Daily Comment (March 17, 2022)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Good morning! The report today begins with Zelensky’s speeches to Congress and the Bundestag. We then give a brief overview of Wednesday’s Fed meeting and the impact it may have on financial markets. Next, we focus on energy and China-related news and conclude with an update on the coronavirus pandemic.

Ukraine-Russia news: In a speech to Congress, Ukrainian President Volodymyr Zelensky pushed lawmakers to do more to defend his country against the Russian invasion. Although he would like the U.S. to enforce a no-fly zone over Ukraine, he said his country would accept a surface-to-air missile system as an alternative. Following Zelensky’s speech to Congress, the Biden administration is considering sending Switchblade drones to Ukraine. In a separate speech to the Bundestag, Zelensky accused Germany of prioritizing its economic relationship with Russia over the security of Europe. The comment comes as Zelensky pushes Europe to apply more pressure on Moscow by banning the imports of Russian oil. Zelensky’s warm welcome in the West has worried Russian officials, as Moscow believes it is losing the information war. In a way to drum up domestic support, Putin accused the West of hurting Russian citizens with sanctions and accused the U.S. of promoting Russophobia to bring the country to its knees.

In light of the sanctions, the Russian government appears to be willing to honor its debt commitments. On Wednesday, the Kremlin announced it fulfilled its $117 million interest payment for two Eurobonds. It also permitted Severstal, a Russian steel and mining company, to make a $12.6 million interest payment but warned that Citi may block the deal. Sanctions have made it difficult for Russian firms to secure the dollars needed to repay debt and avoid defaults. Russian fertilizer company EuroChem may have already missed a debt payment. The sanctions have forced the Russian government to impose new restrictions on foreigners trading Russian assets. Without access to the dollar, the longer these sanctions remain in place, the more likely it is that Russian firms will miss a debt payment.

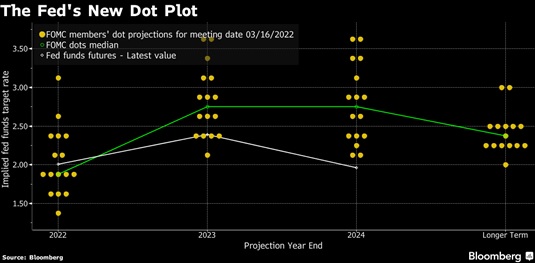

Fed reaction: The Federal Reserve raised rates by 25 bps on Wednesday and signaled that it could raise rates six additional times this year. St. Louis Fed President James Bullard dissented because he favored a 50bps rate hike. The Fed statement showed that the FOMC believes the economy and the labor markets are strong. Additionally, the statement mentioned that Russia’s invasion of Ukraine would likely put upward pressure on inflation and weigh on economic activity. As a result, the Federal Reserve updated its inflation forecast for 2022 from 2.6% to 4.3% and downgraded its median GDP growth projections from 4.0% to 2.8%. Considering the situation in Ukraine, the Fed signaled it was still keen on raising rates and reducing the size of its balance sheet at the next meeting. The chart below shows the updated Fed’s dot plot. The new dot plot shows the terminal Fed Funds rate will be 1.9% for 2022.

Although financial markets responded negatively to the Fed statement, they recovered slightly following Federal Reserve Chair Jerome Powell’s press conference. During the Q&A, Powell hinted the Fed could potentially view quantitative tightening as a substitute for a rate hike. The comment likely signaled that rate hikes might not exceed 25 bps in future meetings. Our view is that the Fed is correct in its decision to raise rates; however, we suspect that given the level of debt, the Fed runs the risk of causing a financial crisis if it follows through on its plan to hike rates six times this year. As a result, we suspect the Fed may take its foot off the gas if it sees signs of a market turmoil.

Other Fed news: The renomination and nomination of Fed Chair Powell and Fed Governor Lael Brainard were approved by the Senate Banking Committee on Wednesday. In addition, the committee advanced two economists, Lisa Cook and Philip Jefferson, in their bid to fill two vacant Fed governor seats.

Energy news: The U.S. Department of Energy has approved more exports of liquified natural gas. The move is designed to help Europe wean itself off of Russian gas. Although this may not be the ultimate solution, this will likely ease some of the burdens of the switch. In other news, President Biden urged oil companies to start lowering the price of gas following the recent decline in crude prices.

China news: The People’s Bank of China will take steps to boost its equity market after pledging to calm market concerns and stimulate the economy. There is growing speculation that the central bank will try to cut rates or lower the reserve requirement to meet this pledge. In addition, monetary easing government officials signaled that their regulatory crackdown could end soon. The developments have had a positive impact on financial markets today.

Other market news: In line with the Federal Reserve, the Bank of England and the Bank of Taiwan raised their benchmark interest rates by 25 bps. The central banks of Hungary, Indonesia, and Turkey held interest rates steady.

COVID-19: The number of reported cases is 463,964,928, with 6,059,216 fatalities. In the U.S., there are 79,631,708 confirmed cases, with 968,329 deaths. For illustration purposes, the FT has created an interactive chart that allows one to compare cases across nations using similar scaling metrics. The CDC reports that 696,801,055 doses of the vaccine have been distributed with 557,644,629 doses injected. The number receiving at least one dose is 254,750,626, while the number of second doses is 216,829,829, and the number of the third dose, granting the highest level of immunity, is 96,232,774. The FT has a page on global vaccine distribution.

- In China, factories in Shenzhen were allowed to resume production after the city was placed in lockdown three days prior. The move was designed to protect the economy and supply chains from the impact of the new wave of Omicron cases.

- Irish Prime Minister Michael Martin tested positive for COVID-19 while in D.C.

- The Biden administration has expressed concern that the reduction in COVID-era policies will lead to an increase in mass immigration. Since the start of the pandemic, the government has been using Title 42 as a way to expel migrants. However, it expects to end this program following the decline in the number of coronavirus cases.