Daily Comment (March 18, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Our Comment today opens with the Bank of Japan’s likely abandonment of negative interest rates this week. We next review a wide range of other international and US developments with the potential to affect the financial markets today, including news that even Beijing-friendly emerging markets are starting to push back against China’s surging exports and big changes coming in the US commercial and residential real estate markets.

Japan: Sources say the Bank of Japan finally plans to end its negative interest rate policy at its two-day policy meeting that begins today, based on its assessment that the economy has at last achieved a virtuous cycle of moderate wage gains and modest price inflation. The revised policy rate of 0.0% or more would mark Japan’s first non-negative interest rate since 2016. Nevertheless, BOJ policymakers have signaled that they will still keep their benchmark rate accommodative, probably in the range of 0.0% to 0.1%.

- One implication of higher (or at least non-negative) interest rates in Japan is that the country’s investors may be tempted to repatriate the enormous sums they’ve invested abroad in search of better yields. A new survey by Bloomberg shows that about 40% of investment managers think Japanese investors will be tempted to start bringing capital back home at the first rate hike.

- News reports on the Bloomberg story emphasized that “only” 40% of investment managers think the Japanese would be tempted to repatriate funds early. To us, 40% sounds like a significant slice. In any case, large amounts of capital shifting back to Japan would likely boost the yen (JPY) and potentially take some of the wind out of US stocks and bonds.

China-Brazil: New reporting says the Brazilian government has launched several anti-dumping investigations as imports of Chinese industrial products soar. The probes target products ranging from steel and chemicals to tires and could ultimately result in the imposition of tariffs, as demanded by Brazilian industries. However, to avoid antagonizing Beijing and to preserve Brazil’s access to the Chinese market for agricultural products, Brazilian President Lula da Silva will probably try to minimize any trade barriers against China.

- We have long argued that China will eventually adopt a neo-colonial relationship with the other members of its evolving geopolitical and economic bloc. To absorb its massive excess capacity and help pay the associated debts, Beijing will focus on exporting cheap, relatively advanced manufactured products to its friends, largely transforming them into mere commodity suppliers to China. As in classic colonialism, the result would be big trade surpluses for China and trade deficits for its partners.

- In our analysis, Brazil is still a member of the China-leaning bloc. It is not quite a Chinese colony yet, and it still maintains a trade surplus with China. As Lula faces the domestic political costs of the evolving China-Brazil trade relationship, a big question is whether he will accept those costs and be drawn closer into the China bloc or resist them and stay out of that camp.

- With China’s excess industrial capacity and debt prompting ever-increasing exports at predatory prices, we note that several other emerging markets have also recently taken steps to protect their domestic markets from the Chinese onslaught, as have some major developed countries. Both the threat to domestic manufacturers and the potential pushback against Chinese exporters will likely have big implications for global investors in the coming months.

China: January-February industrial production was up a solid 7% year-over-year, beating expectations and marking the strongest annual growth in almost two years. However, other data showed property investment was down 9% year-over-year in the same period, and new construction starts were down 30%. The figures suggest manufacturers are seeing some benefit from the government’s modest stimulus measures, but with domestic demand weak, a lot of the new output will likely be exported at low, dumping-level prices.

India: The Electoral Commission of India announced on Saturday that the next parliamentary elections will begin on April 19, with the voting staggered across the country’s various states and due to wrap up on June 1. Prime Minister Modi and his Hindu nationalist Bharatiya Janata Party are widely expected to win the lower house of parliament, giving Modi a third five-year term. A win by the pro-US, business-friendly Modi would likely be taken positively by investors.

Pakistan-Afghanistan: The Pakistani military this morning launched airstrikes against Islamist militants in Afghanistan after accusing them of conducting attacks in Pakistan over the weekend. The Taliban government in Kabul condemned the strikes as a violation of its territory. However, given militants based in Afghanistan have increasingly launched attacks on Pakistan since the Taliban took power in 2021, the Pakistanis appear to have had enough and may now continue their airstrikes until the militant threat is reduced.

Russia: In the presidential election completed yesterday, President Putin appears to be on track to win a new term in office that will allow him to rule until 2030. With some 25% of the ballots counted, Putin was reportedly winning 88% of the votes. Of course, with all potentially competitive opposition candidates barred from participating, the election is in no way free or fair. Nevertheless, Putin is sure to trumpet the result as a mandate justifying his autocratic rule.

European Union: The Wall Street Journal today carries an article explaining the continued rapid rise of European defense stocks as governments boost their purchases of ammunition, military equipment, and weapons. The article notes that European governments are rapidly boosting their defense budgets not only in fear of Russian aggression but also in response to former President Trump’s hints that he might renege on US commitments under NATO’s mutual defense treaty.

- The article is consistent with our oft-written belief that defense spending is likely to rise around the world in the coming years, creating potential investment opportunities in defense companies and other firms that have a lot of defense business.

- Notably, European defense stocks outperformed those of the US over the last year, probably because of the Europeans’ greater urgency to rearm and the US’s continued fiscal squabbles.

Cuba: Prompted by recent electricity blackouts and food shortages, hundreds of protesters took to the streets in two cities over the weekend. In response, the government shut down mobile internet service, just as it did to short-circuit similar protests in July 2021.

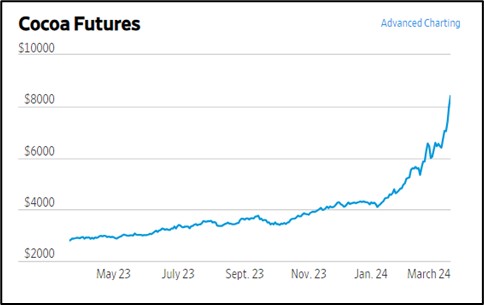

Global Cocoa Market: In bad news for chocolate lovers everywhere (doesn’t everyone love chocolate?), global cocoa prices late last week set a new record high for the first time since 1977. The price of near cocoa futures rose $1,105 per metric ton on Thursday and Friday to reach $8,018 per ton, three times the price from one year ago. Prices so far this morning have topped $8,400 per ton. Cocoa prices are rising in response to bad weather in West Africa, where most of the world’s supply is grown.

US Monetary Policy: In a Financial Times poll of academic economists, more than two-thirds of respondents thought the Federal Reserve would cut interest rates no more than two times in 2024, with the first cut coming in late summer. Even though investors have begun to come around to the fact that the Fed is likely to hold rates higher for longer than anticipated, the poll suggests market participants may still be expecting too many rate cuts this year.

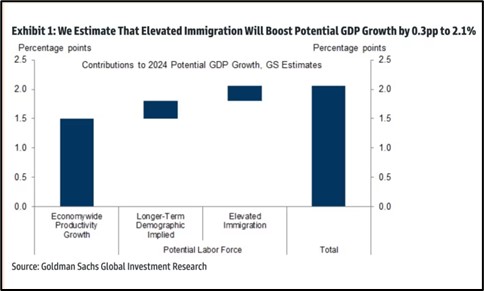

US Labor Market: In what is likely to become a politically controversial position, economists at Goldman Sachs have released analysis suggesting that strong net immigration in 2023 was a key reason why the US economy and payrolls were able to rise so much but didn’t put further upward pressure on consumer price inflation. Looking forward, the analysts think continued strong immigration will continue to boost the US’s potential economic growth in 2024 while also keeping a lid on wages and inflation.

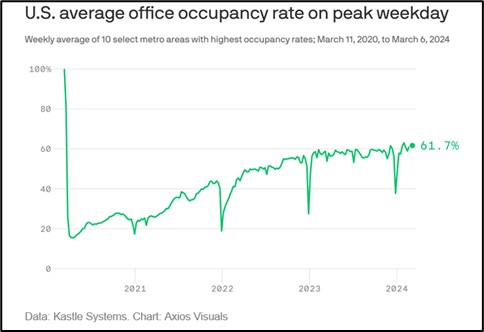

US Commercial Real Estate Market: New data from Kastle Systems shows that even on their peak occupancy days, office buildings in 10 major cities are still filled with only about 61.7% of the employees they had before the COVID-19 pandemic. Moreover, the rate of improvement has slowed to a crawl. The data suggests that office buildings and the debt that backs them will remain a significant financial risk in the coming months and years.

US Residential Real Estate Market: The National Association of Realtors on Friday said it has reached a deal to settle the multiple lawsuits it has been fighting over its standard practice of charging home sellers a commission of about 6%, split between the seller’s and buyer’s agents. Under the deal, commissions will now be negotiated between the seller and his/her agent, and between the buyer and his/her agent. Total commissions are expected to fall to 3% to 4%, sharply reducing realtor income and leading to a mass exit from the industry.