Daily Comment (June 6, 2019)

by Bill O’Grady and Thomas Wash

[Posted: 9:30 AM EDT] Today is the 75th anniversary of D-Day. President Trump is visiting the memorial sites today. Equities are modestly higher this morning, and Mexico and the ECB are dominating headlines. Here is what we are watching today:

The ECB: The ECB released its statement and it involves what looks like a modest tightening. Although the bank promised to keep rates low into 2020, which would be dovish forward guidance, there was some disappointment on QE. The loan rate to banks ticked up 10 bps, while all other rates were left unchanged. Balance sheet policy was also left unchanged. Financial markets were somewhat disappointed and the short end of the Eurozone yield curves are taking it as bearish; Eurozone short rates are higher, while longer duration rates fell and the EUR is up. Nothing earthshattering emerged in the press conference. Although on its face the actions by the ECB were not hawkish, the fact that the markets are taking the decisions as hawkish suggests that expectations were leaning toward additional stimulus.

Mexico: Mexico had a tough night. First, trade talks continue but there isn’t much evidence of progress, which means the tariffs will likely go into effect next week as there was a surge in asylum seekers at the U.S. border. Mexican officials fear a break in U.S. relations, which would undermine Mexico’s economy. Second, rating agencies moved to downgrade Mexican sovereign debt. Fitch lowered Mexico to BBB, nearing junk status, and Moody’s lowered its outlook to negative. The MXP fell sharply on the news. The former suggested that the trade conflict contributed to the downgrade. Mexico has suffered significant damage over the past week, moving from what looked like a safe haven from the China/U.S. trade conflict to a new target of the Trump administration. At this juncture, barring some breakthrough on border negotiations, it looks like the tariffs will go into effect and the Mexican economy is at risk.

The Beige Book: There isn’t much to report on the Beige Book, the Fed report that discusses economic activity across the nation. All districts reported modest growth in April and May. The trade war isn’t having much of an effect on manufacturing yet, while employment was reported to be moderate. Despite tight labor markets, overall wage pressures remain moderate. Prices for inputs were reported to be rising faster than final goods prices, which could signal some margin compression in the future. Overall, though, the report didn’t indicate significant inflation concerns. As expected, the report confirmed continued moderate growth with little price pressures.

Russia and China: The leaders of both nations met this week and declared their friendship. These are not natural allies; Russia has feared that China will eventually spread its influence into Siberia and a hot war between the two states nearly occurred during the Cold War. The Nixon to China moment occurred, in part, due to the deterioration of relations between the U.S.S.R. and China. As the U.S. threatens both nations, they are making common cause in opposing American hegemony. As is often the case, both nations want to end the dollar’s reserve currency status. They made promises to use their own currencies in bilateral trade. As long as both nations have goods to trade and have fairly balanced trade, avoiding dollar use is possible. The problem begins when trade becomes unbalanced; would China want to hold Russian debt in reserve?

Meanwhile, in other news on China, the U.S. is preparing a major weapons sale to Taiwan, which will clearly anger Beijing. From China’s perspective, this would be like a weapons sale from a European power to the Confederacy during the U.S. Civil War. China is adding stimulus to the economy to overcome the negative impact of the trade conflict with the U.S., which includes actions to lift auto sales. The trade conflict has led to a record outflow from Chinese equities. As an update to this week’s WGR, China appears to be preparing to cut exports of rare earth products as the U.S. calls for steps to reduce reliance on overseas sources for these goods.

Brexit: Currently, Boris Johnson remains the front-runner to replace PM May in the Tory leadership election. He generally leans toward a hard Brexit, but others in the leadership race are considered even more hardline. Perhaps the most interesting development is that polls show Labour can’t win in a general election unless it supports a second referendum. Corbyn has tried to avoid supporting a second referendum on fears that Brexit supporters in the Labour Party’s working class wing would ditch the party if it supports another Brexit vote. Labour, like the Conservatives, is torn by the Brexit issue.

Denmark elections: The center-left Social Democrats won the largest share of votes in yesterday’s election. What swung the election was a move by the Social Democrats to support rather harsh anti-immigration measures, which pulled traditional supporters of the center-left who had drifted to anti-immigration parties over immigration issues.

Italy versus the EU: As expected, the EU has put Italy on notice for breaching EU spending rules. Italian officials remain defiant, indicating that adjustments to fiscal spending are not being considered.

An assertive Germany? The German government is considering sending one of its warships through the Taiwan Strait in what would be a rare confrontational action. In the postwar world, Germany has tended to avoid hard power projection. If the Merkel government were to take this step, it would likely be welcomed by the U.S. We will be watching to see if China reacts by targeting German auto firms in China or by other measures.

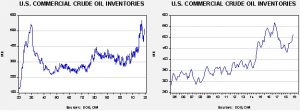

Energy update: Crude oil inventories jumped 6.8 mb last week compared to the forecast drop of 1.8 mb.

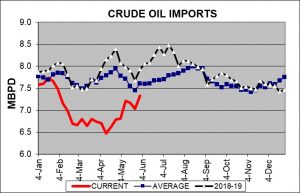

In the details, refining activity rose 0.6% as forecast. Estimated U.S. production rose slightly by 0.1 mbpd to 12.4 mbpd, a new record. Crude oil imports rose sharply, up 1.0 mbpd, while exports were unchanged.

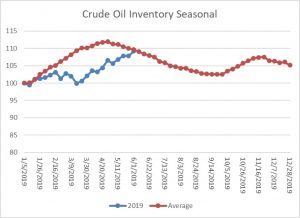

This is the seasonal pattern chart for commercial crude oil inventories. We are now well within the spring/summer withdrawal season so the recent increase in stockpiles is bearish for prices. The seasonal pattern, after holding below normal since January, has now seen a build back to normal levels. Continued increases in stockpiles will be very bearish for prices as stock levels should be declining due to rising refining activity this time of year.

Since early April, we have seen a surge in crude oil imports.

This increase in imports, coupled with record domestic production, is weighing on prices.

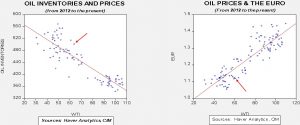

Based on oil inventories alone, fair value for crude oil is $47.06. Based on the EUR, fair value is $51.16. Using both independent variables, a more complete way of looking at the data, fair value is $48.64. In the past two weeks, oil prices have corrected significantly and are getting closer to fair value, although rising inventory levels have also reduced the fair value price. Without reductions in inventory levels soon, prices are likely to fall below $50 per barrel.