Daily Comment (March 5, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EST] | PDF

Our Comment today opens with a discussion of the fiscal challenges faced by Western governments as they look to rebuild their defenses in the face of increased threats from countries like China and Russia. We next review a wide range of other international and US developments with the potential to affect the financial markets today, including a new economic growth target in China and research pointing to more US companies tapping the convertible bond market.

Global Fiscal Policy: In a recent interview with the Financial Times, Danish Prime Minister Mette Frederiksen castigated European governments that slashed their defense spending after the end of the Cold War and then remained far too complacent about the growing threat from Russia in recent years. Importantly, Frederiksen warned that hiking defense budgets as necessary now will require countries to reverse the tax cuts and welfare spending hikes they funded with their post-Cold War defense budget cuts.

- As our regular readers know, we at Confluence believe the intensifying rivalry between the US and China/Russia geopolitical blocs will lead to bigger defense budgets in many countries in the coming years. To put it another way, the Western nations that cut their defense spending so dramatically following the end of the Cold War and happily spent the resulting “peace dividend” on civilian programs may now need to reverse course.

- We have argued that growing geopolitical tensions will likely lead to stronger government intervention in Western economies. Frederiksen’s warning is one of the first in which a top Western leader has been willing to state the trade-offs so clearly: Hiking defense budgets as required now may well require tax hikes and civilian spending cuts.

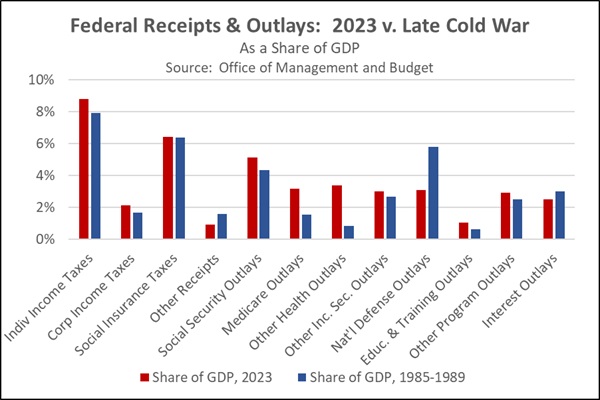

- How would this look? To start scoping out the prospects, we conducted a quick analysis of how the US federal budget would look in an environment like the late Cold War. In the chart below, we show the Office of Management and Budget’s estimated fiscal year 2023 federal receipts and outlays as a share of gross domestic product and compare them to their average shares of GDP in 1985-1989.

-

- The chart clearly suggests the enormous drop in US defense spending since the Cold War has been absorbed mostly by increased outlays on Medicare, Medicaid, and other healthcare, along with Social Security retirement benefits. That likely reflects the aging of the US population and rampant healthcare price inflation.

- If US leaders now wanted to boost the defense budget back to the late-Cold War average of 5.8% of GDP from today’s 3.1% of GDP (to about $1.5 trillion from today’s $815 billion), we think political considerations would likely count out any substantial cuts to Social Security, Medicare, and Medicaid outlays.

- The problem is that other civilian outlays today are not much higher (as a share of GDP) than they were in President Reagan’s second term. Even if they were cut to their share of GDP in 1985-1989, the savings would cover less than half of the required $708 billion hike in defense spending.

- That suggests unpalatable tax hikes of some $400 billion might be needed to bring defense spending back to late-Cold War norms. And these outlay cuts and tax hikes wouldn’t even address the $605 billion reduction in the deficit to bring it back in line with its average of 3.7% of GDP in 1985-1989.

European Union: The European Parliament last night gave preliminary approval to a bill that aims to reduce packaging materials for consumer products. If signed into law, for example, the bill could lead to hotel mini-toiletries and single-use plastic wraps to be banned by 2030. Many paper and cardboard packaging products were spared by intense industry lobbying, but the law will nevertheless probably become another symbol of excessive EU regulations that could be discouraging investment and growth in the region.

Chinese Economic Policy: At the formal opening of the National People’s Congress today, Premier Li Qiang said the government will target economic growth of “about 5%” in 2024, helped by issuing some $139 billion of special, ultra-long-term government bonds to help relieve fiscal pressure on provincial and local governments and investing in high-priority sectors. The target for growth in gross domestic product is the same as last year’s, but analysts believe the target will be harder to achieve because of China’s accumulating structural headwinds.

- We tend to categorize China’s intensifying headwinds as: Weak consumer demand, excess capacity and debt, poor demographics, foreign decoupling, and disincentives from the government’s intrusive economic policies. We think those forces will continue to hold down Chinese growth in 2024, although the government’s recent effort to boost the stock market has helped push Chinese stock prices higher for now.

- Separately, Li’s economic work report also calls for China’s military budget to expand by 7.2% this year, matching the increase in last year’s official budget. However, Li provided no detailed breakdown of the defense spending plan, prompting the Japanese government to complain about the lack of transparency.

Chinese Economic Growth: The February Caixin purchasing managers’ index for the services sector declined to a seasonally adjusted 52.5, down from 52.7 in January. Like most major PMIs, the Caixin indexes are designed so that readings over 50 point to expanding activity. Even though the February figure suggests the Chinese services sector is still growing, the number is now at its lowest since November. We believe that illustrates the continued weak momentum in the Chinese economy.

Japan: The Jibun Bank February PMI for the services sector fell to a seasonally adjusted 52.9 from 53.1 in January. Again, as with most major PMIs, the Jibun indexes are also designed so that readings over 50 indicate expanding activity. The February reading signals that Japan’s services sector has now been growing for a year and a half, despite the small drop last month. In other data today, the Tokyo region’s February consumer price index excluding fresh food was up 2.5% from one year earlier, accelerating from a rise of 1.8% in the year to January.

- Taken together, the data point to further strength in the Japanese economy and consumer price pressures.

- That, in turn, will likely keep the Bank of Japan on track to soon exit its negative interest rate policy.

South Korea: The government’s biennial ranking of countries by technological development found that China’s overall score has pulled ahead of South Korea’s for the first time. Taking US development in key economic sectors as the baseline, the study put the European Union at 94.7% of the US level in 2022, while Japan was at 86.4%, China was at 86.2%, and South Korea was at 81.5%. Since being overtaken by China is seen as a national humiliation, the results are expected to intensify the government’s US-style effort to crack down on technology flows to China.

Haiti: In what appears to be an effort to oust Prime Minister Ariel Henry, armed gangs in recent days have attacked police stations, stormed prisons, and freed about 5,000 inmates. Widespread rampages and violence are reportedly continuing today. The prime minister has been in Africa trying to secure a United Nations peacekeeping mission for the country, and his whereabouts are reportedly unknown.

US Politics: Today is Super Tuesday, with presidential primary elections and other balloting in 15 states across the country. Former President Trump is expected to win enough votes to come very close to clinching the Republican nomination, but he isn’t expected to win it outright today. One key question is therefore whether Former UN Ambassador Haley will keep fighting. President Biden is naturally expected to win the vast majority of Democratic votes and eventually clinch his party’s nomination.

- Separately, interesting new reporting by Axios and The New Yorker indicate that Biden is pushing his campaign staff for a much more aggressive approach than the traditional “Rose Garden” strategy often adopted by sitting presidents.

- Biden is reportedly pushing for a strategy in which he would actively goad and taunt Trump on a near daily basis, hoping to take advantage of Trump’s perceived lack of discipline and make him “go haywire in public.”

- The strategy, if implemented, would also aim to show Biden as a spirited fighter, taking some focus off his age.

- The reporting suggests that the presidential election campaigns could get nastier and more chaotic than we’ve seen so far.

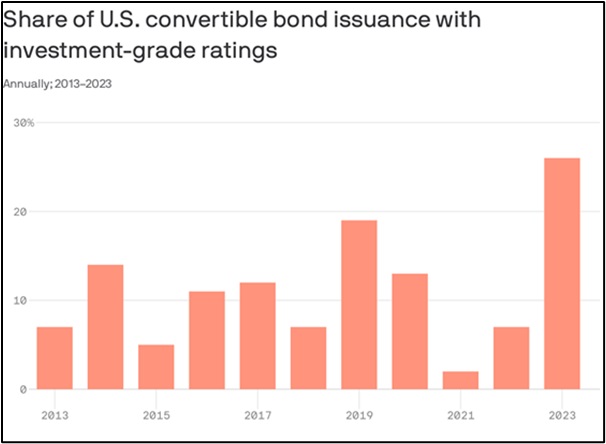

US Bond Market: New analysis from BofA Global Research shows that the share of new convertible bonds issued by companies with investment-grade ratings has surged in the last year. Investment-grade deals made up 26% of convertible deals in 2023, up from 7% in 2022 and just 2% in 2021. Since the opportunity to convert to equity is a powerful sweetener, convertible debt typically comes with relatively low interest rates. The surge in investment-grade convertibles is a reflection of how companies are trying to cut their interest expenses in today’s high-rate world.