Daily Comment (March 28, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Note to readers: the Daily Comment will not be published tomorrow due to the Good Friday holiday.

Good morning! While equities are showing a muted reaction to the revised GDP figures, we are celebrating the start of the MLB season. Today’s Comment dives into the rationale behind why investors shouldn’t overlook large-cap stocks. Additionally, we explore how central bank caution has supported the dollar, while shedding light on the factors contributing to the remarkable ascent of the Mexican peso, which has emerged as one of the top-performing currencies globally. As usual, the report includes a summary of domestic and international data releases.

Not Like the Rest: Hopes for Fed rate cuts and the froth in AI stocks fueled risk-on sentiment in Q1; however, this may not carry over into next quarter.

- Fueled by AI optimism and dovish monetary policy expectations, the S&P 500 surged 10% in Q1, its fastest year-to-date rise since 2019. Policymakers’ promises of rate cuts and tech companies’ defiance of expectations fueled this growth. However, recent headwinds threaten to stall this momentum. Fed officials, like Governor Christopher Waller, have grown cautious, downplaying the possibility of imminent cuts due to strong economic data. Additionally, concerns mount that tech valuations are stretched, potentially jeopardizing their outperformance streak. These mounting doubts raise the specter of whether these trends will be able to hold going into the next quarter.

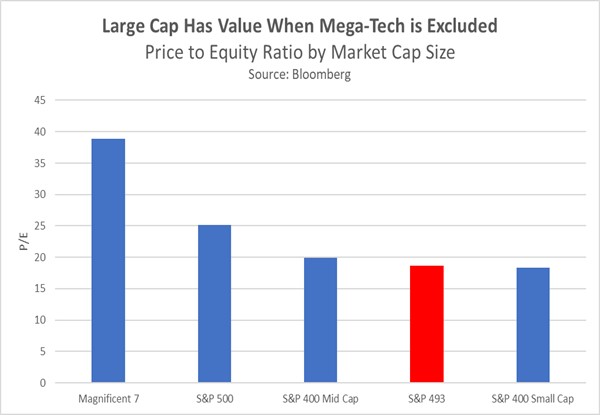

- The market may experience volatility in the next quarter due to a confluence of factors. The Federal Reserve’s monetary policy decisions will be heavily influenced by upcoming employment data. Another strong payroll report, if it exceeds expectations like the recent ones, could lead policymakers to reevaluate their plan for interest rate cuts, potentially reducing the anticipated number to just two for the year. Additionally, investor sentiment is shifting as they look beyond the Magnificent Seven (M7) stocks, whose valuations are reaching expensive territory, and seek safer alternatives.

- The narrow leadership in the market’s 2024 rise suggests a Q2 pullback in momentum is more probable than a correction, absent a significant macroeconomic shock. That said, investors may be able to find value in large-cap companies outside the M7. Excluding those large-cap companies, the index has a P/E ratio of just under 19, which is right in line with historical averages. Given their size, those large-cap firms are relatively well-positioned to absorb changes in Fed policy compared to their mid- and small-cap counterparts and would likely benefit if the Fed follows through on its easing plans.

The Dollar Is Back! The greenback has roared to its strongest quarter in two years, as a shift in market expectations for central bank policy bolstered the dollar’s value.

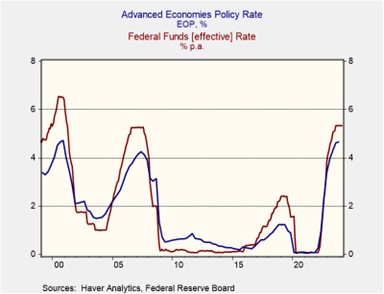

- The US dollar has surged 2.7% in Q1, according to the Bloomberg Dollar Spot Index, fueled by a shift in central bank policy expectations. Markets initially anticipated interest rates converging globally, but recent pronouncements suggest a slower pace of easing. Echoing the Fed’s cautious stance, central bankers worldwide signaled a more measured approach. Bank of England Monetary Policy Committee member Jonathan Haskel indicated that the UK is a long way off from cutting rates, while ECB President Lagarde remained noncommittal on future policy easing after the ECB’s expected June cut. Meanwhile, the Bank of Japan distanced itself from any tightening bias.

- Central banks’ shift away from aggressive rate cuts has resonated with the market. Investors have adjusted their forecasts upward, anticipating a slower pace of rate reductions and a higher interest rate environment over the next three years. This hawkish tilt is particularly pronounced in 2025 projections, with US rates revised up by 70 bps and the UK seeing a 55-bps increase. These revisions suggest the market isn’t convinced that central banks in Europe and the UK will take drastic measures to cut rates independent of the Federal Reserve’s actions, despite economic weakness in those countries.

- The Fed’s aggressive rate cuts, which have historically started from higher points, often result in a lower terminal rate compared to other central banks. Even if the Fed cuts this year, whether before July or after the election, the dollar’s weakness would likely be temporary. However, the current combination of a strong dollar and high interest rates creates tighter global financial conditions than investors may have anticipated for 2024. This could potentially dampen global growth and make US equities more attractive relative to foreign markets.

The Super Peso: The Mexican peso (MXN) has defied expectations in 2023 by strengthening despite rate cuts and potential US tensions.

- The MXN has emerged as the world’s strongest currency against the dollar this year. Two key factors fueled this stellar performance. First, despite lowering its policy rate this year, Mexico boasts one of the highest interest rates globally, making it attractive for carry-trade investors seeking to profit from interest rate differentials. These investors buy foreign currency (like the dollar) and then invest those funds into a higher-yielding currency (like the peso). Secondly, President Andrés Manuel López Obrador’s (AMLO) plan to reduce government spending has helped curb national debt, bolstering investor confidence in the Mexican economy and its currency.

- Mexico’s strong peso hasn’t shielded its stock market from volatility in 2024. The MSCI Mexico soared nearly 30% in the final two months of 2023, but this year’s performance has been choppy. This uncertainty likely stems from outgoing AMLO’s late-term spending spree, which is expected to push the estimate of public debt as a percentage of GDP from 4.9% to 5.0%. Additionally, his presumed successor, Claudia Sheinbaum, has pledged to cap oil production at 1.8 million barrels per day, a slight decrease that suggests a potential move away from fossil fuels.

- Mexico’s upcoming election looms large over its financial markets. The country’s proximity to the US makes it a magnet for companies seeking North American market access. While AMLO has navigated relations with both US presidential contenders, uncertainty swirls around Claudia Sheinbaum and her ability to maintain these ties. Further complicating matters, tensions with the US are rising as Chinese firms attempt to manufacture electric vehicles in Mexico for the US market, attracting criticism from American lawmakers. Immigration, another perennial issue, adds another layer of complexity. If Sheinbaum is able to successfully avoid US hostilities, Mexican companies could present potential opportunities for investors looking for foreign exposure.

Other News: China’s most senior military leader has urged Asia to take responsibility for managing its own security, indicating that despite the thaw in tensions between the world’s two largest economies, significant geopolitical differences persist. The Russian propaganda machine remains active and potent, raising concerns that Moscow may attempt to influence the upcoming US election.