Daily Comment (March 12, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Our Comment today opens with a Nigerian government crackdown on cryptocurrencies and their use to avoid the country’s currency controls. We next review a wide range of other international and US developments with the potential to affect the financial markets today, including a worrisome spike in attempted terrorist attacks in Europe and a potential new US probe into unfair Chinese trading practices.

Nigeria-Cryptocurrencies: Highlighting how governments around the world likely see cryptocurrencies as a threat to their sovereignty, Nigerian authorities have detained two high-level employees of crypto exchange operator Binance, apparently for facilitating Nigerian citizens’ use of stablecoins to skirt central bank exchange-rate controls.

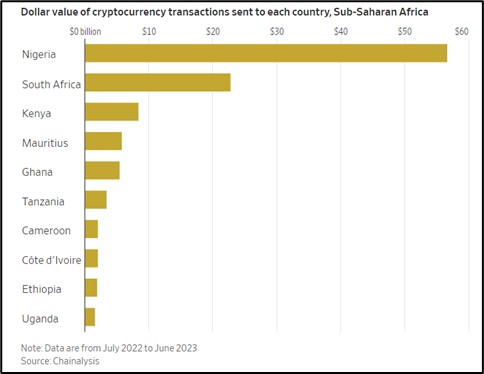

- Such transactions are a risk to Nigeria’s currency controls because cryptocurrencies have become prevalent in the country. Nigeria now has the world’s second-highest rate of cryptocurrency adoption, after India. Nigerian cryptocurrency transactions in the year ended June 2023 totaled almost $60 billion.

- The ability of citizens to skirt government financial and currency controls using crypto assets is one reason why countries may increasingly clamp down on their use, as China has already done. As we have written before, many central banks are instead studying the possibility of issuing their own digital currencies.

Argentina: Radical libertarian President Milei is facing a scandal today after opposition Peronist legislators revealed that he signed a decree giving himself a 50% pay raise last month. In response, Milei has fired his labor secretary and argued that he inadvertently signed the decree because it was an automatic inflation adjustment instituted by the previous Peronist government. The scandal could become another headwind for Milei’s effort to rein in Argentina’s government spending, reduce bureaucracy, spark faster economic growth, and stabilize the currency.

Russia-Ukraine-NATO: Following on French President Macron’s statement last month that the North Atlantic Treaty Organization shouldn’t rule out sending troops to Ukraine, the Polish foreign minister on Friday told his parliament that it “is not unthinkable” that NATO forces could be deployed there. The statement from the foreign minister, which contradicts the view of Polish Prime Minister Tusk, shows how Russia’s new momentum in Ukraine is increasingly scaring Western European leaders and forcing them to consider previously unthinkable actions.

European Union: Authorities in multiple European countries have recently arrested a number of terrorists who were planning attacks on EU soil against Jewish and Israeli-connected targets, apparently in sympathy with Palestinians suffering from the Israel-Hamas war in the Gaza Strip. The terrorists, at least some of whom have posed as refugees, are being directed in part by Iran and its militant Islamist proxies in the Middle East, including Hamas and Hezbollah. The news suggests there is a rising risk of a successful attack that could undermine market confidence.

Israel-Hamas Conflict: In its annual threat assessment report yesterday, the US intelligence community warned that Israeli Prime Minister Netanyahu’s grip on power is “in jeopardy” because of the Hamas attacks on Israel last October 7 and the government’s continued war against Hamas in Gaza. If that leads to new elections in Israel, the assessment argues that voters could elect a more moderate government than Netanyahu’s.

- Separately, Israel and Hezbollah fighters in southern Lebanon have sharply escalated their attacks on each other over the last day. Israel has even launched airstrikes deep into Lebanese territory.

- The intensified fighting in southern Lebanon is a reminder that Israel’s fighting with the Palestinians and Iran-backed militant groups still has the potential to spark a broader conflict that could be deeply concerning for financial markets.

China: Moody’s has downgraded the debt of Vanke, the China’s second-largest real estate developer, to below-investment grade status and warned of further downgrades in the future as the company struggles with declining contracted sales. The downgrade illustrates the ongoing challenges facing the country’s enormous real estate sector as the government leans on it to cut excess capacity and debt, which in turn has prompted lower prices and falling demand.

United States-China: In case you thought you could read a Comment from us that doesn’t include a new US-China friction, think again. The United Steel Workers union will file a petition today with the US Trade Representative alleging that China uses discriminatory practices in shipbuilding and maritime logistics to undermine US producers. The petition will ask the government to launch an investigation into the matter, which could eventually result in further tariffs or other trade barriers against Chinese products or services.

- Ultimately, pushing back against China’s dominance in global shipbuilding aims to help revive the once-thriving US shipbuilding industry. That could have important implications for both private industry and the US Navy, which is constrained by limited domestic shipyards. However, any potential revival of the US industry would be a very long-term project.

- In any case, any new investigation into Chinese unfair trading practices or punitive trade barriers would exacerbate the spiraling tensions between the West and China, further fracturing the global economy and presenting risks for investors.

United States-Philippines: As the Biden administration keeps trying to solidify US alliances to protect against Chinese aggression, Commerce Secretary Raimondo has urged US technology firms to at least double their investment in Philippine facilities that handle a key part of the info-tech supply chain: assembling, testing, and packaging computer chips produced in the US or elsewhere. Raimondo’s call is an example of US “friend shoring,” or trying to shift more of its critical supply chains to friendly countries, both to shore up those allies and boost resilience.

US Fiscal Policy: The Biden administration yesterday released its proposed federal budget for fiscal year 2025, which starts on October 1. The plan calls for total outlays to rise 4.7% to a total of $7.265 trillion, largely because of Social Security, Medicare, Medicaid, and other entitlements passed by Congress in previous years. The plan calls for receipts to rise 7.9% to $5.485 trillion, reflecting both economic growth and proposed tax increases on higher-income people.

- The deficit of $1.781 trillion would be modestly lower than the estimated $1.859 trillion in FY 2024.

- The plan also calls for a number of sweeteners designed to help the Democratic Party in the November election. For example, it calls for a new mortgage tax credit and subsidy for home sales.

- Nevertheless, because of the fractured Congress, the proposed budget is seen as highly unlikely to pass in anything resembling its current form. Rather, the proposal will serve as a key reference point for Biden’s re-election campaign.

US Labor Market: Port operators on the East Coast and Gulf Coast are starting negotiations with the International Longshoremen’s Association for a new, multi-year labor contract to follow the current one when it expires on September 30. However, the dockworkers are already threatening to strike if they don’t get the concessions that they’re demanding. If the negotiations fail and a strike occurs, it will likely happen at the peak of the delivery season for holiday imports, potentially causing important disruptions to the economy and pushing prices higher.