Daily Comment (June 28, 2018)

by Bill O’Grady and Thomas Wash

[Posted: 9:30 AM EDT] As the second quarter winds down, this morning’s news flow is fairly quiet. GDP came in a bit soft (see below). Here is what we are watching this morning:

The EU summit: EU leaders are meeting today through the weekend. The primary topic will be immigration and refugees. There are two issues at hand—what to do with incoming refugees and what to do with them once they are in Europe. Italy and Greece want to change the current rule, called the Dublin Agreement, which says the country that registers an immigrant is responsible for him/her and an EU nation can return the immigrant to the registering nation. Italy and Greece tend to be the landing point for refugees coming from North Africa, so those countries would be required to keep them under the Dublin Agreement. Both nations view this as unfair; however, Greece does appear open to a deal with Germany on this issue.[1] It is unclear what Greece wants in return. Perhaps this is the quid pro quo for the recent debt relief agreement. Italy remains staunchly opposed to maintaining the Dublin Agreement and has been turning refugee vessels away. Merkel is facing tensions within her ruling coalition and having the option of sending migrants back to the south where they landed, even if not exercised, might solidify her government.

One idea being floated is to create disembarking zones outside the EU,[2] perhaps in North Africa, to prevent EU migration rules from being triggered. At these disembarkation points, potential asylum seekers could wait for asylum decisions. If accepted, they could then, in theory, enter any EU nation. Australia uses a similar model where asylum candidates are held on South Pacific islands. The problem that arises is if asylum is rejected. Sometimes rejected asylum seekers live in a form of legal limbo, unwilling to return but unable to enter.

The second problem for Merkel is that she wants migrant sharing among all members of the EU. That position is strongly opposed by several members of the EU. The leader of Austria, Sebastian Kurz, has been in talks with the leader of Bavaria, Horst Seehofer[3]; Kurz has indicated that Italy, Hungary, Austria and Bavaria would form an anti-immigration bloc and refuse to accept EU-mandated immigrant quotas. The alliance with Kurz may give Seehofer enough standing to refuse to cooperate with Chancellor Merkel and potentially bring down her government.

There are other items on the agenda as well. Agricultural interests are pressing for an EU response to trade threats from the U.S. The Common Agricultural Policy (CAP) has come under scrutiny by the Trump administration; recently, tariffs on Spanish olives were implemented. If the U.S. expands its attack on agriculture, the demise of CAP would likely lead to further pressure on the EU and may cause some states to follow the U.K. out of the EU. Anything that threatens the solidity of the EU is probably bearish for the EUR. There will also be discussions about EU reforms proposed by France and Germany.

U.S./Russia Summit: The two nations have agreed to meet on July 16th in Helsinki. Europeans are decidedly nervous.[4] They fear the U.S. will attempt to improve relations with Russia at the expense of European defense, something the U.S. has underwritten since 1947. We believe the Europeans have a right to be worried, although the fears should have predated the current president. The U.S. has become jaded by the costs of hegemony and is probably willing to let Germany rearm to pay for its own defense.

Trade: Although there isn’t anything new today on this topic, we do want to point out a good article by Greg Ip of the WSJ.[5] Companies are restructuring supply chains to deal with rising trade impediments. Although the broad effect will be to raise costs and reduce efficiency, the beneficiaries will likely be those who have been left behind by globalization and deregulation. The overall gains may just be relative; on an absolute basis, the “left behinds” might not be better off, but those who have benefited greatly from globalization and deregulation may suffer more.

Energy recap: U.S. crude oil inventories fell 9.9 mb compared to market expectations of a 2.5 mb draw.

This chart shows current crude oil inventories, both over the long term and the last decade. We have added the estimated level of lease stocks to maintain the consistency of the data. As the chart shows, inventories remain historically high but have declined significantly since March 2017. We would consider the overhang closed if stocks fall under 400 mb.

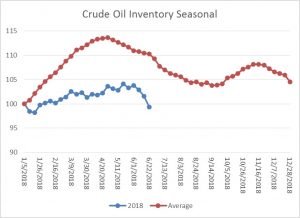

As the seasonal chart below shows, inventories are well into the seasonal withdrawal period. This week’s rather large decline, the second in a row, is consistent with that pattern. If the usual seasonal pattern plays out, mid-September inventories will be 410 mb.

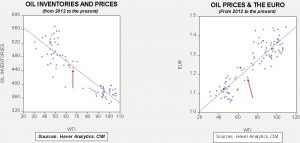

Based on inventories alone, oil prices are near the fair value price of $68.73. Meanwhile, the EUR/WTI model generates a fair value of $60.63. Together (which is a more sound methodology), fair value is $62.94, meaning that current prices are above fair value. Currently, the oil market is dealing with divergent fundamental factors. Falling oil inventories are fundamentally bullish but the stronger dollar is a bearish factor. The action to suppress Iranian oil exports has boosted oil prices but the rapid decline in oil inventories over the past week is very supportive for prices. It should be noted that a 410 mb number by September would put the oil inventory/WTI model in the high $70s per barrel. Although dollar strength could dampen that price action, oil prices should remain elevated. At the same time, refinery utilization is now 97.5%. We will be reaching a point in the near future where domestic oil consumption growth will peak for the summer season, although we do expect the level to remain elevated.

[1] https://www.ft.com/content/5a5f1e8a-7a11-11e8-bc55-50daf11b720d?emailId=5b34612130d92200049bdb3c&segmentId=22011ee7-896a-8c4c-22a0-7603348b7f22

[2] https://www.ft.com/content/1e53958a-7a23-11e8-bc55-50daf11b720d?emailId=5b34612130d92200049bdb3c&segmentId=22011ee7-896a-8c4c-22a0-7603348b7f22

[3] https://www.washingtonpost.com/world/europe/as-merkel-teeters-austrias-kurz-seizes-the-moment-as-europes-rock-star-of-the-new-right/2018/06/26/b2560c2c-732f-11e8-bda1-18e53a448a14_story.html?utm_term=.262ef8a19c1e&wpisrc=nl_todayworld&wpmm=1

[4] https://www.washingtonpost.com/news/global-opinions/wp/2018/06/27/why-europe-is-very-nervous-about-a-trump-putin-summit/?utm_term=.9ef624550dd1&wpisrc=nl_todayworld&wpmm=1

[5] https://www.wsj.com/articles/as-trade-barriers-go-up-global-supply-chains-unravel-1530100987?mod=ITP_us_0&tesla=y