Daily Comment (March 2, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EST] | PDF

Good morning! Today’s Comment begins with a discussion on how earnings may not provide an accurate picture of the business environment and what that could mean for the economy. Next, we give our thoughts on the recent increase in interest rate expectations and how it affects stocks and bonds. Finally, we end with a review of the dollar’s impact on emerging markets.

Earnings Mismatch: Solid Q4 earnings boosted market optimism at the beginning of the year but concerns over quality have forced investors to rethink their outlook for 2023.

- Most S&P 500 companies performed better than expected in the final quarter of 2022. Despite recession concerns, almost 70% of firms reported positive earnings per share and positive revenue surprises. The numbers were far from spectacular but were enough to show that firms were resilient in the face of elevated inflation. This sentiment was reinforced by a FactSet document search showing that the number of S&P 500 firms citing “inflation” in earnings calls fell to its lowest level since February 2021. The strong results helped lift investor confidence that the market may have discounted the worst of a possible recession and buoyed bets of a market rally for when the Fed finishes tightening.

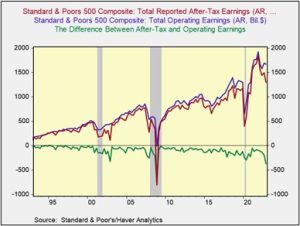

- Unfortunately, last year’s earnings numbers may be misleading. The discrepancy can be seen when comparing after-tax earnings with operating earnings. In Q4 2022, the difference between total after-tax and operating earnings widened to a level not seen since the financial crisis. The gap is related to a massive jump in restructuring costs. Firms generally incur these costs when reorganizing their businesses to make them more efficient. Examples of these one-time expenses include furloughs, layoffs, and plant closures.

- Similarly, the divergence between operating cash flows and profits suggests that earnings quality has also fallen.

- The market will eventually sort out the inconsistencies in earnings. Going into a recession, managers look for alternative ways to show that their firms remain profitable to compensate for higher borrowing costs and slowing demand. This is seen when firms exclude costs associated with a reorganization or soften revenue recognition standards. Luckily, investors respond to low earnings quality by paying less for stocks. The S&P 500’s retreat below 4000 partially reflects the market’s skepticism about the true profitability of firms. That said, the decline in equities suggests that stocks are positioned for a strong rally once the market is able to value these earnings correctly.

Interest Rate Expectations: Fears over a resurgence of inflation have sent markets into a frenzy as investors try to decide what central banks will do.

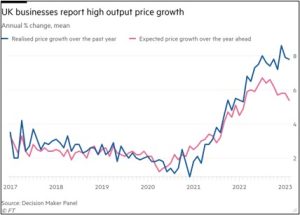

- Investors were forced to revise interest rate predictions after a faster-than-expected rise in inflation, and strong economic data added to concerns that central banks are not done tightening. Core inflation data in the Eurozone rose 5.6% in the year ending in February, above January’s rise of 5.3%. The strong readings in Europe have contributed to concerns that the U.S. consumer price index may also come in hot later this month. Meanwhile, the U.S. purchasing manager index (PMI) showed improvements in February despite remaining in contraction territory, and Eurozone PMI data showed that output passed the growth threshold last month.

- The unexpected rise in inflation and an improvement in manufacturing activity have led investors to revise forecasts of when the Federal Reserve and the European Central Bank will set peak interest rates. Markets predict that the Fed could push rates to 5.5% by September, above a projected peak of just under 5.0% following last month’s Federal Open Market Committee rate announcement. Meanwhile, the European Central Bank is forecast to set rates at 4.0%, their highest level on record. The Bank of England has blunted this trend as comments from BOE Governor Andrew Bailey led investors to revise down peak expectations; however, Thursday’s report of strong wage growth may lead to upward revisions in the BOE’s benchmark policy rate.

- Equity and bond markets do not agree on the path of policy rates. Despite modest adjustments over the last few weeks, the Euro Stoxx 50 is up 9.2% to begin the year, while the S&P 500 rose 3.3% in the same period. The resilience in equities indicates that stock traders still believe that the worst is behind them. Meanwhile, the rise in longer-duration bond yields suggests that fixed-income traders are unconvinced. The 10-year U.S. Treasury yield rose above 4.00% for the first time in 16 years on Wednesday, while today similar duration German government bond yields reached a 12-year high at 2.75%.

Dollar Problems: The U.S. greenback has stagnated over the past few weeks, denying a potential tailwind for emerging markets.

- Foreign investors in troubled countries are rushing to purchase U.S. dollars to protect their savings from losing value. In Iran, a collapse in sanctions relief talks has led the Iranian rial (IRR) to lose a fifth of its value since last week. The Turkish lira (TRY) may also face pressure after the upcoming elections as the government may be unable to offer the same level of support to the currency. Last month, options were pricing in a 60% likelihood that the TRY would lose 25% of its value by year end. Saver skepticism is shown in the recent outflow from Turkish FX-protected accounts.

- Dollar appreciation could lead to higher inflation in emerging market countries. Many foreign transactions are priced in dollars, and thus, currency depreciation will lead to an increase in import prices in items such as fuel and food. Although governments are willing to intervene in markets, their involvement comes at a great cost. Currency support generally leads to some sort of depletion of reserve assets, whether it be gold, monetary reserves, or other liquid securities. This method provides some relief to households, but it also prevents governments from being able to shield economies from the negative impacts of a downturn.

- Although the dollar has stagnated, it still poses risks to emerging markets as it blocks countries from the added relief from price pressures related to greenback depreciation. As a result, central banks may be forced to raise rates in certain countries where inflation remains stubbornly high. This does not mean that all is lost for certain countries. MSCI South Korea (3.45%) has seen its equities outperform the S&P 500 (3.30%) year-to-date, despite the South Korean won’s (KRW) depreciation against the dollar. However, we believe that investors will need to be more vigilant when looking at emerging markets as long as the greenback remains elevated.