Daily Comment (March 1, 2021)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EST] | PDF

The fifth and final part in our recent Weekly Geopolitical Report series, “The U.S.-China Balance of Power,” has been published. We also have several other recent multimedia offerings. There is a new chart book recapping the recent changes we made to our Asset Allocation portfolios. Here is the latest Confluence of Ideas podcast. A new Asset Allocation Weekly, chart book, and podcast are also available. The Weekly Energy Update is available. You can find all this research and more on our website.

Good morning and happy Monday! We leave February today with hints of spring in the air. Spring training baseball is underway; if you want to test your knowledge of your favorite team, try to see how many of the players in after the fifth inning you recognize! After a tumultuous week, risk markets are having a positive day so far. There is a plethora of Fed speakers this week, culminating in the Chair on Thursday. Our coverage this morning begins with international news, with our usual China news next. Policy and economic news follow, and we close with the pandemic update.

International news: In watching politics over the years, we note that every new president enters office with plans to make changes. Often, the focus is on domestic policy; since foreigners don’t directly participate in U.S. elections, most platforms focus on the U.S. However, it often happens that foreign problems intervene. President Biden is dealing with a growing set of foreign concerns, which, at a minimum, will act as a distraction for his domestic policy. The Kingdom of Saudi Arabia (KSA), Iran, Myanmar, and Europe are all in the mix this morning.

- Last week, the U.S. released the long-awaited report on the Khashoggi assassination. There were no real surprises in the report; CP Salman was implicated in the action as authorizing the assassination. As a presidential candidate, Biden suggested harsh action against the KSA for the event. However, as president, his restrictions on the KSA have garnered rebukes from his supporters. In fact, it appears the U.S. is even backing away from what has already been proposed. Conducting foreign policy is much more difficult than commenting on it. Commentators don’t carry the costs of reactions. The administration is attempting to sanction the KSA to show that it didn’t approve of the assassination while, at the same time, trying to maintain the anti-Iran coalition that includes the KSA. One of the criticisms of not punishing the KSA hard is that the threat of oil supply disruptions is not as significant due to U.S. production. However, the environmental policies of this administration are designed to reduce that output, meaning that the geopolitical power of the KSA to manipulate oil prices will likely increase in the coming years (although reductions in U.S. consumption should mitigate this in the long run). The bottom line is that the administration is trying to weave a line between signaling to the KSA that behaviors like the Khashoggi assassination are not supported and not damage relations to the point where it would increase instability. Such paths are nuanced and thus rarely popular.

- Iran has refused direct talks with the U.S. over the nuclear issue. With presidential elections due in Iran in June, there is no upside for the current Iranian administration to engage in talks. The same sticking points exist; the U.S. wants Iran to back away from uranium enrichment as a condition of restarting talks. Iran wants sanctions lifted as a precondition for talks. Candidate Biden called for a return to the Obama-era nuclear deal, but conditions have changed, and a return to that agreement is unlikely. Thus, tensions will remain elevated.

- Israel has blamed Iran for an explosion suffered by an Israeli vessel in the Persian Gulf.

- Security forces in Myanmar used live ammunition on protestors over the weekend, killing at least 18. This attack was the first time security forces used deadly force against protestors, a move that suggests the coup leaders are becoming less tolerant of the unrest. The new government has warned foreign embassies against contacting opposition parties.

- Protests in Spain intensified over the weekend. The catalyst was the arrest of Pablo Hasél, a local singer but evolved into an intergenerational protest against the pandemic lockdowns. Young Spaniards, reflecting the sentiment of the younger generations across the West, are rebelling against lockdowns, arguing that the cost of economic collapse is born by young people who are at less risk from the virus, protecting older people who are at greater risk. We will be watching to see if these protests spread.

- Treasury Secretary Yellen signaled that the new administration is planning to drop the “safe harbor” provisions of a digital services tax. Previously, the U.S. insisted on a safe harbor provision that would allow tech companies, who are overwhelming America, from being forced to comply with EU taxes. This change could be significant. It appears to indicate the U.S. will not only stop protecting tech firms but potentially could cooperate with the EU on taxing and regulating them. Although the U.S. may not directly participate in a tax (getting tax increases through Congress can be a challenge), it is worth noting that opposing technology firms is one of the few bipartisan issues in the U.S. legislature. In addition, giving up the safe harbor will give the U.S. some degree of leverage in bringing the EU along to oppose China’s designs on dominating technology.

- The Italian 5Star movement is in disarray and has asked former PM Conte to try to unify the party.

- BREAKING—a French court has convicted President Sarkozy of corruption and sentenced him to a year in prison.

China: Hong Kong and babies are in the news.

- Nearly 50 democracy activists protested at various police stations across Hong Kong. There were arrested quickly and were charged with conspiracy to commit subversion, which could carry a life sentence. We suspect the protestors are hoping that Beijing won’t severely punish such a large number of protestors; this may be a false hope.

- The U.K. has offered a route to citizenship to Hong Kongers that could bring 300,000 people to Britain. It doesn’t look as if the government is prepared for this influx. If it turns out that the U.K. can’t accommodate these people, it will remove an important backstop from Hong Kongers who oppose Beijing’s crackdown.

- China’s population issues are nothing new. The “one-child” policy of the past supported China’s development by reducing its dependency ratio, the ratio of working-age to non-working-age citizens. But, as the population ages with fewer children, China is seeing a rise in the dependency ratio with little hope of improvement other than the demise of the elderly. China’s labor force aged population should shrink by mid-decade. It seems 2020 was a particularly lean year for new births in China. One way China could address its population issue is by reforming Hukou laws that restrict immigration within China. In practice, rural Chinese move to cities all the time, but they don’t get full government support if they leave their cities of origin without permission. This gives Chinese companies a more compliant workforce, but a workforce that sometimes returns home due to family issues. Allowing free movement would give China one more boost before population declines start to hit growth, but free movement undermines CPC control.

- China is seeing an explosion of fintech; regulators are working furiously to corral the expansion of credit.

Economics and policy: Financial markets remain on tenterhooks, watching the bond market. Negative rates in Europe are starting to affect retail depositors.

- The BOJ came out and made it clear it will not tolerate any increase in 10-year JGB’s above 0%. The Reserve Bank of Australia has directly intervened in longer-duration government bonds. In the U.S., we see a standoff developing, one that harkens back to the “bond vigilante” days of the early 1980s. Essentially, long-duration Treasury interest rates have been rising for weeks, currently reaching a point where the rest of the financial markets have taken notice. There are a number of worries emerging.

- One issue, in particular, is the “behind the curve” argument. The Fed is at risk of allowing inflation to rise enough to build inflation expectations, and once that occurs, a repeat of Volcker will be necessary. Is this possible? Yes, but it’s probably farther off than generally appreciated. Memory tends to compress time. Financial repression during WWII mostly stayed in place for 25 years. It was only in the last 15 years that inflation expectations became a serious problem. For baby boomers, the inflation years of the 1970s marked their economic experience, but there is less recognition of how long reflationary policies were in place before they went off the rails.

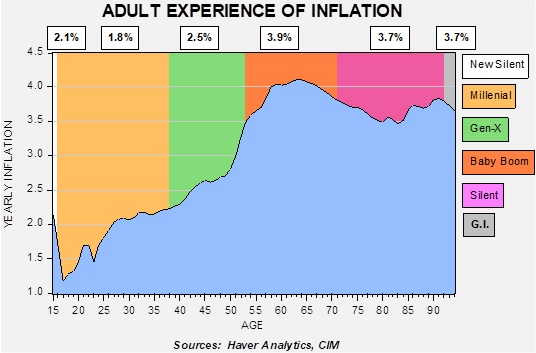

This chart shows the generation experience of inflation. For the most part, the experience of high inflation is restricted to the over 50 years of age group, so the reaction to reflation will likely be less for those younger, meaning that it will take a while for inflation expectations to take hold.

- In the end, as long as the Fed is willing to expand its balance sheet without limit, the Fed can fix the yield curve wherever it wants. We suspect the FOMC loathes to do this because once it does, its independence is lost. Don’t believe the Fed can’t set the rate; it can, as long as it can live with the consequences. But, before we get to full yield curve control, we suspect there will be a series of intermediate steps. For one, we could see the Fed extend rules on bank Treasury buying, which are set to expire at the end of March. We may also need a crisis to trigger yield curve control. But, if the government is going to adopt MMT, yield curve control is probably necessary.

- The use of tax policy to achieve the $15 per hour minimum wage has been abandoned.

- Banks in Germany are starting to apply fees to retail deposits, in effect implementing a negative rate on deposits. The fees apply mostly to large deposits (>€100,000); depositors in Germany are moving deposits to other banks in the Eurozone to avoid the negative deposit rate.

- Congress has approved $25 billion for rental assistance and will add another $20 billion if the current stimulus bill passes. It is unclear if (a) local governments have the staffing to distribute the funding and (b) how much is actually in arrears.

- Automakers are expecting a prolonged chip shortage.

- More department stores are essentially extending credit at zero rates to buyers on “buy now, pay later” plans.

COVID-19: The number of reported cases is 114,217,365 with 2,533,014 fatalities. In the U.S., there are 28,606,224 confirmed cases with 513,092 deaths. In the U.S., deaths, hospitalizations, and infection rates continue to decline. For illustration purposes, the FT has created an interactive chart that allows one to compare cases across nations using similar scaling metrics. The FT has also issued an economic tracker that looks across countries with high-frequency data on various factors. The CDC reports that 96,402,490 doses of the vaccine have been distributed with 75,236,003 doses injected. The number receiving a first dose is 49,772,180, while the number of second doses, which would grant the highest level of immunity, is 24,779,920. The FT has a page on global vaccine distribution.

Virology

- On Saturday, as expected, the Johnson & Johnson (JNJ, USD, 158.46) vaccine was approved for emergency use. This is a single-shot vaccine with easier distribution characteristics, which should increase vaccinations.

- As research on the origins of COVID-19 continues, the growing consensus is that it came from a mutation in wildlife.

- The U.K. has identified six cases of the Brazilian strain of COVID-19 in the country.

- Russia has introduced its Sputnik V vaccine in areas it controls in Ukraine and Georgia, undermining the sovereignty of these nations.