Daily Comment (March 14, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Good morning! Equities have pared early gains due to stronger-than-expected PPI data and subpar retail sales figures. Meanwhile, Purdue, UConn, Houston, and Tennessee were able to secure top seeds for the NCAA Tournament. Today’s Comment dives into our thoughts on central banks moving away from ultra-accommodative policy, the potential for broader social media scrutiny beyond TikTok, and how the IEA’s reversal on its oil demand forecast reinforces our concerns about future inflation volatility. As always, we’ll wrap up with a summary of key international and domestic data.

The Next Monetary Regime: The European Central Bank and the Federal Reserve have signaled potential rate cuts, but this easing cycle could be unlike past ones.

- The European Central Bank (ECB) is poised to implement changes to its operational framework, granting lenders greater autonomy in managing liquidity within the financial system. This shift aims to gradually wean banks off their reliance on the ECB for cash and foster a more self-sufficient approach to liquidity distribution. Interestingly, the Federal Reserve may be following a similar path. The Fed’s recent closure of its Bank Term Funding Program and its encouragement for banks to utilize the discount window suggest a potential move toward a less interventionist approach to liquidity management.

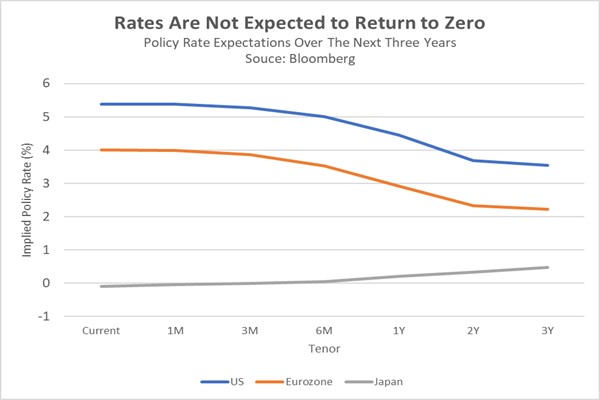

- These central bank adjustments signal a potential departure from pre-pandemic monetary policy norms, which could include a more cautious approach to future interest rate cuts. The White House’s recent inclusion of higher interest rate expectations in its forecasts further reinforces this shift. The strategy to uphold elevated peaks and troughs in interest rates is driven by the imperative need to preserve central bank agility in striking a delicate equilibrium between sustaining price stability and fostering optimal employment levels. The overarching objective is to mitigate the likelihood of exhausting all available monetary instruments once the economy succumbs to recessionary pressures.

- The evolving approach to monetary policy signals a potential paradigm shift for investors. With the era of near or below zero interest rates likely coming to a close, investors will need to adapt their strategies. While central banks may not entirely abandon this tool, their use of it is expected to be more measured moving forward. This shift in preference suggests a new normal for interest rates — they will likely settle at higher points across the yield curve compared to what we’ve witnessed over the past decade and a half. This is likely to remain true not just for the US but for most other developed economies as well.

Election Meddling: With presumptive presidential nominees likely secured by both major parties, lawmakers are shifting their focus to the growing influence of social media, particularly in the age of advancing artificial intelligence.

- A bipartisan effort in the House recently passed a bill that could see TikTok banned in the US. The legislation requires the app’s Chinese owner, ByteDance, to sever ties with the platform or face a potential shutdown in the US. Citing national security concerns, lawmakers worry about the app’s ability to be used for propaganda or voter manipulation. President Biden reportedly supports the bill, but its fate now rests with the Senate. However, Senate Majority Leader Chuck Schumer hasn’t scheduled a vote yet, as concerns about potential free speech limitations and government overreach are expected to be debated.

- While TikTok faces intense scrutiny for potential national security risks, other platforms haven’t escaped criticism. Former President Donald Trump has repeatedly labeled Facebook “the enemy of the people,” alleging bias against conservative voices. On the other hand, New York Rep Alexandria Ocasio-Cortez (D-NY) described the decision of X, formerly known as Twitter, to alter its algorithm to promote or suppress free speech as a form of election interference. The potential of AI-generated deepfakes to spread disinformation on social media platforms is likely to put more pressure on lawmakers to rein in Big Tech.

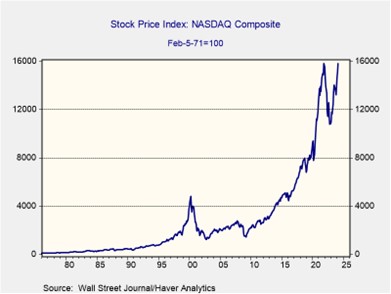

- The growing pushback against tech giants is likely to extend beyond this year’s election cycle. Countries are grappling with the immense power wielded by these companies, and Europe has already implemented a regulatory framework to rein them in. US regulators are also taking a more aggressive stance. However, despite their high stock prices, this increasing regulatory scrutiny highlights the importance of diversification in investment portfolios, given the potential risks associated with tech’s high valuations.

Crude Oil Concerns: A brighter economic outlook in the US is raising concerns that crude oil demand will be significantly higher than the initial projections for 2024.

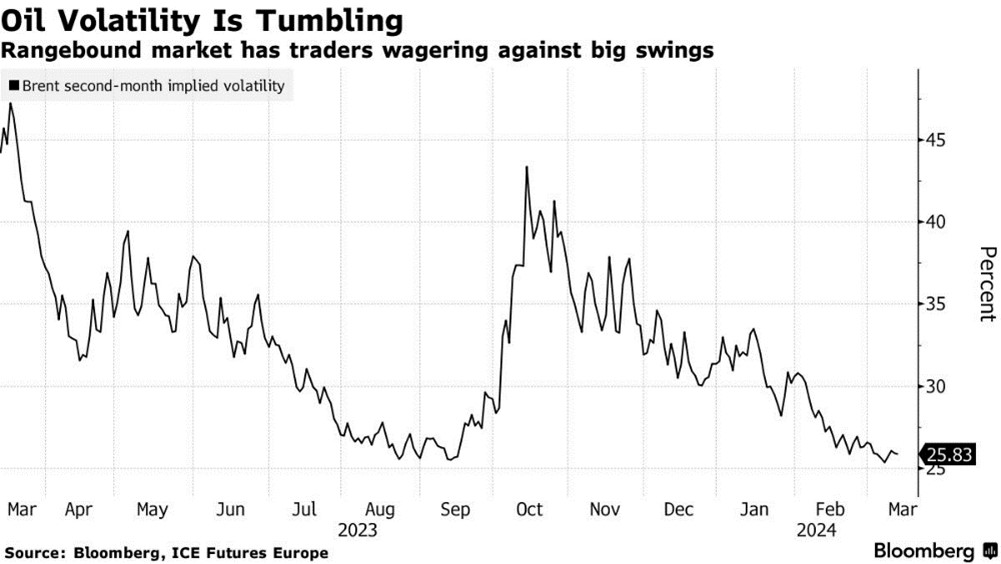

- The International Energy Agency (IEA) adjusted its oil forecast, predicting a shift from a surplus to a deficit due to reduced OPEC supply and robust US economic growth. This adjustment reflects the IEA’s expectation that OPEC will likely maintain production cuts throughout the year, even though the group previously aimed for these cuts to last only until mid-2024. The agency further amplified its oil demand forecast, raising its projection by 50% compared to its June 2023 estimate. This significant upward revision reflects an anticipated increase in bunker fuel consumption due to shipping route adjustments to bypass Red Sea conflict zones.

- The revised economic outlook is likely to further exacerbate the upward pressure on Brent crude prices, which have already surged 11% this year. Continued oil price hikes could significantly impact inflation. This connection is evident in the latest CPI report, where the increases in energy price heavily influenced the overall reading. Notably, even non-energy sectors like airline fares have experienced a recent surge, rising 15.2% at an annualized rate over the past three months. Rising price pressures could prompt the Fed to delay cutting interest rates to ensure that it doesn’t lead to a reacceleration of inflation.

- Inflation volatility, particularly due to swings in commodity prices, is a major concern for the committee. While oil prices have garnered significant attention, rising copper prices are also emerging as an issue. This volatility is amplified by the uncertainty surrounding geopolitical tensions. Despite recent low oil prices amidst the Middle East conflict, we lack confidence in their long-term stability. Our primary concern lies in the potential for countries to hoard and weaponize their resource exports as global political fractures widen, aiming to extract concessions from rivals. As a result, we remain skeptical that inflation will be able to remain, sustainably, under the Fed’s 2% target.

Other News: The US has held secret talks with Iran about ending the violence in the Red Sea, and these discussions highlight efforts from both sides to prevent a broader conflict in the region. Donald Trump, the presumptive Republican presidential nominee, is eying John Paulson as Treasury Secretary, signaling a strategic move to populate his administration with trusted allies. Meanwhile, SpaceX, led by Elon Musk, is poised for its third launch, with ambitions to successfully land a spacecraft on the moon. This endeavor underscores the increasing reliance of the United States on private enterprises for cutting-edge research and exploration.