Daily Comment (March 11, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Our Comment today opens with news that the Russian military was actively considering the use of nuclear weapons in Ukraine in the autumn of 2022. We next review a range of other international and US developments with the potential to affect the financial markets today, including new policy directions that have come out of China’s big “two sessions” political meetings and signs that more mothballed uranium mines are being reopened in the US.

Russia-Ukraine-United States: On Saturday, the New York Times revealed that in October 2022, US intelligence intercepted several Russian military messages in which commanders were having detailed talks about using tactical nuclear weapons in Ukraine as their invasion of that country temporarily began to falter. Even though the US detected no sign of nukes being taken out of storage or moved to firing positions, the intelligence prompted the Pentagon to prepare several potential responses and issue firm warnings to Moscow.

- The intelligence reports are a reminder that as today’s Great Powers come into conflict with each other, even if indirectly, the risk of a dangerous escalation has increased. Of course, the release of this story now may aim to affect the continued US and European discussions about new military aid to Ukraine, although it isn’t clear whether the story would help or hurt that cause. In any case, it seems believable that there is an increased risk that Russia would use tactical nuclear weapons in certain circumstances.

- It’s important to remember that the Russian military has the advantage when threatening to use nuclear weapons since it has a more complete spectrum of military forces, from big, civilization-destroying intercontinental ballistic missiles to tactical nuclear weapons designed for battlefield use to heavy conventional forces, special operations forces, and intelligence operatives. It therefore has a more viable “ladder of escalation,” while the US has few intermediate forces between its conventional military and its nuclear ICBMs.

- Here at Confluence, we’re proud to be among the first investment strategists to recognize, analyze, and scope out the investment implications of today’s growing propensity for countries to expand or develop their nuclear arsenals. We refer our readers to our recent Bi-Weekly Geopolitical Reports from February 12, on the strategy of deterrence, and today, March 11 (publishing later today), on the US effort to modernize its nuclear arsenal.

- We see today’s nuclear brinksmanship and the potential for a new, global nuclear arms race as flowing from the US’s perceived reluctance or hesitation in maintaining its traditional role as global hegemon. China, Russia, and other authoritarian nations not only see that as a sign of weakness, but they also see themselves as strong enough to try to take advantage of the situation and assert themselves.

- This new, tension-filled geopolitical environment looks much scarier than the three decades of globalization after the end of the Cold War, but we don’t think investors should panic or be discouraged. Rather, we think this is a time to look for ways to try to control risks and find any associated opportunities in the new environment. We continue to take that approach, which has already prompted us to make key adjustments in our various portfolios.

China: At the annual “two sessions” meetings of the National People’s Congress and the Chinese People’s Political Consultative Conference over the last week, it has become clear that General Secretary Xi’s major new focus for economic policy is “high quality development” and “new quality productive forces,” by which he means domestically produced high-technology products and services. Xi has signaled a particular focus on promoting China’s prowess in electric vehicles, lithium batteries, and solar panels.

- Separately, Housing and Urban-Rural Development Minister Ni Hong signaled the government is comfortable with more major real estate developers going bankrupt and being liquidated.

- Three years into Beijing’s clampdown on excessive building and ever-increasing debt by the developers, the government has already pushed industry giants Evergrande and Country Garden Holdings over the edge, sparking a deep freeze in the housing market.

- Ni’s statement suggests investor hopes for a reprieve are unfounded. The continued clampdown on property development and a range of other structural economic headwinds are likely to weigh on growth and Chinese asset prices for the time being.

Global Rice Market: The South China Morning Post today carries an article discussing how a new, mutant “weedy rice” has been infesting fields from Asia to the US. The new mutant, which is not fit for human consumption, can cut the output of marketable rice in affected fields by up to 80%. Scientists are still looking for a solution, so at this point, it isn’t yet clear how much of a threat the new variety is to global food supplies and the global rice market.

Australia: The center-left Labor government of Prime Minister Albanese has announced it will unilaterally eliminate almost 500 “nuisance tariffs” that raise little revenue but impose significant red tape for importers. The tariffs are equal to about 14% of all Australian import duties, but they raise only about $20 million per year.

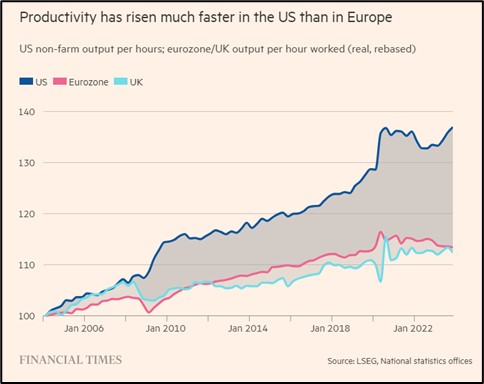

Eurozone: While US data on Friday showed the average value of output per hour worked was up a healthy 2.6% year-over-year, data from the eurozone showed productivity was down 1.2%. The figures have worsened concerns of a “competitiveness crisis” in the eurozone and sparked sharp discussion of whether Brussels can reverse the trend of weak productivity growth by improving incentives for investment or expanding fiscal stimulus programs.

- Productivity growth is key to boosting living standards in an economy and keeping price inflation in check.

- The eurozone’s weak productivity growth, therefore, raises concerns about future economic growth, price stability, and financial market returns in the region.

Portugal: In elections yesterday, the center-right Democratic Alliance coalition won the most votes, but not enough for a majority in parliament. The center-left Socialist Party saw its support virtually collapse from just two years ago, while the far-right Chega Party surged to take second place. However, Democratic Alliance leader Luís Montenegro has insisted that he will not govern with Chega, so the result could be an unstable minority government when all is said and done.

United Kingdom: In another victory for right-wing populists in Europe, the former deputy chairman of the center-right Conservative Party, Lee Anderson, has defected to join the far-right Reform UK camp. The move by Anderson came after he refused to apologize for saying that London’s Labour mayor, Sadiq Khan, was in the grip of Islamists and Anderson was therefore stripped of his position as the Conservatives’ party whip. The move gives Reform UK its first seat in parliament.

India: In response to proposed rules by stock market regulator SEBI that would require certain foreign hedge funds to provide “granular” detail on their investors, several of the funds have warned SEBI that their rules may force them to withdraw from the Indian market. However, it’s not clear if the regulator will back down, given that its proposed rules appear to be in response to a recent short-seller’s report that led to a sharp decline in the value of conglomerate Adani, one of the country’s biggest companies.

US Stock Market: In a little-noticed development, various indicators now show the US equity rally is broadening out beyond the “Magnificent 7” group of large-cap technology stocks. For example, the equal-weighted version of the S&P 500 price index set a new record high last week, indicating good price gains for stocks with relatively smaller market values. Also, almost 80% of the stocks in the S&P 500 now have a market price above their 200-day simple moving average, well above the 70% that many traders see as a sign of a broad market rally.

US Uranium Mining Industry: The Financial Times over the weekend carried an article noting that the push by governments around the world for more nuclear energy and the resulting rise in uranium prices have prompted at least five US uranium miners to reopen mines mothballed after the Fukushima disaster of 2011. The findings are consistent with the analysis in our most recent Bi-Weekly Asset Allocation Report from March 4, in which we explained why we have introduced an exchange-traded fund investing in uranium miners into the majority of strategies of our Asset Allocation portfolios.

US Movie Industry: Finally, in yet another development touching on nuclear issues in today’s Comment, we note that last night’s Academy Awards were dominated by “Oppenheimer,” a movie about the father of the atomic bomb. The movie won a total of seven awards, including the coveted award for best picture and the awards for best director, best actor, and best supporting actor. Enough said!