Daily Comment (June 27, 2019)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez

[Posted: 9:30 AM EDT] U.S. equity markets are higher this morning on hopes of a trade deal at this weekend’s G-20 meeting. The first Democratic debate was held last night; although there is much analysis out in the media, keep in mind that this is like analyzing spring training. A debate with 20 participants doesn’t tell anyone very much. Here is what we are watching today:

G-20: Optimism is coming from reports out of China that the U.S. and China have a deal. The U.S. will not implement further tariffs and will not prevent exports to Huawei (002502, CNY 3.61). In addition, the U.S. will not demand additional exports from China. Reports suggest that the delay of tariffs was China’s demand for a meeting to occur.

If the reports are accurate, it looks like a major concession from the U.S. We note that the tone coming from the White House doesn’t line up with what we are hearing from China. The president is threatening new tariffs on China, for example. However, the new tariffs may not be the 25% level initially proposed and may only be implemented if the talks fail, which, in itself, may be hard to determine.

We expect both nations to issue their own statements. It is quite possible that we end up with strategic ambiguity—both sides say what appears to be the same thing, but each interpret their statements differently. However, the tone coming out from China seems to suggest U.S. capitulation. It would be surprising if the U.S. caves to China at this point. Thus, the optimism we are seeing this morning may not hold.

Presidents Trump and Xi meet Saturday morning in Osaka (a 13 hours difference from New York). As a result, by Saturday morning in the U.S., we should know the outcome of the meeting.

In other news in front of the weekend, President Trump criticized the EU for its treatment of tech firms. He also questioned the U.S./Japan security alliance. French President Macron indicated that action on climate change is a “red line” and he wouldn’t sign a statement without reference to action on this issue.

The other issue that bears monitoring is the U.S./Iran situation. Other than Saudi Arabia, the rest of the G-20 will oppose the U.S. position on Iran. We doubt this will get much airplay, but it might be part of bilateral meetings.

The problem with trade impediments: Yesterday, we noted the problem with trade impediments. Essentially, it comes down to the issue of arbitrage. Arbitrage is one of the oldest methods of making risk-free money. If one can buy in one market at a lower cost and sell the same good for more money elsewhere, it’s a good thing! Under free markets, arbitrage is usually ephemeral; others notice it and the advantage quickly evaporates. However, if there are regulations or trade barriers in place, the likelihood of the arbitrage holding for a longer period of time increases. Of course, there are potential legal risks for the party trying to perform the arbitrage. There are additional articles today about firms managing to avoid tariffs through various methods including transhipments—sending goods from the tariffed nation to a neutral nation and then shipping from the neutral nation to the U.S. The longer tariffs are in place, the more that this sort of activity will occur and undermine the impact of tariffs. Again, at some point, we expect President Trump to finally realize that the best way to get what he wants is to crater the dollar.

Iran: As noted earlier in the week, Iran is very close to breaking the nuclear enrichment threshold. The EU is looking at a plan to give Tehran a lifeline and avoid breaking the nuclear deal. Additionally, China continues to purchase Iranian oil. Iran continues to signal defiance.

Brexit: Boris Johnson is pledging “do or die” for Brexit. The vote for PM occurs next month, and will be decided by a small subset of the U.K. voting population.

Odds and ends: Tensions are high in Indonesia as the highest court determines if the last presidential election was valid. The PM of the Czech Republic survived a no-confidence vote.

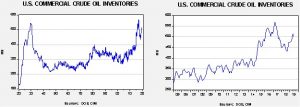

Energy update: Crude oil inventories fell 12.8 mb last week compared to the forecast drop of 2.9 mb.

In the details, refining activity rose 0.3%, below the 0.4% rise forecast. Estimated U.S. oil production fell by 0.1 mbpd to 12.1 mbpd. Crude oil imports fell 0.8 mbpd, while exports increased 0.3 mbpd. The combination of rising refinery demand and a modest drop in production, along with rising imports, all supported the larger than expected drawdown in inventories.

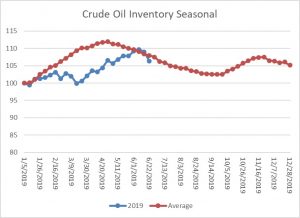

This is the seasonal pattern chart for commercial crude oil inventories. We are now well within the spring/summer withdrawal season. This week’s decline is consistent with the seasonal pattern, but the decline was much faster than normal. After contra-seasonal increases from March to June, we are now seeing a reversal in inventory accumulation. This drop in stockpiles is supportive for oil prices.

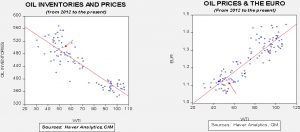

Based on oil inventories alone, fair value for crude oil is $51.52. Based on the EUR, fair value is $53.28. Using both independent variables, a more complete way of looking at the data, fair value is $51.76. Oil prices have based and are now working higher, bolstered by tensions with Iran. The reversal in inventory patterns is also supportive and helping to lift prices.