Daily Comment (March 7, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EST] | PDF

Good morning! Stocks are rallying this morning as investors gain confidence in the possibility of central banks lowering interest rates later in 2024. On the sports front, Real Madrid secured a hard-fought victory against RB Leipzig, advancing to the Champions League quarterfinals. Today’s Comment begins with our thoughts on the financial system following Fed Chair Powell’s testimony before Congress. We also include an analysis of the current state of the labor market and explore why emerging economies, particularly Turkey, have recently captured investor interest. As usual, our report concludes with a round-up of international and domestic data.

Financial System Focus: Banks take the spotlight as the Fed chair testifies before Congress, while New York Community Bank seeks a lifeline.

- In a surprise move on Wednesday, Federal Reserve Chair Jerome Powell announced that regulators intend to ease some of the stricter banking requirements introduced under the Basel III framework. This shift in policy follows complaints from Wall Street that the regulations could limit lending to businesses and consumers. However, the claims remain fiercely contested. Powell’s comments suggest the Fed might be aiming to avoid a major regulatory overhaul during a volatile election year. The issue is highly partisan, with Democrats advocating for increased bank regulations, while Republicans lean toward looser regulations.

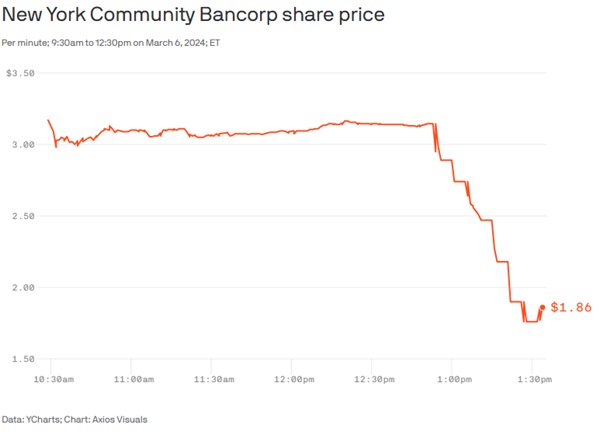

- At the same time, New York Community Bank is seeking to shore up investor confidence. The struggling commercial lender secured a much-needed $1 billion equity investment led by a group that includes former Treasury Secretary Steven Mnuchin. This significant cash infusion aims to alleviate concerns about NYCB’s ability to weather potential losses, stemming from revelations of inadequate internal controls that exposed the bank to riskier loans than previously reported. The company’s stock price surged by 7.45%, reaching $3.46 per share following the announcement. Nevertheless, this increase only partially mitigates previous losses, thus leaving the stock price still considerably below its starting level at the beginning of the year.

- Despite significant uncertainty in the US regional banking system, investor confidence remains somewhat resilient. The KBW Nasdaq Regional Banking Index, while down nearly 8.5% year-to-date, has shown mixed performance since the NYCB issues surfaced. Homestreet Bank, another bank facing scrutiny, has also seen its stock hold steady recently. However, the lack of immediate changes to capital requirements offers a positive sign, particularly as banks prepare for a potential rise in loan defaults as repayments come due in the coming months. Therefore, we do not see any evidence of a possible financial crisis at this time.

Labor Softening: Even though labor markets remain tight, there are signs that employers might be hitting the brakes on hiring.

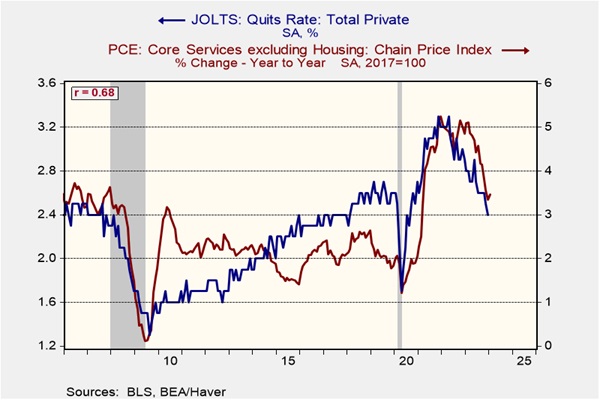

- A recent JOLTS report indicates a decline in job listings by US employers. January saw a drop in job openings from 8.89 million to 8.86 million, the lowest level in over three months. This significant decrease in job postings reflects a broader trend within the labor market, where employers are reevaluating their workforce needs. The ongoing uncertainty regarding job security likely contributes to the persistently low quit rates. At 2.1%, the quit rate remains below pre-pandemic levels, suggesting a lack of confidence among workers in their job prospects.

- A weakening labor market could signal a return to a more balanced relationship between employment and inflation. This aligns with the historical trend of PCE Core Services excluding housing, a measure sensitive to wage pressures, tracking closely with quit rates. Fewer worker resignations likely translate to a gradual decline in overall inflationary pressures. However, this trend could exacerbate if businesses continue to grapple with passing higher costs onto customers, as highlighted in the latest Fed Beige Book. The resulting profit squeeze may impede firms’ capacity to retain employees.

- This Friday’s jobs report will likely provide more clarity on the health of the labor market. While the latest estimate projects the creation of around 200,000 jobs in February, this represents a slowdown compared to the robust 350,000 increase seen in the previous month. We will be paying close attention to the prior month’s data revisions as these often provide valuable insights into underlying trends. Three consecutive months of downward revisions could signal potential labor market troubles. While the previous report did see upward revisions, it’s worth noting that downward revisions were more common throughout 2023, suggesting potential limitations in capturing the complete economic picture.

Emerging Markets En Vogue: Emerging market equities have defied expectations, posting strong gains in the year’s first quarter despite lingering concerns about high interest rates and a potential global slowdown.

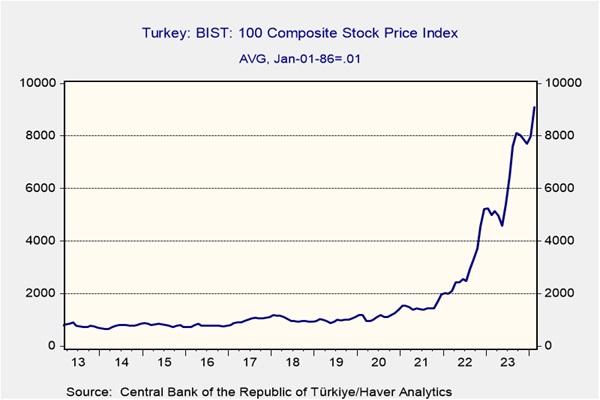

- Fueled by a surge in its technology sector, Turkey has become a leader in the recent emerging market rally. The sector’s growing prominence has captured significant investor attention, propelling Turkey’s benchmark Borsa Istanbul 100 Index up nearly 20% year-to-date. Notably, the technology sector itself has skyrocketed over 60%. This performance aligns with a broader trend of investors seeking undervalued stocks outside the US to capitalize on the global tech investment boom. However, Turkey’s case is unique in that it also seems to be attracting domestic investors seeking a hedge against inflation.

- Turkey’s booming tech sector has fueled its impressive performance in the emerging market rally. However, some uncertainties cloud this optimistic outlook. The upcoming municipal elections in March presents a hurdle as these elections are seen as a test of Erdoğan’s popularity in the country. A strong victory for Erdoğan’s party could raise the prospect of a constitutional change to extend his rule. Additionally, this could complicate efforts from the opposition to field a strong candidate for prime minister in the next election, potentially impacting investor confidence in Turkey’s long-term ability to undertake much-needed economic structural reforms.

- Turkey’s case exemplifies the growing interest in emerging markets as investors seek attractive valuations and potentially higher yields. This trend could be further amplified by a potential decrease in US interest rates, weakening the dollar against other currencies. As a result, countries like Poland, Mexico, Vietnam, Indonesia, and Morocco, often viewed as bridge economies due to their strong trade ties with both the US and China, could become attractive destinations for investors seeking to diversify their portfolios and mitigate risks associated with a US-China trade war escalation.

Other News: The European Central Bank (ECB) kept its interest rates unchanged but hinted at the possibility of a reduction later in 2024. This move aligns with market expectations of central banks adopting more dovish stances. Meanwhile, President Biden proposed a moderate 1% increase in defense spending for 2025, falling short of expectations as concerns over the debt ceiling resurface.