Daily Comment (March 21, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Good morning! Stocks are rallying this morning as investors remain optimistic about the Fed achieving a soft landing. In sports news, March Madness tips off today, and we’re calling a win for the University of North Carolina. Today’s Comment dives into key issues: analyzing the latest FOMC meeting, exploring the budget debates among lawmakers, and examining the recent shift towards military assertiveness by US allies. As always, we’ll keep you informed with a roundup of international and domestic news.

Powell’s Punt: The Federal Open Market Committee’s (FOMC) decision paves the way for a potential rate cut in June; however, it may hinge on the strength of the labor market.

- Despite maintaining a cautious monetary policy, the FOMC signaled a brighter view of the US economy. In their latest decision, they opted to hold the target range for the federal funds rate between 5.25% and 5.50% and continue its balance sheet runoff. Nevertheless, a shift in their economic outlook is evident. FOMC projections show increased optimism, with GDP growth forecasts for 2024 revised upwards from 1.4% to 2.1%. Additionally, the unemployment rate is expected to dip slightly, from 4.1% to 4.0%. Notably, inflation projections remain unchanged, suggesting policymakers believe this economic uptick won’t significantly impact price pressures.

- The market initially welcomed the FOMC’s announcement, but a deeper analysis suggests a potentially hawkish undertone. Although the median dot plot remained flat at 4.625%, a rise in the weighted average from 4.70% to 4.80% signaled a slight shift among some policymakers. This could stem from concerns about the persistent tightness in the labor market, which might hinder progress toward the Fed’s 2% inflation target. Reinforcing this, Federal Reserve Chair Jerome Powell hinted during the press conference that persistently strong employment data could lead the central bank to hold interest rates higher for a longer period than currently anticipated by the market.

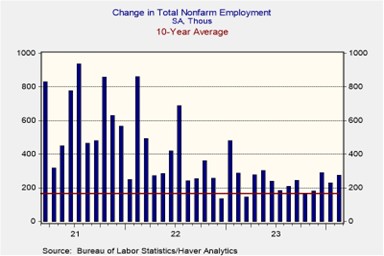

- The Fed’s decision on a June rate cut remains uncertain. While they haven’t committed to it, our baseline expectation is a cut if they aim to deliver on their projected three reductions this year. Thus, the strength of the employment data will be a key factor. If the US continues adding jobs at a solid pace, exceeding 180,000 per month, the Fed may delay easing policy, especially with inflation still above its target. However, to maintain political neutrality, the central bank might delay its first rate cut until July at the latest. This would keep them on track for three total reductions this year, with the other two likely occurring in the November and December meetings.

Slash Entitlements: Lawmakers are setting their sights on benefit programs as a potential area to address the government’s budget deficit.

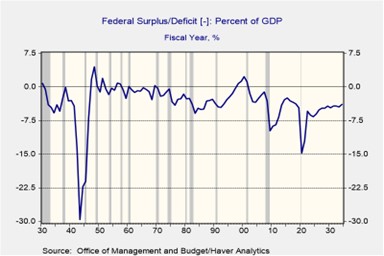

- The Republican Study Committee (RSC), a conservative group within the Republican Party, has proposed a plan to ensure the long-term solvency of social programs. This proposal includes raising the Social Security retirement age, tightening work requirements for food stamps, and capping unemployment benefits based on prevailing wages, possibly around $15 per hour. While immediate passage seems unlikely, the RSC plan reflects a growing emphasis within the Republican Party on reforming entitlement programs. This aligns with recent comments by former President Trump, who called for streamlining Social Security to address potential inefficiencies. The Republican budget proposal is expected to reduce outlays by $14 trillion over the next decade.

- This plan addresses the challenge of the national debt’s sustainability through the implementation of rigorous spending controls, a matter both political parties are exploring alternative approaches to resolve. Democrats aim to reduce costs by allowing the expiration of the Trump tax cuts in 2025 and by increasing taxes on high-income individuals. President Biden has indicated his intention to raise taxes on individuals earning over $400k annually and to elevate corporate taxes from 21% to 28% should he be re-elected. This projection suggests Biden’s plan could generate nearly $5 trillion in additional revenue over the next decade.

- Austerity measures, including tax hikes and cuts to social programs, could free up resources to improve the fiscal balance. However, this approach faces significant hurdles. Public spending makes up a nearly a quarter of GDP, a substantial portion. Additionally, Social Security costs are projected to rise further by 2033, and these programs are essential for many voters. Tax increases are likely to encounter resistance from lobbyists representing groups who would shoulder the burden. While we remain optimistic that the government will take the necessary steps to stabilize government spending, we also acknowledge there may be bumps along the way. That said, we remain confident that defense spending will be fairly insulated.

Foreign Defense: With growing concerns about international conflicts, key US allies are taking a harder look at their defense capabilities.

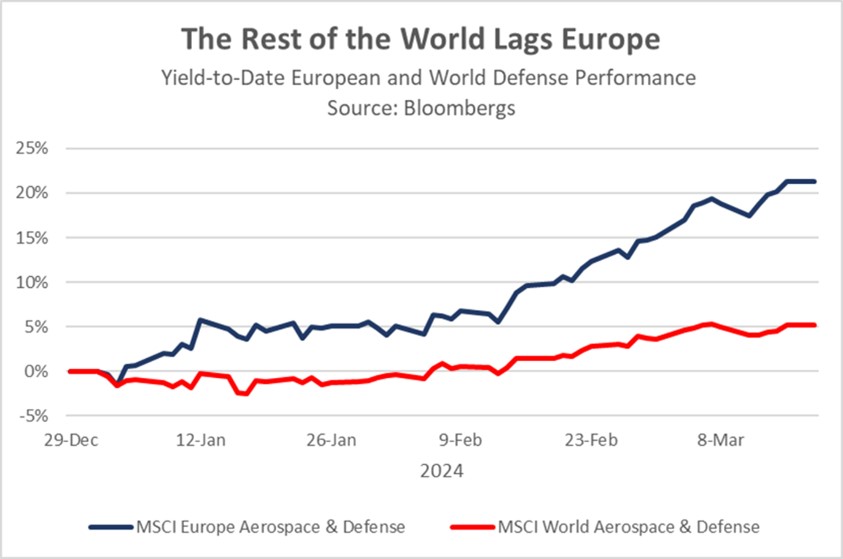

- The UK and Australia fortified their defense partnership on Thursday with a pact addressing China’s growing influence in the Indo-Pacific. This agreement streamlines troop deployments, further solidifying the ties established by the 2021 AUKUS defense pact. Meanwhile, in response to Russia’s escalating threat on the European continent, French President Emmanuel Macron has revived plans for EU defense bonds to bolster Europe’s military capabilities. However, this proposal faces an uphill battle as Germany remains staunchly opposed. Nonetheless, these moves reflect a broader Western trend of unease over rising threats from both Russia and China.

- The Ukraine invasion in 2022 marked a turning point for Western priorities. Previously, these nations prioritized domestic spending on social programs, often neglecting defense budgets. The war has triggered a significant shift. Western powers are now demonstrably reorienting their focus towards bolstering their own defenses and supporting allies in a climate of heightened security threats. This is evident in Europe’s recent surge in support for Ukraine, which has had a cascading effect, revitalizing the Continent’s defense industry. European defense stocks have surged 21% year-to-date, outperforming the US defense sector which has gained 5%.

- US allies, particularly in Europe, are investing in their own defense industries. Though, established US firms like Lockheed Martin, General Dynamics, and Northrop Grumman are well-positioned to remain key partners in the near future. These giants boast a proven track record of fulfilling allies’ growing demands for advanced weaponry. To capitalize on the expanding global defense market, they may look to expand through acquisitions and partnerships in other markets. This trend towards increased defense spending across the Western world bodes well for the industry as a whole.

Other News: Central banks in the West are taking a dovish turn, with the Bank of England signaling a potential rate cut later this year, and the Swiss National Bank taking a surprise step by lowering rates immediately. Yemen has told Russia and China that their ships will not be targeted; the move is further evidence of Iran’s growing influence on the conflict in the Red Sea. President Biden’s continued focus on reducing housing costs underscores the growing political importance of affordability.