Daily Comment (June 11, 2019)

by Bill O’Grady and Thomas Wash

[Posted: 9:30 AM EDT] Good morning! Unlike what we have had for the past couple of weeks, it’s a relatively quiet news day. Here is what we are watching:

A deal with Mexico: As news spread that the tariffs on Mexico would be rescinded, stories broke that Mexico hadn’t agreed to anything that was not already in place. Mexico has confirmed that no “secret” deal existed. However, this characterization isn’t quite correct. Mexico is taking a different tack with Central American immigrants, increasing enforcement on its border and appearing, at least, to be less welcoming. And, despite comments from Mexican officials suggesting they didn’t offer anything new to the U.S., they did work hard to “sell” to the U.S. that Mexico is cracking down. In the end, we suspect what is really going on here is a series of face-saving exercises on both sides of the border. It is poison for a Mexican president to appear to kowtow to the U.S. Therefore, the stories that suggest nothing new has emerged are part of that issue. On the U.S. side, it is quite possible the president realized that applying tariffs could be an economic “own goal” and needed a way to back down without looking like he was doing so. Thus, his tactic was to talk up the measures that Mexico is taking. What we see is that Mexico is taking limited steps to try to control a serious and growing problem on the border that is going to get worse. It won’t completely solve the problem but it is at least an attempt to bring some degree of control to it. One item of note—Mexico is proposing to bring other countries into the asylum issue, including Guatemala, Panama and Brazil, which often act as transit nations for asylum seekers from other nations. This action of broadening the discussion would improve the odds of slowing the flow of refugees.

Meanwhile, with China (and the Fed): President Trump is threatening to apply tariffs on an additional $300 bn of Chinese imports if Chairman Xi refuses to meet at the G-20. China has indicated it will respond to any new trade actions by the U.S. There are reports suggesting that plans are being made for the two leaders to meet in Japan. Treasury Secretary Mnuchin has hinted that the two leaders might call a ceasefire, much like they did last year in Buenos Aires. President Trump has indicated he thinks China will make a deal because he believes his bargaining position is superior. At the same time, we note that China has announced new stimulus measures, which are helping to lift global equities.

Meanwhile, President Trump is suggesting the dollar is too strong and it’s because monetary policy is too tight. This position has led to broadsides against the FOMC. One of the more interesting comments has been that “these are not my people,” even though he appointed five of them to governor positions. However, in the fog of media criticism, there are three important items to take away from these comments:

- The people appointed to the FOMC by the administration are establishment figures. For the most part, the administration has been praised by the establishment media for the quality of his selections. However, the president doesn’t really want sober economists making policy within the mandate of the Fed in an independent manner; what he really wants are policymakers who will do his bidding. The president has populist leanings. He would prefer loyalists.

- The bigger issue is the tension between the White House and Fed independence. We have detailed how uncomfortable President Truman was with giving the Fed its independence in 1951. We have also noted when President Johnson physically assaulted Fed Chair William Martin, and how President Nixon created a lie to make Chair Arthur Burns look like he wanted a pay raise to coerce him into easy policy. Furthermore, we’ve discussed Reagan telling Volcker he can’t raise rates. We had an unusually peaceful period between the White House and the Federal Reserve that began under President Clinton; however, that era was probably an anomaly and what we have now is more normal. An independent Fed can torpedo a president and there isn’t much he can do about it. The bigger issue is that Fed independence isn’t written in stone; it is important for inflation control but if the goal is stimulus then independence isn’t necessarily a positive feature. President Trump knows his trade policy could act as a short-term drag on the economy and he wants monetary policy to offset the potential negative effects. This desire isn’t out of line; it’s just that he has no direct way to force the Fed to do what he wants. So, he has moved to public criticism.

- The problem with public criticism is that it may lead the FOMC to resist policy easing even if it deems it might be necessary in order to defend the central bank’s independence. Thus, the president’s actions might actually undermine what he wants.

Overall, we think President Trump’s assault on Fed independence is the start of a trend. If a left-wing populist gains office and MMT becomes the order of the day, a compliant Fed will be required for that policy to work. Fed independence is critical when inflation control is a goal, but when inflation fears are dormant and the nation wants growth, a compliant central bank becomes necessary. That is the path we are on.

Big tech under fire: President Trump offered a rare compliment to the EU, praising its fines on the tech industry. Although he characterized it as a money grab, he did note that their actions have a point. Meanwhile, the WSJ trotted out the consumer standard as a reason not to attack the tech industry. Although that standard does offer a good reason to protect tech, the standard, like Fed independence, didn’t come down from Mount Sinai. That standard is a legal construct that can be changed…and we suspect it will.

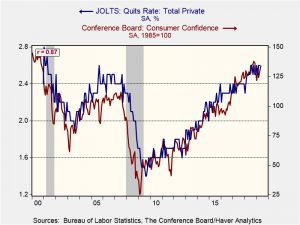

Odds and ends: Yesterday, we noted that Japan might go through with its plan to increase its consumption taxes. It has now promised to use fiscal stimulus if the economy slumps. Venezuela’s woes continue; it is now facing widespread fuel shortages and massive gas lines. Greece has called snap elections. Finally, yesterday’s JOLTS report, a labor market survey, showed a continued strong labor market. One interesting data point is the elevated quits rate. In general, a high level of quits suggests that workers feel confident they can find another job and suggests a tight labor market. We note that quit rates are highly correlated to consumer confidence.