Daily Comment (March 17, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Happy St. Patrick’s Day! Today’s Comment begins with a discussion about the European Central Bank’s rate decision and how it could impact monetary policy around the world. Next, we review the latest developments in the ongoing banking crisis. Lastly, we give an update on the rivalry between the U.S. and China.

What Now? The European Central Bank raised rates by 50 bps but the reluctance with which they made this move highlights monetary policymakers’ hesitancy to maintain aggressive policy in light of elevated financial strain.

- Some European policymakers were uncomfortable with the central bank’s decision to increase its benchmark policy rate by half a percentage point. ECB President Christine Lagarde noted that some of the members of the governing council wanted to halt rate hikes until the bank situation unfolded. The decision to ditch their written commitment to keep lifting rates further supports the idea that members are not sure about the future path of monetary policy. The indecisiveness among the ECB governing council was interpreted as a dovish shift by the central bank as investors now believe that it is less committed to fighting inflation.

- The ECB’s decision to raise rates now puts pressure on the Federal Reserve to lift its policy rate. Fed officials are dealing with similar circumstances as their European counterparts, but their reaction is far from certain. The Fed is already facing scrutiny for its failure to prevent the collapse of Silicon Valley Bank (SIVB, $106.05) and Signature Bank (SBNY, $70.0). As a result, it may be subject to increased political backlash if it overdoes it next week in its rate decision. The Organization for Economic Cooperation and Development (OECD) has weighed in on the matter by requesting central banks (most likely the Fed) to resume rate hikes. That said, continued tightening by the Fed raises the odds of a recession.

- In the United Kingdom, the decision to tighten monetary policy is even more complicated. The Bank of England and the U.K. Treasury have very different outlooks for the economy over the next few years. While the central bank predicts that output growth will be relatively unchanged by 2025, the Office for Budget Responsibility projects GDP to expand by 5% within that same period. The differing forecasts from monetary and fiscal policymakers suggests the two institutions might impose contradictory policies. In other words, the BOE is likely to become dovish, which may lead to an end to tightening, while the Treasury department may lean more hawkish thus paving the way for possible budget cuts or tax increases.

- The recent deceleration in U.K. inflation expectations further reaffirms our belief that the Bank of England may lean toward not tightening in its next meeting.

New Developments: Financial contagion may be fading but it is still too early to tell whether the central bank’s job is done.

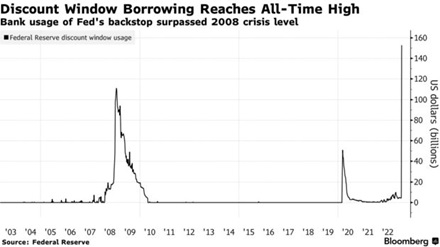

- Banks have taken full advantage of the Fed’s facilities to shore up their cash positions as they borrowed $165 billion from the discount window and the Bank Term Funding Program in the week ending March 15. The unusually high usage of the discount window shows the level of panic triggered by the collapse of Silicon Valley Bank. The discount window lent $153 billion, a new record. Meanwhile, the BTFP lent $12 billion. J.P. Morgan (JPM, $130.75) estimates that the Fed could administer up to $2 trillion into the U.S. financial system. The new bank funding facilities should prevent a liquidity crunch; however, its usage suggests that the financial system is still on edge.

- In other related news, J.P. Morgan has teamed up with other banks to rescue First Republic Bank (FRC, $34.27). A group of 11 lenders, which include Bank of America (BAC, $28.97), Citigroup (C, $45.62), and Wells Fargo (WFC, $39.30), have offered $30 billion in deposits to prop up the struggling California lender. The large transfer comes as fears of bank runs have led depositors to move their money from small and mid-sized banks to ones with large holdings. The group of banks agreed to park their deposits at First Republic Bank for at least 120 days.

- Fears of a potential financial crisis are fading, but it is not clear where the Fed will go from here. The Fed backstops have reassured markets that the central bank was willing to provide liquidity to stabilize the banking system. However, there are still concerns about whether the financial system is capable of dealing with further tightening. Hawkish Fed policy has made deposits less attractive as investors are now able to get more money using money market funds and purchasing Treasuries. That said, inflation is too high for the Fed to pivot now. The market seems to believe that the Fed will raise rates by 25 bps at its March 22 meeting, which is lower than the prediction of 50 bps made after Powell spoke to Congress last week.

Major Power Rivalry: As the West attempts to isolate China, Beijing looks to bolster its ties with Moscow.

- Russia and China continue to build closer ties, while the U.S. tries to find ways to thwart the two countries’ global ambitions. Chinese President Xi Jinping is set to visit Moscow on Monday to reaffirm the countries’ strong ties. Meanwhile, Republicans are pressuring the Biden administration to deter nuclear cooperation between Russia and China. It was reported that a Moscow state-owned nuclear energy company was providing Beijing with highly enriched uranium. China claims to be acting as a mediator between Russia and Ukraine, but China’s actions show that it does not want Putin to lose the war. China and Russia have used their partnership to reduce American influence around the world.

- Accordingly, the Western alliance is becoming less enchanted with Beijing due to its growing relationship with Russia. In a move that will certainly ruffle feathers in Beijing, a German finance minister is set to visit Taiwan for the first time in 26 years. The trip highlights the precarious relationship between Beijing and Berlin. Although Germany is dependent on trade, it wants to pressure China to distance itself from Russia. Meanwhile, more countries are joining the U.S. in its push to ban TikTok on government devices. The U.K. was the latest country to restrict the social media app. The West believes that the app poses serious security risks, and, as a result, the EU, Canada, and the U.S. have all restricted its usage in government settings.

- We have discussed our belief that the world is breaking up into two major economic and geopolitical blocs as countries move away from globalization, one led by the U.S. and the other by China. The rivalry between the two blocs will lead to proxy conflicts and trade battles. The war in Ukraine and the banning of TikTok are examples of how this has started to play out. As tensions begin to rise, the potential for a direct conflict will increase. At this time, neither the U.S. nor China favor outright war, but that could change if Putin’s failure in Ukraine triggers China to make a Hail Mary run for Taiwan. A conflict between the major powers would be very bullish for commodities as supplies will likely be constrained.