Daily Comment (March 23, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Good morning! Today’s Comment begins with our thoughts on the Federal Reserve’s rate decision. Next, we discuss the Fed’s economic outlook and why it may not be representative of future policy. Lastly, the report examines China’s battle to avoid isolation by the U.S.

Proceed with Caution: The Fed insists it believes that the U.S. banking system is “sound and resilient,” but its guidance suggests otherwise.

- The banking crisis has shifted Fed sentiment regarding future policy. On Wednesday, the Federal Open Market Committee decided to raise its benchmark policy rate by 25 bps to a target range of 4.75% – 5.00%, its highest level since 2007. The hike was in line with market expectations but comments in the Fed statement indicated that policymakers may be less committed to hikes going forward. This view is reinforced by the FOMC’s decision to replace the phrase “ongoing increases in its target rate” with “additional policy firming” in its official statement. In another sign the Fed has become less committed to imminent hikes, Fed Chair Jerome Powell implied that the FOMC may view stricter lending standards as a substitute for policy tightening.

- On a related note, the Bank of England also raised rates by 25 bps.

- Despite hints that the Fed may be close to ending its hiking cycle, Powell also insisted that the central bank does not plan to cut rates this year. The lack of commitment to either raise or lower interest rates confused the market as the ongoing banking turmoil and elevated inflation suggests that the Fed should be taking some sort of action. This indecisiveness led to concerns that the Fed fears a recession may be near. As a result, the S&P 500 seesawed by rising to a session high of +0.8% at the beginning of the press conference but closing down 1.7% on the day. Additionally, gold was up 1.3% around market close, and the U.S. Dollar index dipped 0.62% in the same period.

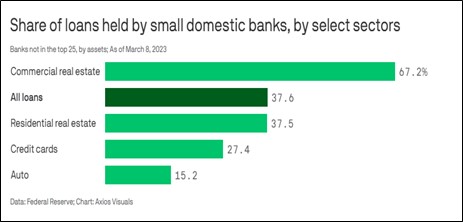

- Policymakers are still worried about the ongoing banking crisis. After all, deposit flight remains a major issue for regional banks, as demonstrated by the recent disclosure from PacWest Bank (PACW, $10.12). The possible guarantee of bank deposits do little to allay those fears since rising interest rates incentivize depositors to put their savings into higher yielding mutual funds and U.S. Treasuries. If deposit outflows persist, the Fed may be left with no choice but to cut rates in order to protect small banks, which make up nearly 40% of all loans and 70% of commercial real estate loans, and their failure could lead to a broader economic crisis.

Not Adding Up: The Summary of Economic Projections (SEP) highlights the inconsistencies regarding the Federal Reserve’s narrative.

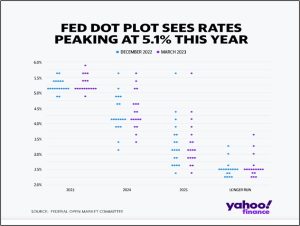

- Although the Fed dot plot from 2023 appears to be unchanged from the previous meeting, a direct comparison shows that policymakers were less inclined to reduce interest rates. The latest median forecast policy rate of the dot plots remained relatively unchanged from the December meeting, with the 2024 forecast revised slightly higher from 4.1% to 4.3%. That said, a direct comparison shows that members are more hawkish than the statement implied. As the following chart indicates, several fed officials revised up their policy rate projections. The upward revision signals that policymakers are not comfortable with lowering rates even with the ongoing banking turmoil.

- GDP and employment predictions also failed to articulate a consistent story about the Fed’s view regarding the economy. Policymakers’ median forecast showed economic output expanding by 0.4% in 2023 and the unemployment rate increasing from 3.6% to 4.5% in the same year. These projections are confusing as it implies that the Fed expects that over 1.4 million workers could be displaced over a 10-month period and that would translate to merely an economic slowdown and not a recession. There is no historical precedent of this ever happening, with the closest being a period between 2002 and 2003, when household unemployment climbed to 962,000 while the annualized GDP growth ranged from 0.5-3.6% within the same time frame.

- The SEP reinforces our view that the Federal Reserve may believe that the window for raising rates may be closing fast. Its modest upward revision in dot plots reflects members’ belief that the economy is too hot to bring inflation back to its 2.0% mandate. Meanwhile, the year-end forecast of the unemployment rate implies that they are not confident that the labor market will be able to remain tight throughout the year. The lack of clarity suggests that interest rate expectations could become very volatile over the next few weeks as the market weighs the release of economic data and Fed speeches. This may lead to sideways movement in the S&P 500 as investors battle over the direction of the economy and monetary policy.

China Related News: Beijing’s fear of being isolated by the U.S. and its allies appears to be edging closer to reality.

- Apprehension over China’s growing influence has made it easier for the U.S. to strengthen its ties with its Indo-Pacific allies. Chinese officials expressed fury over the U.S. and U.K.’s attempts to supply Australia with nuclear-powered submarines. Beijing’s ambassador to the International Atomic Energy Agency, Li Song, warned that such a move could lead other countries to follow suit. Meanwhile, a growingly assertive China has forced some former foes to warm their ties. On Wednesday Japan ended trade restrictions on exports to South Korea, paving the way for a normalization of trade relations which had been weakened due to a dispute involving Japan’s treatment of Koreans during World War II.

- Intelligence sharing by the U.S. allowed New Delhi to repel an attempted Chinese military incursion along the contested China-India border late last year. The U.S. provided satellite imagery and other real-time intelligence showing the Chinese forces gathering and preparing for the operation, which then allowed India to position sufficient forces to thwart the incursion with only minor casualties. The intelligence assistance was reminiscent of the aid provided to Ukraine last year that helped it fight back against the Russian invasion.

- As China and the members of its evolving geopolitical bloc continue to probe for weak spots in the territorial defenses of their rivals, it appears that the U.S. has decided to use increased intelligence sharing to help strengthen and secure the cooperation of countries within the Indo-Pacific region such as India, Japan, Australia, and South Korea. The move to isolate China from the rest of the world risks retaliation from Beijing, who may look to offer its military weapons expertise to countries opposed by the U.S. If this assumption is correct, it would suggest that we may be headed toward a more hostile and less trade-friendly world.

- As we have mentioned in previous reports, this situation generally bodes well for commodities as the hoarding of essential raw materials are likely to drive up prices.