Daily Comment (March 8, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EST] | PDF

Good morning! Equities are off to a blazing start today, fueled by a stellar jobs report. Adding to the excitement, Phoenix secured its place as the host city for next year’s NBA All-Star Game! Today’s Comment delves into central bank views on the economy and interest rates, why gold is still king, and the regulatory challenges facing Big Tech giants. We’ve also got a comprehensive roundup of international and domestic news to keep readers informed on the latest developments.

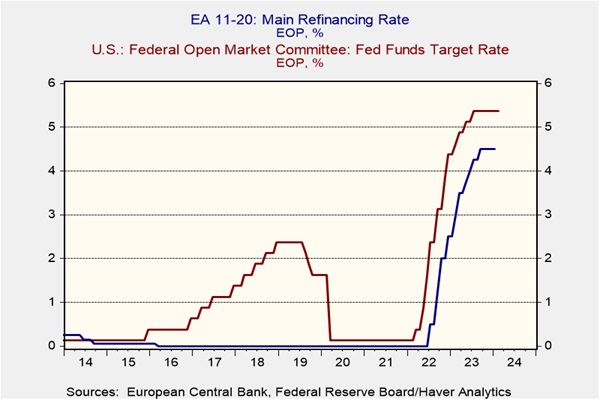

Together but Different: While the European Central Bank (ECB) and Federal Reserve agree on interest rate cuts in 2024, their stances diverge on economic health and financial stability.

- The heads of the two central banks recently spoke publicly to offer their perspectives on the future of policy and the economy’s condition. ECB President Christine Lagarde announced the bank will maintain its current policy, keeping the benchmark interest rate at 4.0%. Similarly, Fed Chair Jerome Powell, testifying before the Senate Committee, signaled the Fed won’t rush rate cuts at their next meeting. However, both central bankers anticipate inflation subsiding later this year, with markets pricing in the first rate cut potentially happening in June.

- Despite their shared focus on inflation, Christine Lagarde and Jerome Powell offered contrasting views on the economic outlook. Lagarde, reflecting the eurozone’s current struggles, took a cautious approach. She acknowledged surveys suggesting a later-year bounce but highlighted existing economic weakness. Conversely, Powell struck a more optimistic tone, emphasizing sustained and healthy growth in the US economy. He even expressed confidence in the Fed’s ability to handle a potential commercial real estate crisis. Interestingly, while Lagarde hasn’t addressed commercial real estate directly, ECB Vice President Luis de Guindos has raised concerns about its potential impact on financial stability.

- Although usually in sync on policy decisions, the ECB and the Fed might diverge this time around. A slowing economy and worries about the commercial real estate market are pushing the ECB toward considering looser monetary policy. An April rate cut is even on the table if current trends hold. Historically, the ECB has preferred a more accommodative stance, likely aiming to keep the euro weaker relative to the dollar to boost exports. However, deep cuts are unlikely from either central bank this year as both remain concerned about the persistent threat of inflation.

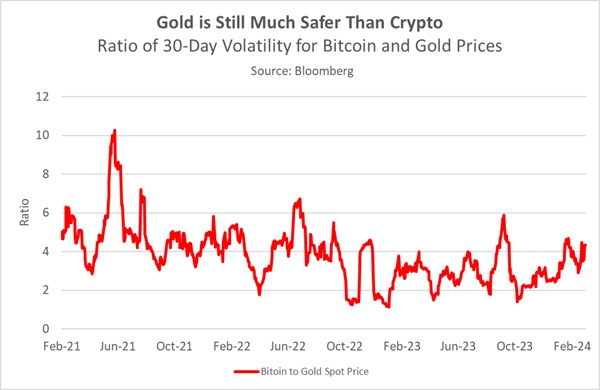

Flight to Safety: Gold and Bitcoin soar as investors seek safe haven amid rising uncertainty.

- Gold prices have surged 5% in the past month, fueled by a buying spree from China. The Asian nation has become the world’s largest gold purchaser, partly driven by its central bank’s strategy to diversify reserves away from the US dollar. This diversification allows China greater flexibility in conducting trade and potentially mitigating sanctions, especially as it seeks to strengthen economic ties with Russia. Increased trade between these two countries benefits both as China boosts its exports, while Russia gains access to essential imports.

- Gold’s resurgence as a safe-haven asset faces a unique challenge—the rise of Bitcoin. While gold regains investor interest, the most popular cryptocurrency has surged 51.5% in the last 30 days. This digital asset’s popularity is partly fueled by potential applications in traditional finance, like the SEC considering its use in options trading. However, Bitcoin’s high volatility casts doubt on its reliability as a store of value. As the chart below shows, Bitcoin is about four times as volatile as gold prices, indicating it may be a riskier option for long-term investors.

- The choice between gold and Bitcoin might hinge on age. Younger investors, comfortable with technology, may embrace the potential of digital assets like Bitcoin. Older generations, valuing stability, might favor the established security of physical gold. Gold boasts advantages; its tangibility and long history as a store of value inspire greater trust among some. Bitcoin, however, faces regulatory uncertainty and limited mainstream adoption, reflected in its lower trading volume compared to traditional financial instruments. It’s essential to conduct thorough due diligence before venturing into this asset class as cryptocurrencies are still susceptible to significant price corrections.

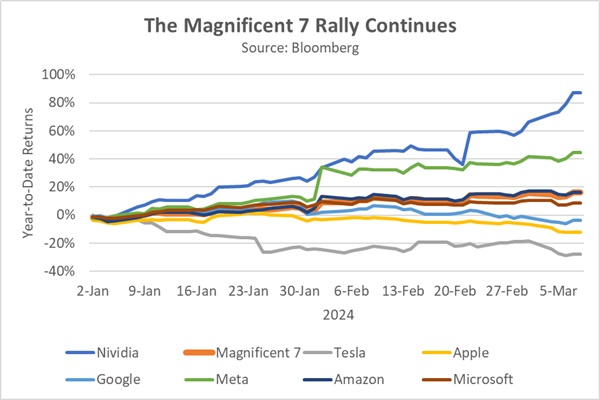

Tech’s Regulatory Dance: Geopolitical tensions are fueling growing concerns from US lawmakers about the expanding influence of Big Tech.

- House Majority Leader Steve Scalise (R-LA) is poised to introduce a bill that could force TikTok’s parent company ByteDance to divest the popular video-sharing platform due to national security concerns. The House Committee on Energy and Commerce unanimously approved the measure (50-0) on Thursday, propelling it closer to a vote on the House floor. This push to restrict access to TikTok, a favorite app among Gen Z, stems from anxieties that the Chinese government could be using it for surveillance and propaganda purposes. If ByteDance refuses to sell TikTok, the legislation could lead to a nationwide ban.

- In the wake of congressional restrictions on TikTok due to national security concerns, speculation is rising that similar actions could target generative AI. This is being underscored by the European Parliament, which is poised to pass legislation on March 13 regulating AI based on potential risks. For instance, the law would ban the use of AI for “emotion recognition” systems in workplaces. Importantly, this legislation applies to any provider or developer whose products enter the EU market, meaning US companies will also be impacted. Although the US is considering its own AI legislation, it has not formally introduced a bill to regulate its use.

- Escalating tensions, particularly between the US and China, threaten to ensnare major tech companies in a global regulatory web. Their vast international presence makes them especially vulnerable to a shifting regulatory landscape. Western companies could face the brunt of this, with increased restrictions inflating development costs and limiting access to crucial foreign markets. China’s push for self-sufficiency in key components like semiconductors further complicates the picture. For investors, this environment suggests a need for diversification. Investors may consider broadening their portfolios beyond traditional tech giants and exploring sectors with stronger fundamentals that are less susceptible to geopolitical headwinds.

In Other News: In his State of the Union address, President Joe Biden championed a call for increased taxes on billionaires and corporations, marking a notable shift toward a more populist stance. The US embassy warned of an extremist attack in Moscow, another sign of growing geopolitical risks. There is growing speculation that the Bank of Japan could tighten monetary policy in March.