Daily Comment (March 13, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Our Comment opens with a discussion of today’s expected congressional vote on forcing Chinese tech giant ByteDance to divest the US operations of TikTok. We next review a range of other international and US developments with the potential to affect the financial markets today, including strong wage increases in Japan that could help prompt the central bank to end its negative-interest rate policy and more detail on the Biden administration’s proposed federal budget for the coming fiscal year.

US-China Espionage: The House of Representatives is set to vote on a bill today that would force Chinese tech giant ByteDance to divest the US operations of its social media app TikTok or have the app banned in the US. The move by the lawmakers stems from growing concern by intelligence officials that the app could be used to funnel data back to China for espionage or influence campaigns. The House is widely expected to approve the bill, but its fate in the Senate is less certain.

- The renewed focus on reining in TikTok will surely add another source of friction between the US and China, raising the risk that China will try to force a major US technology firm to divest its operations in China. Obvious potential targets might be Tesla or Apple.

- More broadly, the anti-TikTok bill illustrates how big, influential technology firms are being forced to choose sides in the US-China rivalry. Both Washington and Beijing are now so distrustful that they don’t want their rival’s companies doing business on their home turf. To the extent that they ban firms owned by their adversary from their home market, the result is basically “decoupling.”

- Major US technology firms are generally very globalized, and many count China among their most important markets or their top manufacturing base. Some may try to maintain their businesses in China, but they will run the risk of increasingly brutal pressure to pull out of that market. Naturally, the resulting shift in addressable market will have a major impact on those companies’ sales, profits, and stock values.

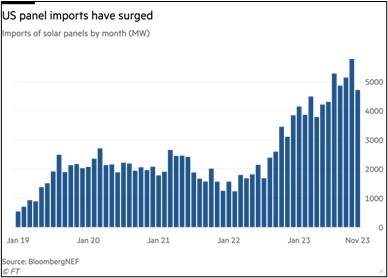

US-China Trade: New analysis shows Chinese solar panel makers have doubled their output capacity in just the last year to 1 trillion watts annually and now produce fully three times as many panels as there is global demand. The resulting glut of panels has driven global prices down some 50%, and the surge of imports into the US is threatening to put US producers out of business despite the expansion subsidies they’ve been offered through the Inflation Reduction Act. We therefore suspect solar panels will become another key point of US-China frictions.

China: The central government has ordered a stop to a string of big, expensive infrastructure projects in several poorer, highly indebted provinces in the country’s interior. The move marks an expansion of Beijing’s effort to rein in excess capacity and debt, which has tripped up the real estate development sector over the last couple of years. Importantly, the clampdown on investment and debt will likely exacerbate the Chinese economy’s other structural headwinds and could make it difficult to meet the government’s target of 5% economic growth this year.

Japan: In the annual “shunto” wage negotiations that mostly wrapped up today, major Japanese companies granted average pay hikes of 4% or more, marking an acceleration from last year’s 3.6% increase and the biggest wage increase since 1992. The robust raise will likely help ensure that Japanese consumer prices will keep rising and encourage the Bank of Japan to finally lift its negative-interest rate policy as early as this month.

Russia-Ukraine War: The Ukrainian military has reportedly launched drone strikes against at least three oil refineries deep in Russian territory near Moscow and St. Petersburg. Sources say the strikes, which were designed to starve the invading Russian military of resources, caused “significant damage.” However, we suspect that even knocking out three refineries temporarily would have only a limited impact on Russia’s warmaking capability and economy.

US Politics: After winning primary elections in several states yesterday, both President Biden and former President Trump have locked up enough of their respective party convention delegates to win their nominations for president. Given the candidates’ ages and other factors, there is probably still some chance that either or both could be replaced at the head of their party ticket before November, but for now, it’s a Biden-Trump race until we see if a third-party candidate emerges.

US Artificial Intelligence: If you’re fascinated by the new Sora artificial intelligence tool for generating videos with simple prompts, the Wall Street Journal’s technology editor has a story today with new examples. Like some of the Sora-generated videos already released publicly, the videos are fascinating by themselves. In addition, they suggest how difficult it’s becoming to discern real videos from those that might be artificially generated to influence political opinions or defraud consumers.

US Fiscal Policy: While yesterday’s Comment discussed President Biden’s overall proposed budget for the fiscal year starting October 1, today we give more detail on the proposed budget for defense, since one of our key theses is that global defense spending is likely to rise in the coming years. The proposed budget calls for total defense spending of $926.8 billion, up just 2.1% from FY 2024 because of a deal between the White House and Congress to cap spending. That marks a big slowdown from the estimate’s rise of 10.7% in defense spending this year.

- Since the nominal 2.1% rise in defense spending is below the expected rise in prices, the proposed budget actually represents a small decline in the military’s purchasing power.

- The main savings in the proposed defense budget comes in weapons procurement and research, development, testing, and evaluation. Spending on those items will fall even in nominal terms.

- In contrast, the proposal calls for a 4.5% increase in troop pay, partially offset by a small decline in troop counts and shifting more of the force from active duty to reserves.

- In any case, increasing US-China geopolitical tensions and healthy Congressional support for the military will likely result in a bigger increase in funding than in the proposed budget.