Daily Comment (March 3, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EST] | PDF

Today’s Comment begins with our thoughts on the Fed’s overreliance on economic data to dictate policy. Next, we review signs that interest rates are finally starting to weigh on the economy. We end the report by discussing the ongoing feud between Brazilian President Luiz Inácio Lula da Silva and his central bank.

Market Choppiness: Noisy economic data and conflicting views from central bankers have made it difficult for investors to parse out the future path of policy rates.

- Fed officials refuse to commit to future rate decisions. On Thursday, Federal Governor Christopher Waller and Atlanta Fed President Raphael Bostic offered conditional support for maintaining the current policy path. Bostic stated that he would prefer a 25 bps rate hike in March, while Waller argued that a peak rate between 5.1% and 5.4% would make sense if inflation cools. These estimates are roughly in line with the latest Fed dot plot. However, both officials have argued for higher rates if inflation begins to reaccelerate. Their comments led to a sharp, but likely temporary, jump in the S&P 500 yesterday as investors reacted positively to Fed officials not ruling out a pause before the end of the year.

- Economic statistics are still distorted due to pandemic-related anomalies. For instance, labor hoarding and delays in termination have made employment data look good on the surface. Last month’s blockbuster 517k jobs number was elevated due to seasonal adjustments related to fewer layoffs than in a typical January. Meanwhile, many tech job cuts are slated to take effect in March, meaning that they won’t show up in the employment report until the following month. The lack of accuracy in the data suggests that the Fed may be slow to react to real-time changes in the business cycle.

- As a side note, markets will be closed when April’s job report is released, since it falls on Good Friday. Coincidence? We think not.

- The Fed wants to keep its options open when deciding future policy. It may fear that if it stops hiking too soon, inflation expectations could become unanchored. Although the Fed’s position is understandable, it puts investors in an awkward position as they await a signal that it is a good time to jump back into the market. So far, investors have allocated a record $4.8 trillion of their funds to money market accounts. The elevated level of cash holdings should fuel a strong rally toward the end of the year. In the meantime, we expect Fed policy uncertainty to keep equities relatively stagnant in the short-term and possibly even the medium-term.

Tightening Pain: A strong start to the year has overshadowed underlying problems within the U.S. economy

- The housing market is firmly in contraction. Data from Redfin has shown that U.S. home sale prices had their first annual decline in over a decade. The average sale price for a home fell 0.6% from the prior year in the final four weeks ending February 26. The price declines come as higher mortgage rates hinder home affordability for new home buyers. Although homebuilders reported higher confidence in the housing market in February, it was largely based on the idea that financial conditions would continue to ease. However, the upward movement of 10-year Treasury yields above 4% will likely dent hopes of a sudden resurgence in the demand for homes.

- Meanwhile, high lending rates have also hurt the auto market. Car prices have slumped over the last few months due to higher inventory and weaker demand. The decline in auto value has increased the number of car owners with negative equity in their vehicles, which will make it harder for households to get out of debt and could sap future vehicle demand. Additionally, those who bought cars at peak demand in 2021 may be incentivized to stop making payments. The resulting defaults and repossessions could flood the used car market, possibly exacerbating the decline in auto prices.

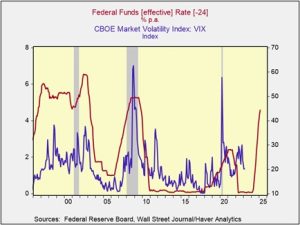

- The U.S. economy’s resiliency has bolstered optimism that the Fed may be able to avoid a hard landing. The ability of the financial system to avoid the blowback from the crypto fallout, thus far, has added to this confidence. However, there are reasons to be worried that the Fed has overplayed its hand. The housing and auto markets are two areas where we notice trouble lurking, but we also believe that traditional indicators may be masking trouble. For example, the CBOE Volatility Index (VIX), also known as the fear gauge, remains below its complacency level of 20 despite the recent pull back in equities and the rise in bond yields.

Lula Headaches: The new Brazilian president is having trouble achieving his objectives to boost living standards and reduce poverty.

- The Brazilian economy contracted in the final three months of the year. Gross domestic product fell 0.2% in Latin America’s largest economy with weak services and shrinking industrial output driving the quarterly decline. Mining remained the bright spot in the report, as oil production prevented a deeper decline in industrial activity. High-interest rates may weigh on economic activity further throughout the year as the Central Bank of Brazil tries it best to return inflation to its 3.25% target.

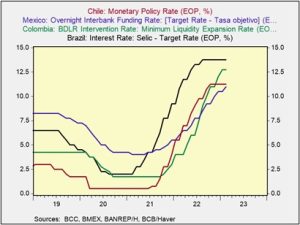

- Brazil was among the first and most aggressive central banks to hike its benchmark policy rate. At 13.75%, it currently has the second-highest policy rate out of the top five Latin American economies, trailing only Argentina. Elevated interest rates have angered Lula, who believes the Central Bank of Brazil policies will prevent him from realizing his campaign pledges. He has blamed Central Bank Chief Roberto Campos Neto for the economic slowdown. To Lula’s credit, Campos Neto has voiced concerns that the new government’s spending plan could undermine the central bank’s progress in fighting inflation.

- We will be paying close attention to the ongoing spat between Lula and the Central Bank of Brazil. Campos Neto has vowed to finish out his term as the head of the central bank, which is set to expire in December 2024. However, his ongoing feud with Lula and his left-wing allies threatens the central bank’s credibility. It has been speculated that the government could raise the inflation target to a higher level to pressure the central bank to begin easing policy. That said, any extreme move by the government to impact the central bank authority will likely negatively impact the Brazilian real (BRL).