that the right-wing populists were not the cause of the CDU’s problems. To some extent, this poor showing may be due to regional factors. The Greens are being seen as a center-left pragmatic party that governs well; that may have been true in Baden-Württemberg, but it may not translate nationally.

- The CDU has been hit with a series of scandals and, as is often the case for parties losing a strong leader, the succession leadership hasn’t inspired voters. The disruption caused by the pandemic is also a negative for the party in power, no matter how difficult the situation was. This loss could give the CDU an incentive to adjust before September.

- If the center-right does lose power in the autumn, it will be a risk factor for Eurozone assets and the EUR as Germany is the dominant nation in the bloc.

- Protests continue unabated in Myanmar and the death toll is grimly rising as well. Over 50 people were fatally shot over the weekend. The military declared martial law over the Hlaingthaya district of Yangon over the weekend, the first declaration since the coup. In an escalation, protestors burned down Chinese factories. We will be watching to see how patient Beijing will be with Myanmar’s leaders if Chinese assets continue to be threatened.

- U.S. negotiators are ramping up efforts to bring the Afghanistan war to a close. Afghan officials worry that the talks are more about the end of U.S. involvement and less about stabilizing the country.

- The conservative government in Australia has been rocked by allegations of rape by members of the administration. The allegations and subsequent protests have started to adversely affect the government’s poll numbers.

- Although the Biden administration says it will “sit down tomorrow” with the Iranian leadership to restart talks, the reality is that both sides are far apart on numerous issues. We doubt Iran will return to talks until after the June elections. We are seeing reports that former Iranian President Mahmoud Ahmadinejad is considering a run for his old position; the mullahs are reportedly cool to the idea. Ahmadinejad has been open to talks with the U.S.

- The fallout from Brexit continues; about €100 billion of Irish-listed securities left the securities depository in London for EuroClear in Brussels over the weekend.

Economics and policy: All eyes remain on the Treasury market.

- Last year, the Fed relaxed the supplemental leverage ratio (SLR), sort of an extra leverage ratio that banks have that acts as a restraint on bank balance sheets. In addition to the capital assigned to various bank assets, the SLR is an overall leverage ratio for all bank assets. Essentially, it measures the assets relative to cash and equity, including common equity and some forms of preferred equity. Last March, the Fed granted temporary relief to banks from the Treasuries they held, in that the Treasuries on the balance sheets of banks would not count against the SLR. In addition, banks had restrictions on dividends and stock repurchases.

- The dividend and stock repurchase restraints have been eased. The SLR adjustment is scheduled to end on March 31. Senators Warren (D-MA) and Brown (D-OH) oppose extending the measure.

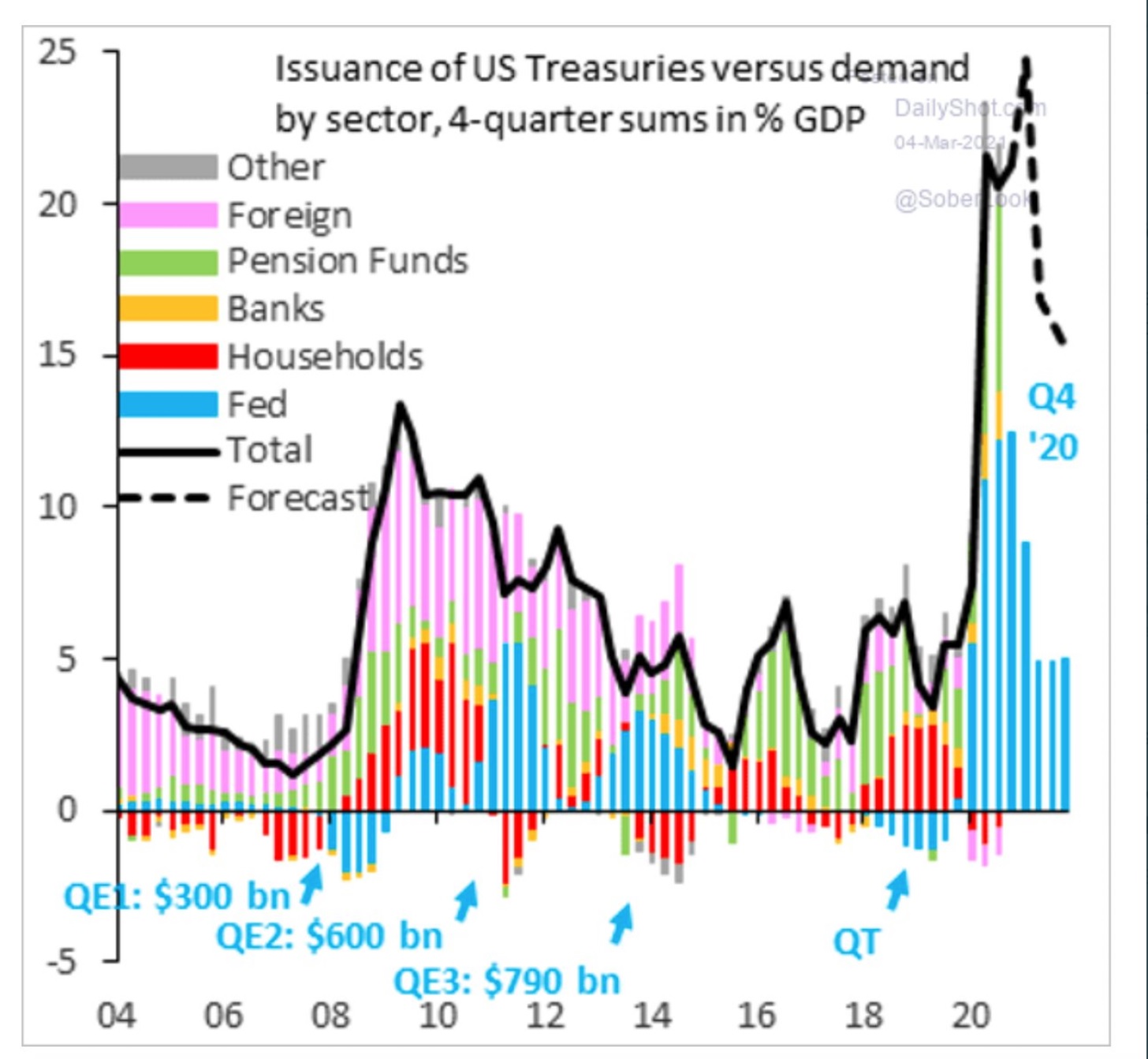

- The fear is that if the SLR reverts back to its previous rules, banks will reduce their Treasury purchases. In fact, banks may be forced to reduce their holdings to comply with SLR rules. This raises questions on who will buy to clear the Treasury markets and at what price (yield).

- One source of demand could be foreigners. Although foreigners have been net sellers recently, recent moves in the dollar have led to favorable hedging conditions.

- Despite opposition from the left-wing populists, the Fed could extend the waiver; that idea is apparently under consideration. The tradeoff might be restrictions on dividends and buybacks.

- A complicating factor is that as relief checks hit accounts as deposits, the corresponding increase in assets (at least initially, in reserves) will further stretch leverage ratios, leading to the paradoxical problem where stimulus leads to banks selling assets (and, given the liquidity in Treasuries, that will likely be the first asset sold), lifting interest rates and unsettling markets. Already, there is talk of banks applying a negative rate to commercial deposits or simply refusing to accept them. Of course, the SLR itself seems unreasonable; it seems odd that a safe asset like Treasuries would be included in a leverage ratio anyway.

- We do expect this situation to be resolved, but it may require a crisis first.

- In anticipation of a change in immigration policy, there has been an influx of migrant children on the U.S./Mexican frontier. The Biden administration finds itself in the middle of controversy on this issue. Left-wing populists are pushing hard for a more open border, but the White House fears that uncontrolled immigration will be a potent political point for the midterm elections. The administration has been slow to overturn Trump-era immigration policies, likely trying to weave a middle road between the left and right. The House will hold a couple of votes this week as a test of what might be possible.

- With the passage of the stimulus bill, the focus has shifted to infrastructure. Given the widening deficit, there is growing talk of tax measures to fund at least part of the spending. It’s not clear to us if this will pass; centrist Democrats know that tax hikes will make reelection difficult in 2022. There has been consideration of a wealth tax; OECD analysis of wealth taxes are that they are mostly ineffective because wealth can move around.

- Companies are still slow to respond to the inevitable end of LIBOR.

- One of the positive surprises is that state and local government coffers have held up during the pandemic. There was great fear, that we shared, that a drop in tax revenue would lead to a situation similar to what occurred in 2010-11, where cuts in state and local government spending more than offset federal spending. So, why did the states do so well? Taxes on pot sales.

- The U.S. is rethinking its cybersecurity policy in the wake of numerous recent failures.

- The Fed meets this week. Although no change in policy is expected, the markets will be watching to see if there is any concern about inflation. We don’t expect any worry to be expressed.

- Florida has been experiencing a flood of outsiders moving in, and former residents moving out. The net result is that the state actually lost population last year. The influx is being driven by the usual goal of retiring to a warmer climate and low taxes; the outflow is being driven by increasing temperatures, a reluctance to deal with hurricanes, and rising home prices.

- In the 1980s, New Zealand led the practice of central banks targeting inflation. The RBNZ may be starting a new trend; the central bank is starting to monitor home prices in formulating policy. For the most part, developed market central banks have studiously avoided using asset prices to set policy. This stance has tended to lead to policies that have fostered asset price inflation. We will be watching to see if this becomes a new trend.

China: CPC meetings are finished; now, we see how the policy is implemented.

- So now that the CPC meetings are behind us, what is the message of the next five-year plan? In a nutshell, self-sufficiency. General Secretary Xi is embarking on a plan of deglobalization to protect China from U.S.-driven isolation. Xi is also seemingly moving China to a war footing.

- China’s economy is doing well, but mostly due to rising investment. Since investment is usually debt-funded, the worry is that growth is being boosted by unsustainable borrowing.

- It is also becoming increasingly clear that Chinese regulators are cracking down on fintech. Part of the reason is a rise in consumer debt, mostly among younger households. The fintech firms make borrowing easy; regulators appear poised to make borrowing more difficult, which may stunt consumption.

- In Europe, there is evidence of concern about Chinese dominance. First, German industry is pushing the EU to take a stronger stance against China’s trade practices. Second, Ukraine announced it was nationalizing Motor Sich (MSICH, UAH, 5298), a firm that makes engines for cargo aircraft and helicopters, in order to prevent the company from being sold to Chinese firm Skyrizon (0941, HKD, 52.00). Skyrizon is on the Commerce Department’s sanction list due to its ties to the Chinese military. It appears the action was taken to avoid problems with Washington.

- Meanwhile, a federal judge has blocked enforcement of the investment ban on Xiaomi (1810, HKD, 24.35), calling the process “deeply flawed.”

- The “five eyes” coalition is actively mining rare earths in Greenland.

- Microsoft (MSFT, USD, 235.75) is investigating if cybersecurity companies with which it collaborates may be leading vulnerabilities to hackers. The company is part of an international consortium of cybersecurity firms, some of which are Chinese.

COVID-19: The number of reported cases is 119,942,311 with 2,655,161 fatalities. In the U.S., there are 29,439,057 confirmed cases with 534,889 deaths. U.S. case counts are the lowest since early October. For illustration purposes, the FT has created an interactive chart that allows one to compare cases across nations using similar scaling metrics. The FT has also issued an economic tracker that looks across countries with high frequency data on various factors. The CDC reports that 135,847,835 doses of the vaccine have been distributed, with 107,060,274 of doses injected. The number receiving a first dose is 69,784,210, while the number of second doses, which would grant the highest level of immunity, is 37,459,269. The FT has a page on global vaccine distribution.

Virology

- The travails of EU vaccine distribution continue. The Netherlands and Ireland have suspended use of the AstraZeneca (AZN, USD, 48.42) vaccine due to blood clotting concerns. EU officials admit that “mistakes were made” in ordering vaccines; the EU seemed more worried about price than quantity and thus is coming up short to meet the needs of the members. The grumbling is rising; Austria’s chancellor made calls to other heads of state to complain.

- In contrast, the Johnson government is scaling up its vaccination efforts.

- Meanwhile, Israeli research shows that the Pfizer (PFE, USD, 34.94) vaccine was 97% effective in preventing illness. Even more importantly, it appears it halts asymptomatic spread, suggesting it grants sterilizing immunity.

- China and Russia have made diplomatic inroads by providing vaccines to the emerging world. The U.S. and Japan are stepping up foreign distribution efforts. However, we note that Indian vaccine producers are warning that U.S. policy is slowing global distribution efforts.

- There have been modest, at best, international efforts to distribute vaccines. For the most part, vaccine nationalism has tended to dominate, even for research. The experience of South Africa shows that this policy, although reasonable, is short-sighted because the lack of vaccinations in the developed world will tend to foster variants of the virus that could be vaccine resistant.

- One of the ways we tried to measure the impact of COVID-19 was to compare it to influenza pandemics. The most recent research tends to suggest that COVID-19 was far more deadly. This analysis potentially resolves a problem in the data; there wasn’t a lot of evidence in the economic data to suggest the 1956 and 1968 influenza pandemics were a big problem. That wasn’t necessarily the case with the 1918 influenza pandemic, but even that one didn’t seem to have a huge effect. The most recent data suggests the COVID-19 virus was more virulent than influenza, and thus, had a greater impact.

- One of the natural experiments we have noted is how Florida has done relative to other states. The Sunshine State had less stringent policies relative to other states, but the performance in dealing with the pandemic appears to be about the same. It is far too early to tell why this was the case, but the performance should give ample data to see what worked and what didn’t.

- In addition, in the emerging world, waves of infections tended to dissipate. It is unclear why this occurred. Again, this will be another area for further analysis.