Daily Comment (March 6, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EST] | PDF

Our Comment today opens with a discussion of the European Union’s proposed new defense industrial strategy, which is designed to boost the region’s ability to produce weapons, military equipment, and ammunition. We next review a wide range of other international and US developments with the potential to affect the financial markets today, including a surprise financial reform in debt-ridden Egypt and a preview of Federal Reserve Chair Powell’s testimony before Congress today.

European Union: The European Commission yesterday released its defense industrial strategy, which constitutes its plan for shifting the EU economy to a war footing in the face of potential Russian aggression. The plan includes multiple steps aimed at expanding and shoring up the EU’s defense industry base so that it can produce more military supplies. For example, the plan calls for more joint purchases of weapons and ammunition, new subsidies to expand defense industry capacity, and new authorities to compel firms to prioritize EU defense orders in crisis.

- The plan is a response not only to Russia’s increasing territorial ambitions, but also to concerns that former US President Trump could stop the US from meeting its mutual defense obligations to the North Atlantic Treaty Organization if reelected in November.

- Nevertheless, it isn’t clear that the plan will get the required unanimous approval of all 27 members of the EU. Many national leaders are wary of a potential power grab by Brussels and would prefer to keep defense procurement and overall policy as a national prerogative. National leaders are also wary of the potential cost of the plan.

- The plan calls for the EU to support it with €1.5 billion (about $1.63 billion) through 2027.

- However, EU officials have floated the possibility of eventually providing some €100 billion (about $109 billion) to finance the plan. That sum would likely require some kind of joint bond issuance and/or tax hikes.

- We would note that many EU countries are already boosting their defense budgets. As we predicted more than a year ago, the bulk of their procurement spending recently has gone to US defense contractors. One risk for those US firms is that a successful expansion of the EU defense industry base could result in a loss of sales.

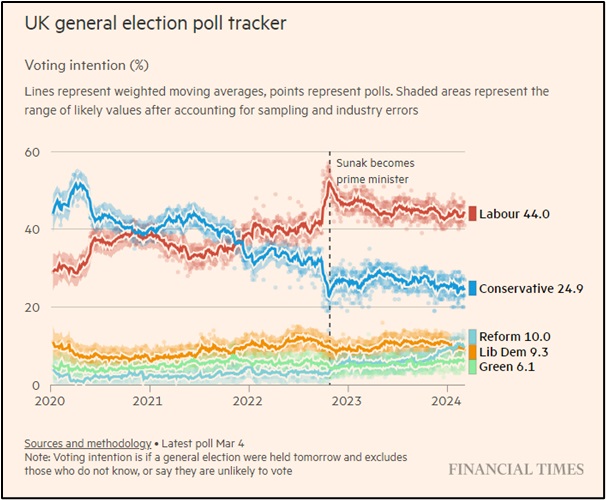

United Kingdom: Chancellor Jeremy Hunt today released the government’s proposed budget for the coming fiscal year, with multiple tax and spending initiatives designed to help the ruling Conservative Party turn around its dismal polling ahead of elections this autumn. The proposals so far include a 2% cut in required payroll contributions to the National Insurance scheme and an announcement that the government will buy land for large, new nuclear power plants and solicit bids to build small modular nuclear reactors to boost the country’s energy supply.

Egypt: President Al Sisi’s government today unexpectedly announced a series of financial reforms long demanded by the International Monetary Fund to help the country manage its massive foreign debt. Among the key reforms, the government allowed the currency to float and hiked benchmark interest rates. The currency swiftly lost more than half its value, which will likely boost Egyptian price inflation, but the move could help unlock an IMF rescue package and avert a potential default down the line.

Venezuela: The government said it will hold a presidential election on July 28. Authoritarian President Maduro has not announced his candidacy for a new term, but he is widely expected to do so. And of course, given the government’s stranglehold on political power and its practice of disqualifying any viable opposition candidates, Maduro would be expected to win. The rigging of the electoral system will likely maintain Venezuela’s pariah status and continue to exacerbate tensions with the US, just as its recent territorial threats to Guyana have done.

China-Philippines: Chinese and Philippine coast guard vessels once again collided yesterday in the South China Sea around the disputed Second Thomas Shoal. In response, Beijing accused the Philippines of deliberately ramming its vessel, while Manila accused the Chinese vessel of “reckless and illegal” behavior.

- The Wall Street Journal today carries a fascinating article about what it’s like for the crews on the Philippine ships being harassed by the Chinese. The article includes a video of how the Chinese coast guard vessels use heavy-duty water cannon to force the Philippine vessels away from the area.

- We continue to believe that the frictions between China and the Philippines are a key risk for investors, especially since any outbreak of fighting between the countries could draw in the US because of its mutual defense treaty with Manila.

Chinese Stock Market: Sharmin Mossavar-Rahmani, the chief investment officer at Goldman Sachs Wealth Management, said in an interview with Bloomberg that she could not advise clients to buy Chinese stocks, despite the government’s recent success in stabilizing stock prices and touching off a modest recovery. According to Mossavar-Rahmani, Chinese stock values are likely to be held back by structural problems such as moderating economic growth, opaque policymaking, and doubts over the authenticity of economic data.

- As our regular readers know, we think Chinese stock prices will also continue to be hurt by worsening tensions between the US and the China/Russia geopolitical blocs.

- The statement from Mossavar-Rahmani illustrates how major Wall Street investment firms and big investors are coming around to our view of the headwinds facing Chinese stocks.

- The statement also echoes a 2022 report from JPMorgan Chase that called Chinese technology stocks “uninvestable” before retracting the statement later, possibly under Chinese pressure.

US Politics: In yesterday’s Super Tuesday presidential primary elections, former President Trump won in 14 of the 15 states holding Republican contests, with former UN Ambassador Haley winning in Vermont. By our calculation, Trump won about 72% of the votes in the Republican ballots, with Haley taking about 28%. Meanwhile, President Biden won in all 15 states holding Democratic contests, pulling in an average of 89% of his party’s voters.

- With Trump’s victories to date leaving him on the cusp of clinching the Republican nomination, Haley this morning will reportedly suspend her campaign. However, sources say Haley won’t yet endorse Trump. Instead, she will at least temporarily withhold her endorsement in an effort to encourage Trump to respond to the interests and concerns of her supporters.

- While it certainly looks like Biden and Trump will be the official candidates in the November election, this campaign still has the potential to turn volatile. For example, the advanced age of each candidate alone suggests that either or both could drop out before the November balloting. We could also see the emergence of a third-party candidate (potentially even Haley). And in any case, if no candidate wins enough electoral votes, the decision could be thrown to the House of Representatives.

US Monetary Policy: Federal Reserve Chair Powell today begins his semi-annual testimony to Congress with an appearance at the House Financial Services Committee. Early indications are that he will assure lawmakers that the central bank is on track to cut interest rates this year, but it will not move until it is sufficiently confident that price pressures have fallen and won’t rebound. Powell will speak before the Senate Finance Committee tomorrow.

US Financial Markets: The Securities and Exchange Commission has signed off on a new type of security backed by royalty streams from songs recorded by such artists as Taylor Swift, Beyoncé, and even Stevie Wonder. The securities, offered by start-up firm JKBX and designed for everyday investors, are essentially bonds backed by the royalties from hit songs. It’s not clear yet whether the new securities will be a hit with investors.

US Military: The US Air Force published images of an operational hypersonic missile, the “Air-Launched Rapid Response Weapon” (ARRW), loaded onto a B-52 bomber at Guam. The Air Force has said the ARRW is a test weapon not intended for large-scale procurement, but showing the missile deployed at one of the US’s main Western Pacific bases is thought to be a message to China of US capability in this cutting-edge type of weapon. We take this as further evidence of US commitment of resources to high-tech weaponry and a broader defense build-up.