Daily Comment (March 19, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Our Comment opens with confirmation that today the Bank of Japan ended its many years of negative interest rates. We next review a range of other international and US developments with the potential to affect the financial markets, including reports that the European Union is preparing to impose punitive tariffs on grain and grain products from Russia and Belarus, and a preview of the Federal Reserve’s latest policy meeting starting today.

Japan: As flagged in our Comment yesterday, the Bank of Japan today ended its eight-year policy of negative interest rates, dismantled its yield curve controls, and scrapped most other emergency policies it had adopted to fight the country’s past economic stagnation and deflation. It set the new target for benchmark short-term interest rates at 0.0% to 0.1%. Just as important, the central bank said it will stop setting a yield target for 10-year Japanese government bonds and cease buying stocks, real estate investment trusts, and other unorthodox investments.

- Despite taking the momentous step of ending their negative interest-rate era, the policymakers insisted that overall monetary policy will remain accommodative for the time being in order to support economic growth. Indeed, the policymakers said they would continue buying Japanese government bonds.

- Since the move was well telegraphed over the last several months, today’s announcement has had little impact on financial markets. Japanese stocks today appreciated modestly, and the yen (JPY) weakened 0.9% to 150.44 per dollar.

China-Hong Kong: The Hong Kong municipal government today unanimously passed a controversial new national security law to supplement the security law imposed by Beijing on the territory in 2020 and align the city’s security rules with those of mainland China. Among the tough new provisions in the law, treason could be punished by life in prison, and sedition could be punished by two to seven years in jail.

- Stealing or disclosing “state secrets” could be punished by up to 10 years in jail.

- Importantly, the law broadens the definition of state secrets to include information about the economic, technological, or scientific development of Hong Kong or mainland China.

- The new law has therefore struck fear in the hearts of foreigners working in Hong Kong, who now worry that they could more easily be arrested merely for handling business data. Those concerns are likely to make the new law another point of tension between China and the West and make Hong Kong a less attractive place to do business.

European Union-Russia-Belarus: The European Commission is reportedly preparing to impose punitive tariffs on Russian and Belarusian grain and grain products for the first time. The plans reportedly call for tariffs of 95 EUR per ton on the affected grains, which would raise their price by about 50% and effectively push them out of the EU market. The move would in large part be punishment for Russia’s invasion of Ukraine and its repression at home.

- Nevertheless, the move is also apparently an effort to respond to Europe’s restive farmers, who have been complaining not only about EU regulations but also about surging imports from the east amid the disruptions of the war in Ukraine.

- Even though Russian grain and grain products only account for about 1% of the EU market, the tariffs can be presented as protection for farmers’ economic interests.

European Defense Industry: In a report last week, the North Atlantic Treaty Organization said 11 of the alliance’s current 32 members met the NATO standard of spending at least 2% of gross domestic product on defense in 2023. As a group, the European NATO members met the 2% standard, helped by especially high defense spending in countries like Poland and Greece. The report also said two-thirds of the NATO countries should achieve the 2% standard in 2024.

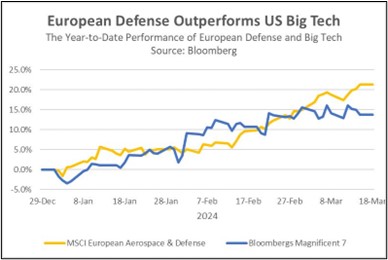

- The total European NATO defense spending of $470 billion in 2023 helps explain the strong performance of European defense stocks over the last year, which we mentioned in our Comment

- To help illustrate the recent strong performance of European defense stocks, the chart below shows that they have actually outperformed the US’s vaunted Magnificent 7 large-cap technology stocks so far in 2024.

US Monetary Policy: The Federal Reserve’s policymaking committee begins its latest meeting today, with its decision due on Wednesday at 2:00 PM EDT. The Federal Open Market Committee is widely expected to hold the benchmark fed funds interest-rate target at its current range from 5.25% to 5.50%. The first cut is now expected in June. Nevertheless, the policymakers could signal an earlier or later date for their first cut and may also announce an end to their quantitative tightening policy or other changes in their approach to policy,

US Fiscal Policy: The White House and Congressional negotiators last night resolved a last-minute dispute over border enforcement spending, setting the stage for Congress to pass the remaining six appropriations bills for the remainder of the federal fiscal year before the current stop-gap spending bill runs out on Friday. The process of getting those bills passed and signed into law could still lead to a partial shutdown of the government, but it appears any shutdown would last at most a few days and would not be very disruptive.

US Artificial Intelligence Industry: Reports yesterday said technology giants Apple and Google are in talks to include Google’s generative AI system Gemini into Apple’s iPhones. The news sparked significant increases in each company’s stock price yesterday, based on hopes that such a deal would reinvigorate Apple’s iPhone franchise and give Google added scale in the evolving AI “arms race.” Nevertheless, we note that such an outcome assumes that regulators approve any such deal.

- Separately, AI chipmaker Nvidia also saw its stock price jump as it prepared to announce a new generation of AI processors that will be much faster and bigger than its current blockbuster H100 series.

- The new chips from Nvidia are expected to be available later this year, helping ease the current shortage of H100 chips.

US Nuclear Energy Industry: TerraPower, a company started by Microsoft founder Bill Gates, said it will begin building the nation’s first liquid-sodium cooled nuclear reactor by June, with expectations that it will only cost half as much as a conventional water-cooled reactor and be generating electricity by 2030. The announcement shows how the US is trying to compete in building a new generation of cheaper, more efficient nuclear generating plants using innovative cooling technologies and small, modular designs to cut costs and shorten construction periods.

US Auto Industry: The United Auto Workers filed a petition yesterday with the National Labor Relations Board requesting a unionization vote of the 4,000 or so workers at Volkswagen’s car factory in Chattanooga, Tennessee. According to the UAW, a “supermajority” of workers at the plant have signed a petition expressing an interest in joining the union. If the unionization effort is successful, it would mark the first organization of a US auto plant not affiliated with one of the Detroit Three automakers.

US Defense Industry: As the US struggles to boost its output of nuclear-powered submarines to counter rising threats from the China/Russia geopolitical bloc, Newport News Shipbuilding, a unit of defense giant Huntington Ingalls, has announced that it is trying to hire 3,000 skilled tradesmen this year and 19,000 within the next decade. Meanwhile, the Hampton Roads Workforce Council warned that the Virginia region’s maritime shipbuilding vacancies could rise to 40,000 by 2030 if more workers can’t be drawn into the market.

- The Newport News announcement highlights the US’s rising demand for skilled tradespeople, such as welders and pipefitters. The rise in demand reflects factors such as near-shoring production within the US, increased factory construction, and rising defense budgets.

- In contrast, the decades-long advantage of college-educated workers continues to be eroded. The result is likely to be a rebalancing of opportunities in the labor market, with skilled tradesmen now enjoying more demand vis-á-vis the college educated.